Region:Global

Author(s):Dev

Product Code:KRAB0667

Pages:80

Published On:August 2025

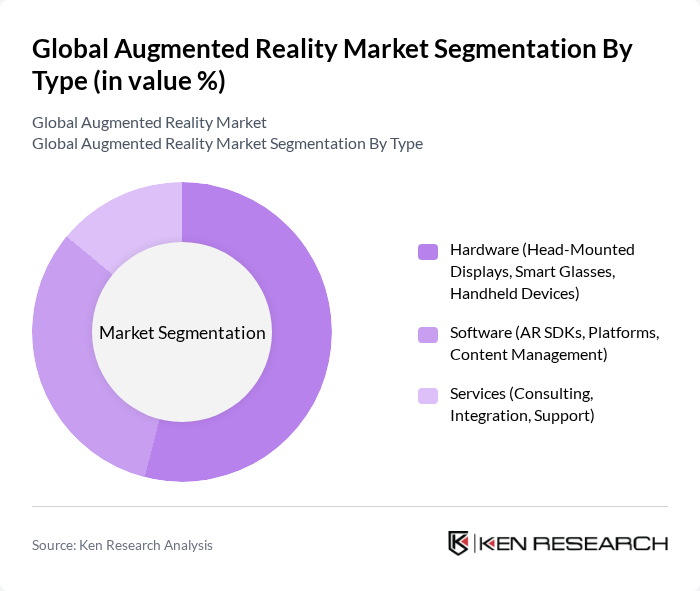

By Type:The market is segmented into Hardware, Software, and Services. The Hardware segment, which includes Head-Mounted Displays, Smart Glasses, and Handheld Devices, leads the market, driven by demand for immersive experiences in gaming, retail, and industrial applications. The Software segment, encompassing AR SDKs, platforms, and content management, is experiencing robust growth as businesses develop customized AR solutions and interactive content. Services, including consulting, integration, and support, are essential for successful AR implementation and ongoing optimization.

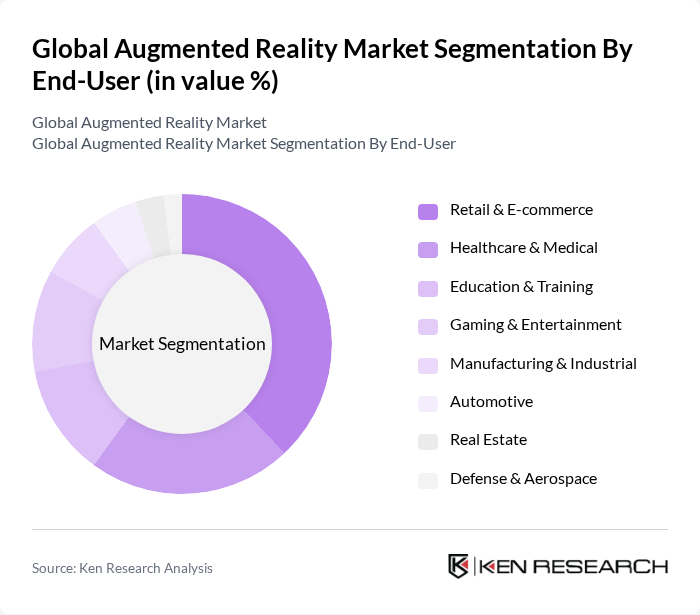

By End-User:The end-user segmentation includes Retail & E-commerce, Healthcare & Medical, Education & Training, Gaming & Entertainment, Manufacturing & Industrial, Automotive, Real Estate, and Defense & Aerospace. The Retail & E-commerce segment is the dominant force, propelled by the adoption of AR for virtual product visualization, interactive marketing, and personalized shopping experiences. Healthcare & Medical is rapidly expanding, with AR used for medical training, surgical visualization, and patient education. Education & Training, Gaming & Entertainment, and Manufacturing & Industrial are also significant, leveraging AR for immersive learning, interactive gaming, and operational efficiency.

The Global Augmented Reality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Google LLC (Alphabet Inc.), Apple Inc., Meta Platforms, Inc. (formerly Facebook Technologies, LLC), PTC Inc., Niantic, Inc., Magic Leap, Inc., Vuforia (PTC Inc.), Snap Inc., Unity Technologies, Epson America, Inc. (Seiko Epson Corporation), Qualcomm Technologies, Inc., Varjo Technologies Oy, Lenovo Group Limited, Blippar Ltd., Vuzix Corporation, Samsung Electronics Co., Ltd., Kopin Corporation, Layar (Blippar Group) contribute to innovation, geographic expansion, and service delivery in this space.

The augmented reality market is poised for significant transformation, driven by technological advancements and increasing consumer expectations. As AR technology becomes more accessible, industries such as healthcare and education are expected to adopt AR solutions at an accelerated pace. Furthermore, the integration of AR with artificial intelligence and machine learning will enhance personalization, creating more engaging user experiences. This convergence of technologies will likely lead to innovative applications, expanding the market's reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware (Head-Mounted Displays, Smart Glasses, Handheld Devices) Software (AR SDKs, Platforms, Content Management) Services (Consulting, Integration, Support) |

| By End-User | Retail & E-commerce Healthcare & Medical Education & Training Gaming & Entertainment Manufacturing & Industrial Automotive Real Estate Defense & Aerospace |

| By Application | Navigation & Mapping Remote Assistance & Collaboration Training and Simulation Marketing & Advertising Virtual Try-On Product Visualization |

| By Distribution Channel | Online (App Stores, Direct Sales) Offline (Retail, VARs, Distributors) |

| By Component | AR Devices (HMDs, Smart Glasses, Mobile Devices) AR Software (SDKs, Platforms, Content Creation Tools) AR Content (3D Models, Animations, Interactive Media) |

| By Industry Vertical | Electronics Manufacturing Telecommunications Advertising & Media Robotics Social Media Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail AR Applications | 100 | Retail Managers, Marketing Directors |

| Healthcare AR Solutions | 80 | Healthcare Professionals, IT Managers |

| Education AR Tools | 60 | Educators, Curriculum Developers |

| Gaming AR Experiences | 90 | Game Developers, User Experience Designers |

| Industrial AR Applications | 70 | Operations Managers, Safety Officers |

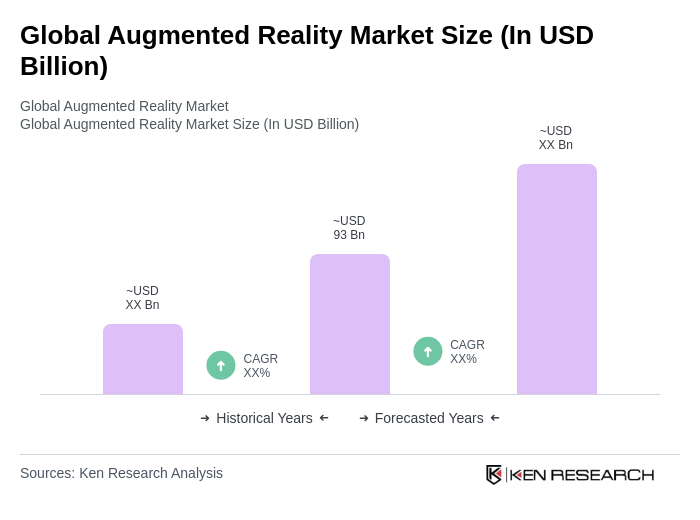

The Global Augmented Reality Market is valued at approximately USD 93 billion, driven by advancements in AR technology and its applications across various sectors, including retail, healthcare, and education.