Region:Asia

Author(s):Dev

Product Code:KRAC3450

Pages:97

Published On:October 2025

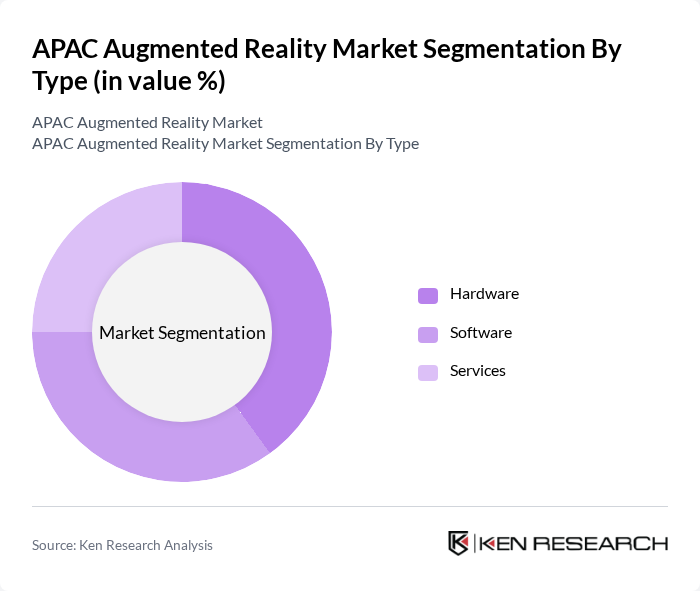

By Type:The market is segmented into Hardware, Software, and Services. Hardware includes devices such as AR glasses and headsets, while Software encompasses applications and platforms that enable AR experiences. Services refer to the support, integration, and maintenance provided for AR solutions .

The Hardware segment is currently dominating the market, driven by the increasing demand for AR devices such as smart glasses and headsets. As industries like retail, healthcare, and manufacturing adopt AR technologies for enhanced customer engagement, training, and operational efficiency, the need for advanced hardware solutions has surged. This trend is further supported by technological advancements that improve device functionality and user experience, making hardware a critical component of the AR ecosystem .

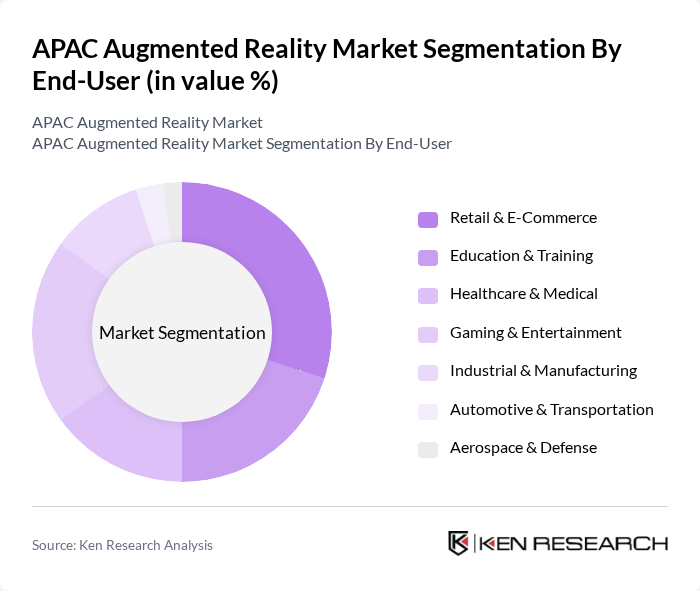

By End-User:The market is segmented into Retail & E-Commerce, Education & Training, Healthcare & Medical, Gaming & Entertainment, Industrial & Manufacturing, Automotive & Transportation, and Aerospace & Defense. Each segment represents a unique application of AR technology tailored to specific industry needs .

The Retail & E-Commerce segment is leading the market, fueled by the rapid expansion of online shopping and the demand for enhanced customer experiences. Retailers are increasingly utilizing AR for virtual try-ons, interactive product displays, and immersive marketing, significantly improving customer engagement and satisfaction. Industrial and manufacturing sectors are also accelerating adoption, leveraging AR for real-time guidance, remote maintenance, and training simulations, while healthcare institutions use AR for pre-surgical planning and medical training .

The APAC Augmented Reality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Google LLC, Apple Inc., Niantic, Inc., PTC Inc., Vuforia (PTC), Magic Leap, Inc., Snap Inc., Unity Technologies, Epson Corporation, Blippar, Augment, 8th Wall, Huawei Technologies Co., Ltd., Alibaba Group Holding Limited, Samsung Electronics Co., Ltd., Sony Group Corporation, Lenovo Group Limited, Rokid Corporation Ltd., Realmax Inc., ThirdEye Gen, Inc., Seiko Epson Corporation, WaveOptics (Snap Inc.), Tencent Holdings Ltd., Ximmerse contribute to innovation, geographic expansion, and service delivery in this space.

The APAC augmented reality market is poised for transformative growth, driven by technological advancements and increasing integration across various sectors. As businesses recognize the potential of AR to enhance customer engagement and operational efficiency, investments are expected to surge. The rise of remote work solutions and the growing emphasis on user experience will further propel AR adoption. Additionally, collaborations with telecom companies will facilitate broader access to AR technologies, creating a more interconnected ecosystem that supports innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software Services |

| By End-User | Retail & E-Commerce Education & Training Healthcare & Medical Gaming & Entertainment Industrial & Manufacturing Automotive & Transportation Aerospace & Defense |

| By Country/Region | China Japan South Korea India Australia & New Zealand Southeast Asia (Singapore, Malaysia, Thailand, Vietnam, Indonesia, Philippines) Rest of APAC |

| By Application | Training and Simulation Marketing and Advertising Maintenance and Repair Product Visualization Remote Assistance |

| By Distribution Channel | Online Sales Retail Stores Direct Sales |

| By Investment Source | Venture Capital Government Funding Private Equity |

| By Policy Support | Tax Incentives Grants for AR Development Subsidies for AR Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector AR Applications | 100 | Retail Managers, Marketing Directors |

| Healthcare AR Solutions | 80 | Healthcare Administrators, IT Managers |

| Education Technology Integration | 60 | School Administrators, Curriculum Developers |

| Gaming Industry Insights | 90 | Game Developers, Product Managers |

| Manufacturing AR Use Cases | 50 | Operations Managers, Engineering Leads |

The APAC Augmented Reality market is valued at approximately USD 18.7 billion, driven by rapid digital transformation and increasing adoption across sectors such as retail, healthcare, and manufacturing, reflecting a robust growth trajectory in recent years.