Region:Global

Author(s):Geetanshi

Product Code:KRAA2319

Pages:96

Published On:August 2025

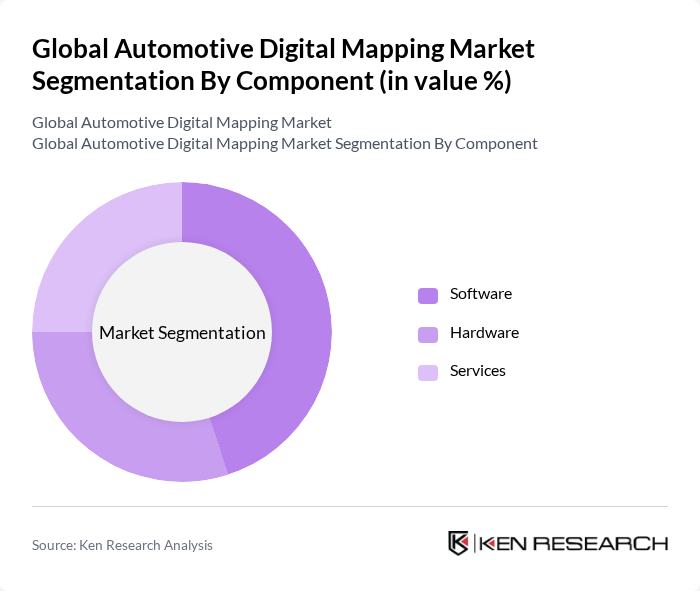

By Component:

The software segment is dominating the market due to the increasing reliance on advanced algorithms and data analytics for navigation and mapping solutions. The rise of connected vehicles and the demand for real-time updates have led to a surge in software development, making it essential for enhancing user experience and operational efficiency. Additionally, the integration of artificial intelligence and machine learning in mapping software is driving innovation and attracting investments, solidifying its leadership position .

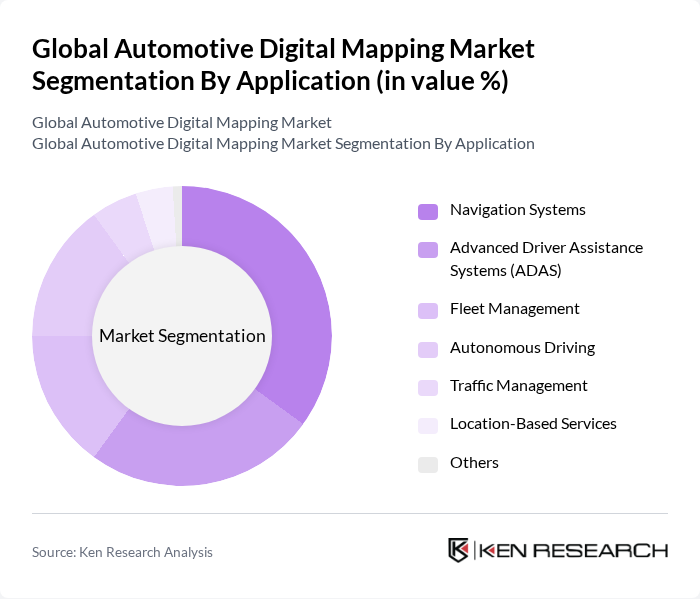

By Application:

The navigation systems application is leading the market, driven by the increasing demand for accurate and real-time navigation solutions among consumers and businesses. The proliferation of smartphones and in-car navigation systems has significantly contributed to this growth. Furthermore, the integration of mapping technologies with other applications, such as ADAS and fleet management, is enhancing the overall functionality and user experience, reinforcing the dominance of navigation systems .

The Global Automotive Digital Mapping Market is characterized by a dynamic mix of regional and international players. Leading participants such as HERE Technologies, TomTom N.V., Google LLC, Apple Inc., Mapbox Inc., Esri, INRIX, Inc., OpenStreetMap Foundation, Baidu, Inc. (Baidu Maps), Yandex N.V. (Yandex Maps), Sygic a.s., MapQuest, Inc., Telenav, Inc., Zenrin Co., Ltd., NavInfo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive digital mapping market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As the demand for autonomous vehicles and smart city initiatives grows, companies will increasingly focus on developing innovative mapping solutions. The integration of AI and IoT technologies will enhance real-time data accuracy, while partnerships with automotive manufacturers will facilitate broader adoption. Furthermore, sustainability will become a key consideration, influencing the development of eco-friendly mapping technologies that align with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Hardware Services |

| By Application | Navigation Systems Advanced Driver Assistance Systems (ADAS) Fleet Management Autonomous Driving Traffic Management Location-Based Services Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles |

| By Deployment Mode | Cloud-Based On-Premises |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs Digital Mapping Usage | 60 | Product Managers, R&D Directors |

| Fleet Management Companies | 50 | Operations Managers, IT Directors |

| Mapping Technology Providers | 40 | Business Development Managers, Technical Leads |

| Smart City Planners | 45 | Urban Planners, Transportation Engineers |

| Consumer Insights on Navigation Systems | 55 | End Users, Automotive Enthusiasts |

The Global Automotive Digital Mapping Market is valued at approximately USD 8.1 billion, driven by the increasing demand for advanced navigation systems, autonomous vehicles, and the integration of digital mapping technologies across various automotive applications.