Region:Asia

Author(s):Geetanshi

Product Code:KRAC3009

Pages:92

Published On:October 2025

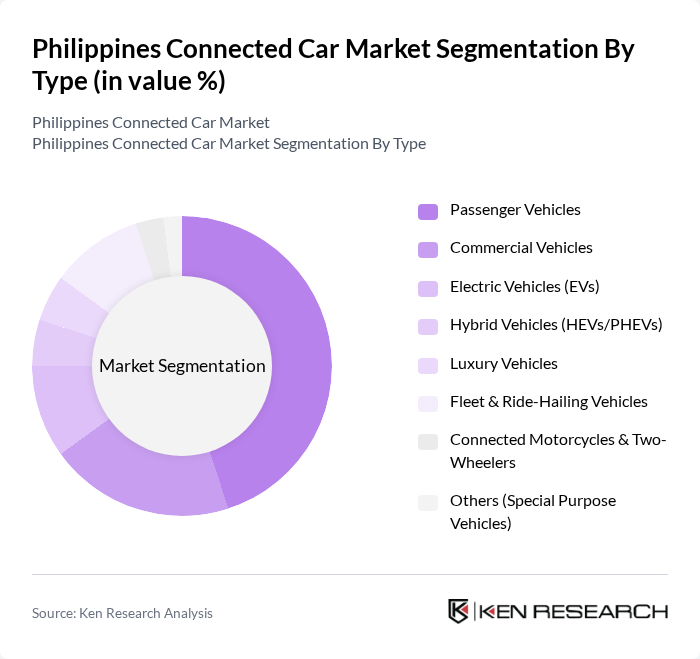

By Type:The market is segmented into various types, including Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), Hybrid Vehicles (HEVs/PHEVs), Luxury Vehicles, Fleet & Ride-Hailing Vehicles, Connected Motorcycles & Two-Wheelers, and Others (Special Purpose Vehicles). Among these, Passenger Vehicles dominate the market due to the high demand for personal transportation and the increasing trend of urban mobility solutions. The rise in disposable income and changing consumer preferences towards connected features in personal vehicles further bolster this segment. Battery electric vehicles have captured significant attention with 75 percent of EV sales in the first half of 2025, while hybrids demonstrated remarkable growth with a 40 percent year-over-year expansion.

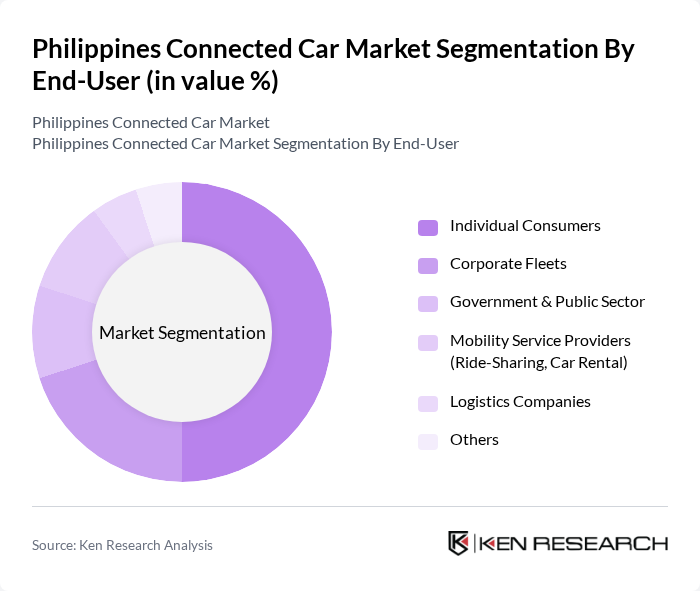

By End-User:The end-user segmentation includes Individual Consumers, Corporate Fleets, Government & Public Sector, Mobility Service Providers (Ride-Sharing, Car Rental), Logistics Companies, and Others. Individual Consumers represent the largest segment, driven by the growing preference for connected features in personal vehicles. The increasing trend of ride-sharing and car rental services also contributes to the demand from Mobility Service Providers, reflecting a shift in consumer behavior towards shared mobility solutions. Fleet electrification and fleet management technologies are gaining prominence as corporate and logistics operators seek operational efficiency improvements through connectivity features.

The Philippines Connected Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Philippines Corporation, Mitsubishi Motors Philippines Corporation, Honda Cars Philippines, Inc., Ford Motor Company Philippines, Inc., Isuzu Philippines Corporation, Nissan Philippines, Inc., Suzuki Philippines, Inc., Hyundai Asia Resources, Inc. (Hyundai Motor Philippines), BMW Philippines, Inc., Auto Nation Group, Inc. (Mercedes-Benz Philippines), Kia Philippines, Inc., Changan Motor Philippines, Inc., Sojitz G Auto Philippines Corporation (Geely Philippines), BYD Cars Philippines, Inc., Volkswagen Philippines (AC Motors), Chevrolet Philippines (The Covenant Car Company, Inc.), Foton Motor Philippines, Inc., MG Philippines (The Covenant Car Company, Inc.), Tata Motors Philippines, Dongfeng Motor Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the connected car market in the Philippines appears promising, driven by technological advancements and increasing consumer demand for connectivity. As 5G networks expand, expected to cover 60% of urban areas by future, the potential for enhanced vehicle communication and data exchange will grow. Additionally, partnerships between automotive manufacturers and technology firms are likely to foster innovation, leading to the development of more sophisticated connected car solutions that cater to evolving consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) Hybrid Vehicles (HEVs/PHEVs) Luxury Vehicles Fleet & Ride-Hailing Vehicles Connected Motorcycles & Two-Wheelers Others (Special Purpose Vehicles) |

| By End-User | Individual Consumers Corporate Fleets Government & Public Sector Mobility Service Providers (Ride-Sharing, Car Rental) Logistics Companies Others |

| By Application | Navigation & Real-Time Traffic Remote Vehicle Diagnostics & Maintenance Safety & Security (eCall, Stolen Vehicle Tracking) Infotainment & In-Car Connectivity Fleet Management & Telematics Others |

| By Distribution Channel | OEM-Installed Aftermarket Online Sales Dealerships Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Penetration Pricing Others |

| By Connectivity Type | Embedded (SIM-based) Tethered (via Smartphone/Device) Integrated/Smartphone Mirroring (Apple CarPlay, Android Auto) Wireless (Wi-Fi, Bluetooth) G/LTE G Others |

| By Ownership Model | Owned Vehicles Leased Vehicles Subscription-Based Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 45 | Product Managers, R&D Directors |

| Connected Car Service Providers | 50 | Business Development Managers, Technology Officers |

| Fleet Operators | 55 | Fleet Managers, Operations Directors |

| Consumer Insights | 120 | Car Owners, Potential Buyers |

| Government Transportation Officials | 40 | Policy Makers, Urban Planning Experts |

The Philippines Connected Car Market is valued at approximately USD 1.1 billion, driven by the increasing adoption of advanced automotive technologies and consumer demand for connectivity features. This growth reflects a significant expansion in the automotive industry within the region.