Region:Global

Author(s):Rebecca

Product Code:KRAA2461

Pages:80

Published On:August 2025

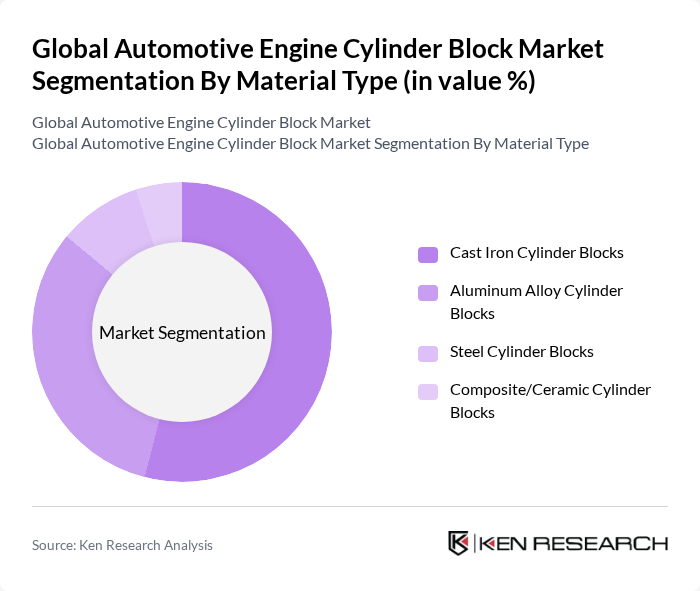

By Material Type:The material type segmentation includes Cast Iron Cylinder Blocks, Aluminum Alloy Cylinder Blocks, Steel Cylinder Blocks, and Composite/Ceramic Cylinder Blocks. Cast Iron Cylinder Blocks continue to hold the largest market share, attributed to their durability, cost-effectiveness, and excellent thermal conductivity, making them a preferred choice for internal combustion engines. Aluminum Alloy Cylinder Blocks are increasingly favored for their lightweight properties, which contribute to improved fuel efficiency and reduced vehicle emissions. While cast iron remains the traditional choice, especially in heavy-duty applications, the adoption of aluminum and advanced composites is rising as automakers seek to optimize engine performance and meet regulatory requirements .

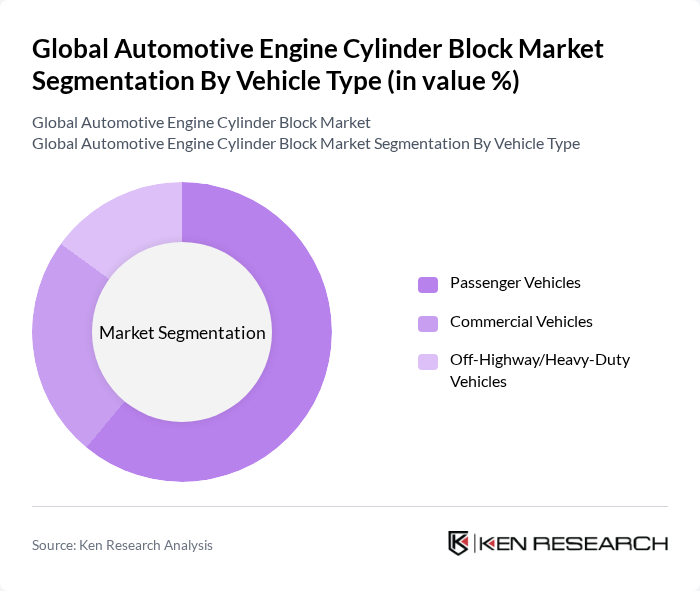

By Vehicle Type:The vehicle type segmentation covers Passenger Vehicles, Commercial Vehicles, and Off-Highway/Heavy-Duty Vehicles. Passenger Vehicles account for the largest share of the market, driven by rising consumer demand for personal mobility and increasing vehicle ownership in emerging economies. Commercial Vehicles represent a significant segment due to their essential role in logistics and transportation. Off-Highway/Heavy-Duty Vehicles are experiencing steady growth, supported by ongoing infrastructure development and the need for robust engine components in construction and agricultural machinery .

The Global Automotive Engine Cylinder Block Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, General Motors Company, Ford Motor Company, Hyundai Motor Company, Volkswagen AG, Stellantis N.V. (formerly Fiat Chrysler Automobiles N.V.), Cummins Inc., Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Mahle GmbH, Linamar Corporation, Rheinmetall AG, Nemak, S.A.B. de C.V., Tata Motors Limited, and Bharat Forge Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive engine cylinder block market in the None region is poised for transformation, driven by the shift towards electric and hybrid vehicles. As manufacturers adapt to changing consumer preferences, the integration of smart technologies and lightweight materials will become increasingly prevalent. Additionally, the adoption of 3D printing technology is expected to streamline production processes, reducing costs and enhancing customization capabilities. These trends will shape the market landscape, fostering innovation and sustainability in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Cast Iron Cylinder Blocks Aluminum Alloy Cylinder Blocks Steel Cylinder Blocks Composite/Ceramic Cylinder Blocks |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Off-Highway/Heavy-Duty Vehicles |

| By Engine Type | Internal Combustion Engines Hybrid Engines Electric Vehicle Platforms (with integrated cylinder block or range extenders) |

| By Manufacturing Process | Sand Casting Die Casting Investment Casting Other Advanced Processes (e.g., 3D Printing, High-Pressure Die Casting) |

| By Region | North America (U.S., Canada, Rest of North America) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Rest of the World (Brazil, Mexico, UAE, Other Countries) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Engine Manufacturers | 100 | Production Managers, R&D Engineers |

| Raw Material Suppliers | 60 | Procurement Managers, Supply Chain Analysts |

| Automotive OEMs | 80 | Product Development Managers, Quality Assurance Leads |

| Aftermarket Parts Distributors | 50 | Sales Managers, Operations Directors |

| Industry Experts and Analysts | 40 | Market Analysts, Automotive Consultants |

The Global Automotive Engine Cylinder Block Market is valued at approximately USD 27.5 billion, reflecting a significant growth driven by the demand for fuel-efficient vehicles and advancements in engine technology.