Region:Middle East

Author(s):Rebecca

Product Code:KRAC3945

Pages:96

Published On:October 2025

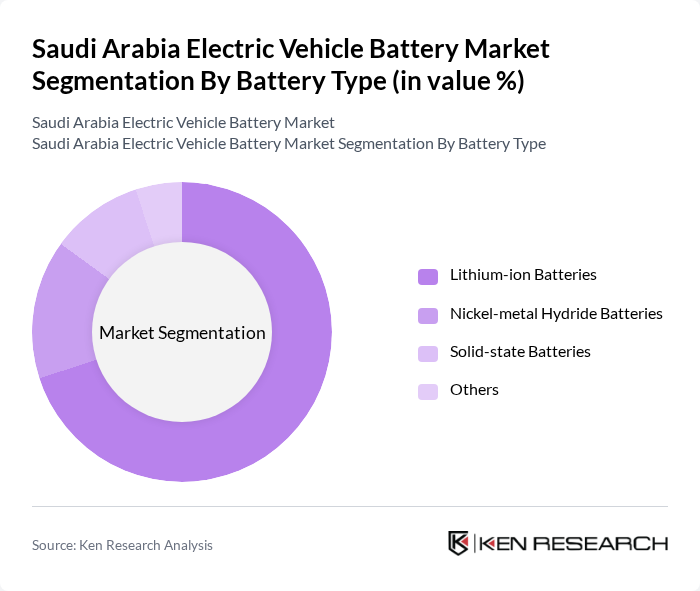

By Battery Type:

The battery type segmentation includes Lithium-ion Batteries, Nickel-metal Hydride Batteries, Solid-state Batteries, and Others. Among these, Lithium-ion Batteries dominate the market due to their high energy density, longer lifespan, and decreasing costs, making them the preferred choice for electric vehicles. The growing demand for electric vehicles has led to increased investments in lithium-ion technology, further solidifying its market leadership. Nickel-metal Hydride Batteries are also utilized, particularly in hybrid vehicles, but their market share is declining as lithium-ion technology becomes more prevalent.

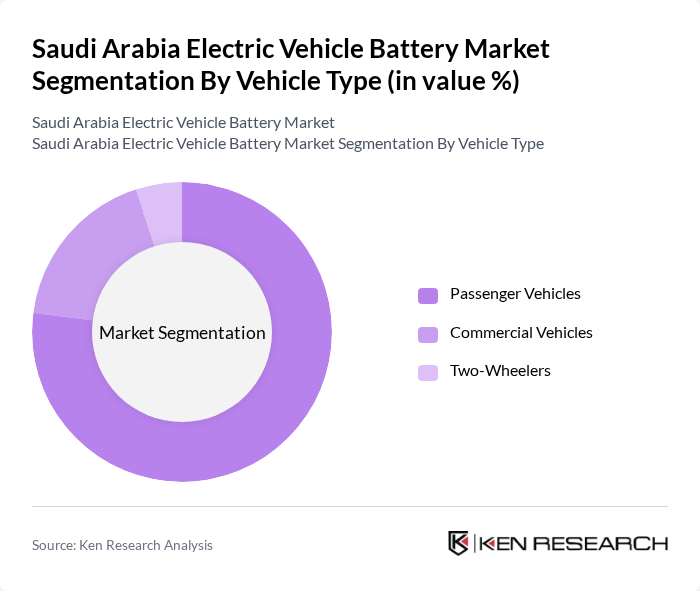

By Vehicle Type:

This segmentation includes Passenger Vehicles, Commercial Vehicles, and Two-Wheelers. Passenger Vehicles hold the largest share of the market, driven by consumer preference for electric cars and the increasing availability of models. The commercial vehicle segment is also growing, supported by government initiatives to electrify public transport and logistics. Two-Wheelers, while a smaller segment, are gaining traction due to their affordability and convenience in urban areas, contributing to the overall market growth.

The Saudi Arabia Electric Vehicle Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Contemporary Amperex Technology Co., Limited (CATL), LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Limited, Panasonic Corporation, SK On (SK Innovation), Envision AESC Group, Farasis Energy Inc., Northvolt AB, EVE Energy Co., Ltd., Gotion High-Tech Co., Ltd., CALB (China Aviation Lithium Battery), Saft Groupe S.A. (TotalEnergies), Toshiba Corporation, Svolt Energy Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia electric vehicle battery market appears promising, driven by increasing government initiatives and a shift towards sustainable energy solutions. In future, the integration of renewable energy sources is expected to power 60% of charging stations, enhancing the appeal of electric vehicles. Additionally, advancements in battery technology, such as solid-state batteries, are anticipated to improve performance and reduce costs, further stimulating market growth and consumer adoption.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-ion Batteries Nickel-metal Hydride Batteries Solid-state Batteries Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers |

| By Battery Capacity | Below 50 kWh 100 kWh Above 100 kWh |

| By Propulsion Type | Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) Fuel Cell Electric Vehicles (FCEV) |

| By End-User Application | Private Fleet Commercial Fleet Public Transport Logistics and Delivery Services |

| By Distribution Channel | OEM Direct Sales Aftermarket Distributors Online Channels |

| By Region | Central Region (Riyadh) Western Region (Jeddah, Makkah) Eastern Region (Dammam, Khobar) Northern and Southern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Manufacturers | 60 | Production Managers, R&D Directors |

| Electric Vehicle OEMs | 50 | Product Development Managers, Supply Chain Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Charging Infrastructure Providers | 40 | Operations Managers, Business Development Executives |

| Industry Experts and Consultants | 45 | Market Analysts, Strategic Advisors |

The Saudi Arabia Electric Vehicle Battery Market is valued at approximately USD 2.3 billion, driven by the increasing adoption of electric vehicles, investments in charging infrastructure, and advancements in battery technology.