Region:Global

Author(s):Dev

Product Code:KRAA2622

Pages:99

Published On:August 2025

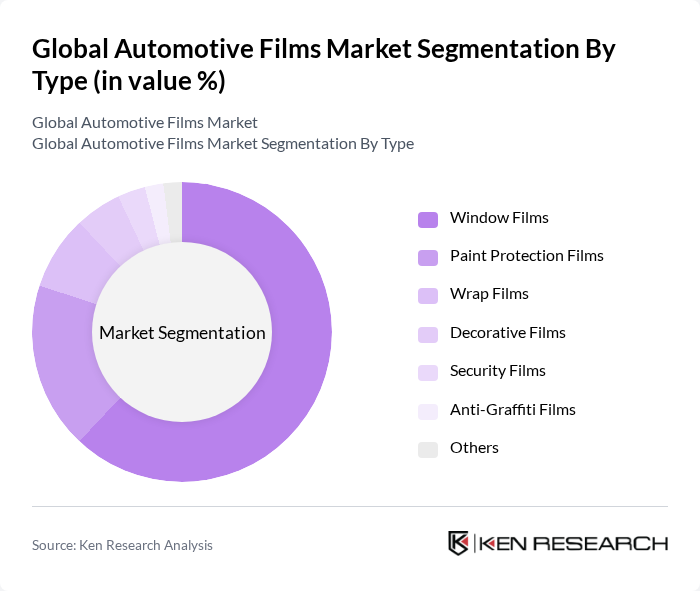

By Type:The automotive films market can be segmented into various types, including Window Films, Paint Protection Films, Wrap Films, Decorative Films, Security Films, Anti-Graffiti Films, and Others. Each type serves distinct purposes, catering to different consumer needs and preferences .

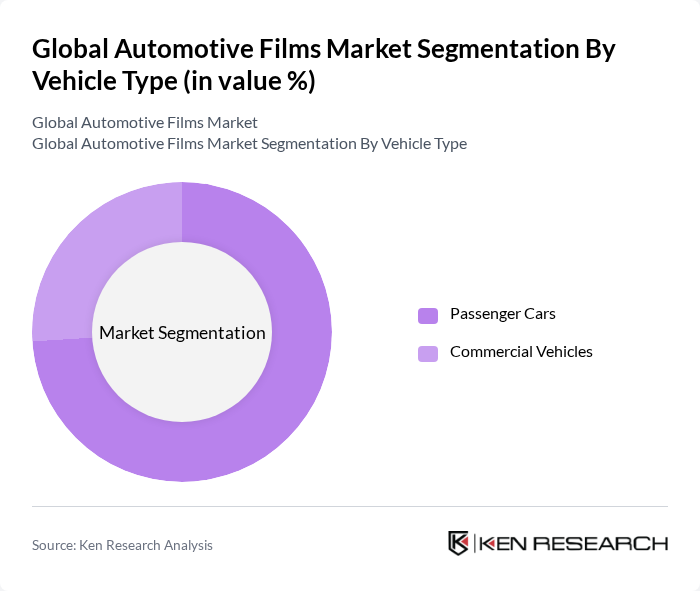

By Vehicle Type:The market is also segmented by vehicle type, which includes Passenger Cars and Commercial Vehicles. Each segment has unique requirements and preferences, influencing the types of films used .

TheWindow Filmssegment is currently dominating the market due to its multifunctional benefits, including UV protection, heat control, and aesthetic enhancement. Consumers increasingly prefer window films for their ability to improve comfort, safety, and energy efficiency while driving. The growing trend of vehicle customization and heightened awareness of the harmful effects of UV rays are further driving demand for window films, making this segment the largest by market share .

ThePassenger Carssegment leads the vehicle type category, accounting for the majority of the market. This dominance is attributed to the higher global volume of passenger vehicles compared to commercial vehicles, as well as the increasing trend of personalizing passenger cars with various films for both aesthetic and protective purposes. Demand for enhanced comfort, privacy, and safety features in personal vehicles continues to drive the adoption of automotive films in this segment .

The Global Automotive Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Eastman Chemical Company, Avery Dennison Corporation, Madico, Inc., Saint-Gobain Performance Plastics (Solar Gard), Hexis S.A., XPEL, Inc., SunTek (Eastman Chemical Company), Johnson Window Films, Inc., V-KOOL International Pte Ltd, Global Window Films, Tesa SE, Renolit SE, Garware Hi-Tech Films Ltd., and Lintec Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive films market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to invest in developing biodegradable films. Additionally, the rise of electric vehicles is expected to create new opportunities for specialized films that enhance energy efficiency. The market is also anticipated to benefit from the expansion of online sales channels, making automotive films more accessible to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Window Films Paint Protection Films Wrap Films Decorative Films Security Films Anti-Graffiti Films Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles |

| By Application | Exterior Interior |

| By Function | UV Protection Heat Control Privacy Glare Reduction Aesthetics Safety/Security |

| By Distribution Channel | Online Retail Offline Retail |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Film Thickness | Thin Films Thick Films |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 60 | Product Development Managers, Procurement Officers |

| Aftermarket Suppliers | 50 | Sales Managers, Operations Directors |

| Film Manufacturers | 40 | Technical Directors, R&D Managers |

| Automotive Design Firms | 40 | Design Engineers, Project Managers |

| Industry Analysts | 40 | Market Research Analysts, Economic Advisors |

The Global Automotive Films Market is valued at approximately USD 6.9 billion, driven by increasing demand for vehicle aesthetics, UV protection, and safety features. This market is expected to grow significantly due to rising consumer awareness and technological advancements in film materials.