Saudi Arabia Automotive Coatings Market Overview

- The Saudi Arabia Automotive Coatings Market is valued at USD 70 million, based on a five-year historical analysis. This market is primarily driven by the increasing demand for high-performance coatings that offer durability and aesthetic appeal, alongside the expansion of the automotive sector in the region. The rise in vehicle production and sales, coupled with advancements in coating technologies, has significantly contributed to the market's expansion .

- Key cities such as Riyadh, Jeddah, and Dammam dominate the automotive coatings market due to their robust automotive manufacturing and assembly plants. The concentration of automotive OEMs and aftermarket service providers in these urban centers fosters a competitive environment, driving innovation and enhancing the availability of diverse coating solutions .

- The Saudi Standards, Metrology and Quality Organization (SASO) issued the "Technical Regulation for Paints (Dyes) and Varnishes" (M.A.-161-17-07-03), which mandates the use of eco-friendly coatings in automotive manufacturing. This regulation establishes requirements for volatile organic compound (VOC) content, labeling, and safety, promoting the adoption of low-VOC and water-based coatings to align with environmental standards .

Saudi Arabia Automotive Coatings Market Segmentation

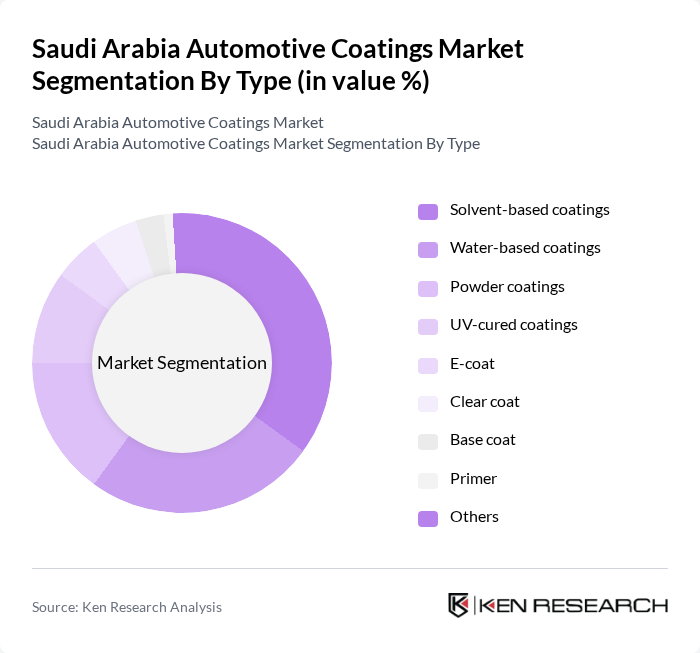

By Type:The automotive coatings market can be segmented into various types, including solvent-based coatings, water-based coatings, powder coatings, UV-cured coatings, E-coat, clear coat, base coat, primer, and others. Among these, solvent-based coatings have traditionally dominated the market due to their excellent performance characteristics and ease of application. However, there is a noticeable shift towards water-based and UV-cured coatings as manufacturers and consumers become more environmentally conscious .

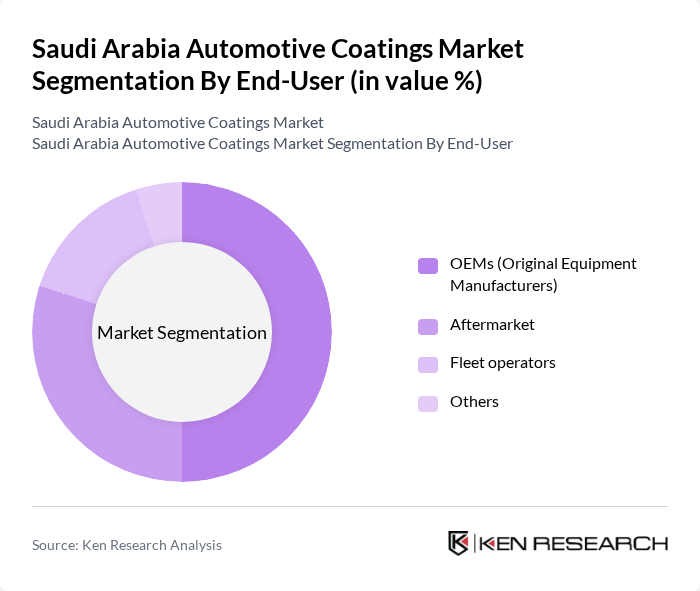

By End-User:The automotive coatings market is segmented by end-user into OEMs (Original Equipment Manufacturers), aftermarket, fleet operators, and others. The OEM segment holds a significant share due to the increasing production of vehicles and the demand for high-quality coatings that enhance vehicle aesthetics and protection. The aftermarket segment is also growing, driven by the rising trend of vehicle customization and maintenance .

Saudi Arabia Automotive Coatings Market Competitive Landscape

The Saudi Arabia Automotive Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries Inc., BASF SE, AkzoNobel N.V., The Sherwin-Williams Company, Axalta Coating Systems Ltd., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun A/S, RPM International Inc., Hempel A/S, Berger Paints, National Paints Factories Co. Ltd., Al-Jazeera Paints Co., KCC Corporation, Covestro AG contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Automotive Coatings Market Industry Analysis

Growth Drivers

- Increasing Automotive Production:The automotive production in Saudi Arabia reached approximately 1.1 million units in future, driven by government initiatives to boost local manufacturing. The Saudi Vision 2030 plan aims to increase this figure significantly, targeting a production increase of 50% in future. This surge in production directly correlates with the demand for automotive coatings, as each vehicle requires multiple layers of coatings for protection and aesthetics, thus driving market growth.

- Rising Demand for Vehicle Aesthetics:The Saudi automotive market is witnessing a shift towards enhanced vehicle aesthetics, with consumers increasingly prioritizing visual appeal. In future, the demand for high-quality automotive coatings surged, with an estimated 30% increase in premium coatings usage. This trend is supported by a growing middle class and rising disposable incomes, which are projected to reach $1.2 trillion in future, further fueling the demand for aesthetically pleasing vehicles.

- Technological Advancements in Coating Materials:Innovations in coating technologies, such as the development of nanotechnology-based coatings, are enhancing the performance and durability of automotive coatings. In future, the market for advanced coatings grew by 20%, driven by improvements in scratch resistance and UV protection. These advancements are expected to continue, with R&D investments projected to exceed $200 million in future, fostering a competitive edge in the automotive coatings sector.

Market Challenges

- Fluctuating Raw Material Prices:The automotive coatings industry in Saudi Arabia faces significant challenges due to volatile raw material prices. In future, the cost of key raw materials, such as titanium dioxide and epoxy resins, increased by 15% due to supply chain disruptions. This unpredictability can lead to increased production costs, affecting profit margins for manufacturers and potentially leading to higher prices for consumers, thereby impacting overall market growth.

- Stringent Environmental Regulations:The automotive coatings market is increasingly challenged by stringent environmental regulations aimed at reducing VOC emissions. In future, the Saudi government implemented new regulations that require a 30% reduction in VOC levels in future. Compliance with these regulations necessitates investment in cleaner technologies, which can strain the financial resources of smaller manufacturers, potentially limiting their market participation and innovation capabilities.

Saudi Arabia Automotive Coatings Market Future Outlook

The future of the automotive coatings market in Saudi Arabia appears promising, driven by a combination of technological advancements and evolving consumer preferences. As the market shifts towards eco-friendly and sustainable solutions, manufacturers are expected to invest heavily in research and development. Additionally, the rise of electric vehicles will create new opportunities for specialized coatings, enhancing performance and aesthetics. The integration of digital technologies in manufacturing processes will further streamline operations, ensuring competitiveness in a rapidly evolving market landscape.

Market Opportunities

- Expansion of Electric Vehicle Market:The electric vehicle (EV) market in Saudi Arabia is projected to grow significantly, with sales expected to reach 100,000 units in future. This growth presents a unique opportunity for automotive coatings tailored to EVs, focusing on lightweight and energy-efficient solutions that enhance vehicle performance and sustainability.

- Growth in Aftermarket Services:The aftermarket services sector is anticipated to expand, with an estimated value of $1 billion in future. This growth is driven by increasing vehicle ownership and the demand for customization. Automotive coatings that cater to aftermarket enhancements, such as protective films and custom finishes, will likely see heightened demand, providing lucrative opportunities for manufacturers.