Region:Global

Author(s):Shubham

Product Code:KRAD0689

Pages:85

Published On:August 2025

By Type:The market is segmented into various types of fuel tanks, including plastic, metal, composite/hybrid structures, and capless/filler modules & integrated modules. Plastic fuel tanks—especially multi?layer high?density polyethylene (HDPE)—continue to gain share due to lightweighting and superior resistance to corrosion and permeation under stringent evaporative emission norms . Metal tanks (steel, aluminum) remain relevant in heavier-duty and cost-sensitive applications for their durability and structural strength . Composite/hybrid structures are an emerging niche, balancing mass reduction with rigidity and chemical resistance, while capless/filler and integrated modules are increasingly adopted for refueling convenience, safety, and packaging efficiency in modern platforms .

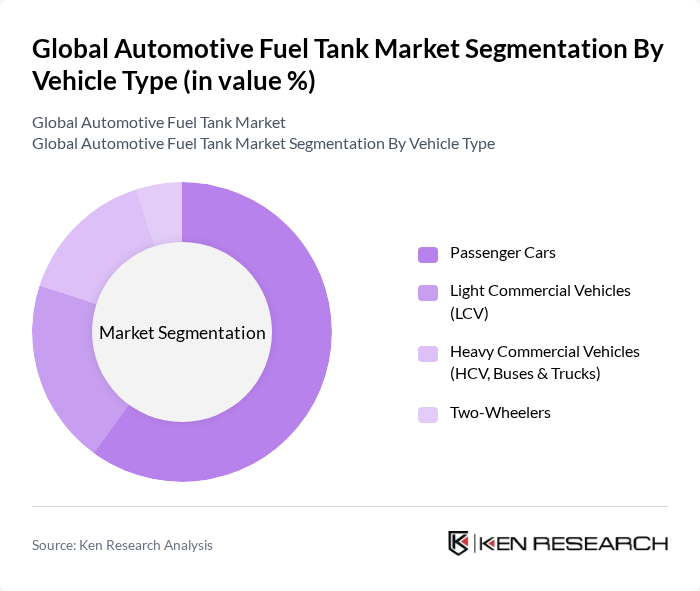

By Vehicle Type:The segmentation by vehicle type includes passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV, buses & trucks), and two-wheelers. Passenger cars account for the largest share, aligned with their dominant global production volumes; LCV demand is reinforced by e?commerce and logistics growth; HCVs contribute outsized value via larger tank capacities; and two?wheelers remain significant in emerging markets with high ownership and usage intensity .

The Global Automotive Fuel Tank Market is characterized by a dynamic mix of regional and international players. Leading participants such as TI Fluid Systems plc (formerly TI Automotive), Kautex Textron GmbH & Co. KG, Yachiyo Industry Co., Ltd., Plastic Omnium SE, Magna International Inc. (Components business), Continental AG (Fuel Supply Modules), AISIN Corporation, Inergy Automotive Systems (Plastic Omnium subsidiary), Hyundai Mobis Co., Ltd., DENSO Corporation, Sango Co., Ltd., Fuel Total Systems Co., Ltd. (FTS), Kongsberg Automotive ASA, YAPP Automotive Systems Co., Ltd. (YAPP), Unipres Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive fuel tank market is poised for transformation, driven by technological advancements and evolving consumer preferences. As the industry shifts towards sustainability, manufacturers are likely to invest heavily in lightweight materials and smart technologies. Additionally, the integration of composite fuel tanks will enhance safety and efficiency. With the electric vehicle market expanding rapidly, traditional fuel tank manufacturers must adapt to maintain relevance, focusing on innovation and compliance with stringent regulations to capture emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Plastic (HDPE, Multi?layer Plastic) Metal (Steel, Aluminum) Composite/Hybrid Structures Capless/Filler Modules & Integrated Modules |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV, Buses & Trucks) Two?Wheelers |

| By Fuel Type | Gasoline (Petrol) Diesel Flex?Fuel/Ethanol Blends CNG/LPG Tanks and Modules |

| By Capacity | Below 30 Liters –45 Liters –70 Liters Above 70 Liters |

| By Sales Channel | OEM Aftermarket (Replacement) Online Aftermarket Authorized Dealer/Service Network |

| By Region | North America Europe Asia?Pacific Latin America |

| By Price Range | Economy Mid?Range Premium/High?Performance Specialty/OEM?Custom |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Fuel Tanks | 140 | Product Managers, R&D Engineers |

| Commercial Vehicle Fuel Tanks | 100 | Fleet Managers, Procurement Specialists |

| Fuel Tank Manufacturing Processes | 80 | Manufacturing Engineers, Quality Control Managers |

| Regulatory Compliance in Fuel Tanks | 70 | Compliance Officers, Safety Engineers |

| Innovations in Fuel Tank Materials | 60 | Materials Scientists, Product Development Managers |

The Global Automotive Fuel Tank Market is valued at approximately USD 20 billion, based on a five-year historical analysis. This valuation reflects the market's growth driven by vehicle production and advancements in fuel tank technologies.