Region:Middle East

Author(s):Dev

Product Code:KRAC2778

Pages:97

Published On:October 2025

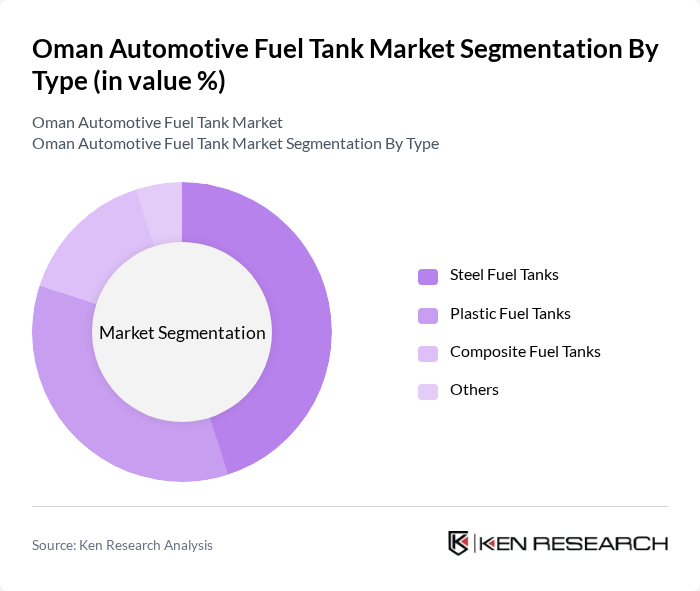

By Type:The market is segmented into Steel Fuel Tanks, Plastic Fuel Tanks, Composite Fuel Tanks, and Others. Steel Fuel Tanks remain prevalent due to their durability and resistance to corrosion, making them a preferred choice for commercial and heavy-duty vehicles. However, Plastic Fuel Tanks are increasingly favored for their lightweight properties and cost-effectiveness, particularly in passenger vehicles, as manufacturers seek to improve fuel efficiency and reduce vehicle weight. Composite Fuel Tanks are gaining traction, driven by technological advancements that enhance safety, compatibility with alternative fuels, and performance, especially in newer vehicle models .

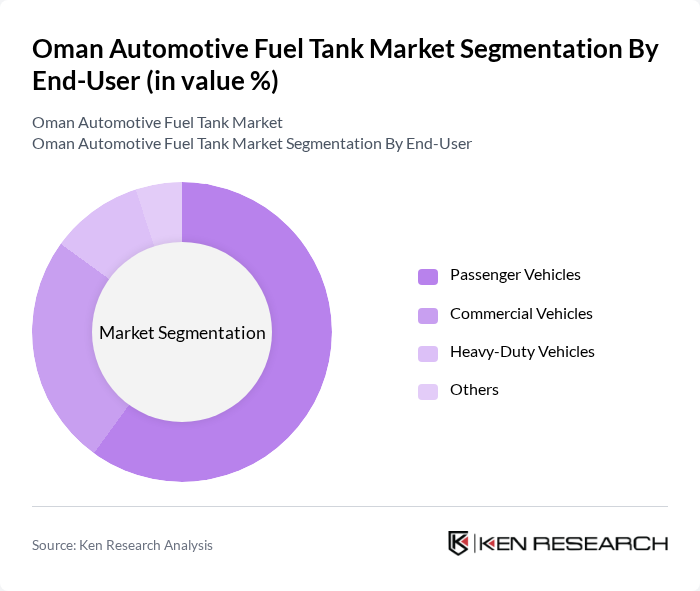

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, and Others. Passenger Vehicles account for the largest market share, driven by the growing number of personal vehicles and rising consumer preference for lightweight, fuel-efficient models. The expansion of e-commerce and logistics sectors has increased demand for Commercial Vehicles, while Heavy-Duty Vehicles are essential for construction and infrastructure projects. The Others category encompasses specialized vehicles, which, though smaller in volume, contribute to market diversity and innovation .

The Oman Automotive Fuel Tank Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Group, Oman Oil Marketing Company, Muscat Motors, Al-Mamari Group, Al-Harthy Group, Al-Jazeera Group, Al-Mansoori Specialized Engineering, Oman National Engineering & Investment Company, Gulf International Chemicals, Al-Balagh Trading & Contracting, Al-Muheet Group, Al-Hazm Group, Al-Mahrouqi Group, Al-Saeed Group, and Oman Cables Industry contribute to innovation, geographic expansion, and service delivery in this space.

The Oman automotive fuel tank market is poised for significant transformation as it adapts to evolving consumer preferences and regulatory requirements. The shift towards sustainable materials and the integration of smart technologies are expected to redefine product offerings. Additionally, the expansion of electric vehicles will create new opportunities for manufacturers to innovate and diversify their product lines, ensuring they remain competitive in a rapidly changing market landscape. Strategic partnerships will also play a crucial role in driving growth and enhancing market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Fuel Tanks Plastic Fuel Tanks Composite Fuel Tanks Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Others |

| By Fuel Type | Gasoline Diesel Alternative Fuels Others |

| By Manufacturing Process | Injection Molding Blow Molding Welding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Price Range | Low Price Mid Price High Price |

| By Application | OEM Applications Aftermarket Applications Custom Applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 60 | Product Development Managers, Procurement Officers |

| Fuel Tank Suppliers | 45 | Sales Directors, Operations Managers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Automotive Repair Shops | 50 | Service Managers, Technicians |

| Industry Experts and Analysts | 40 | Market Analysts, Automotive Consultants |

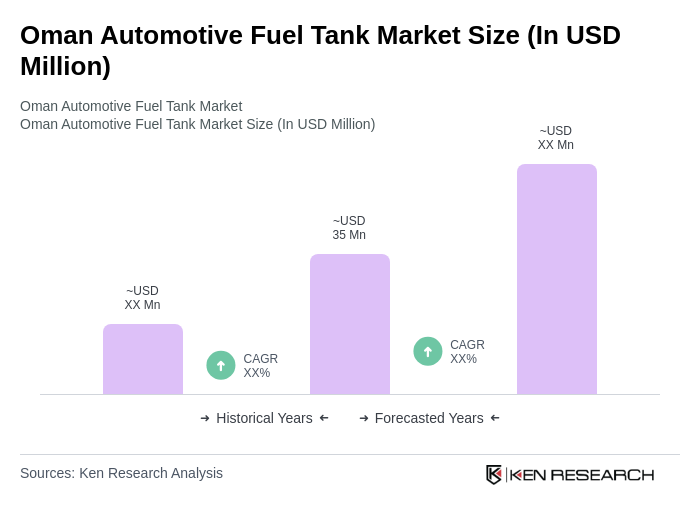

The Oman Automotive Fuel Tank Market is valued at approximately USD 35 million, reflecting growth driven by increased vehicle demand, urbanization, and rising disposable incomes, which have led to higher vehicle ownership and fuel tank requirements.