Region:Global

Author(s):Shubham

Product Code:KRAC2874

Pages:99

Published On:October 2025

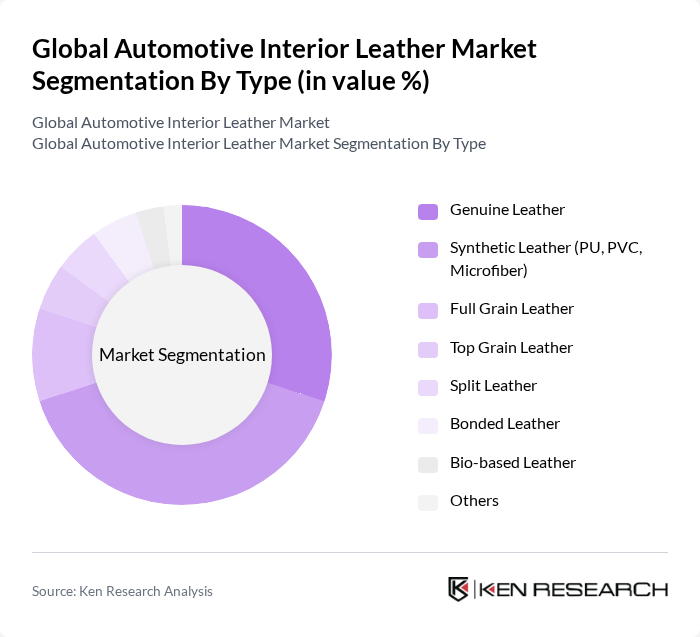

By Type:The market is segmented into various types of leather, including Genuine Leather, Synthetic Leather (PU, PVC, Microfiber), Full Grain Leather, Top Grain Leather, Split Leather, Bonded Leather, Bio-based Leather, and Others. Each type caters to different consumer preferences and applications within the automotive industry. Synthetic leather, particularly polyurethane (PU) and microfiber types, is gaining market share due to its cost-effectiveness, durability, and compliance with sustainability standards. Genuine leather remains dominant in luxury and premium vehicle segments, while bio-based leather is emerging in eco-conscious applications.

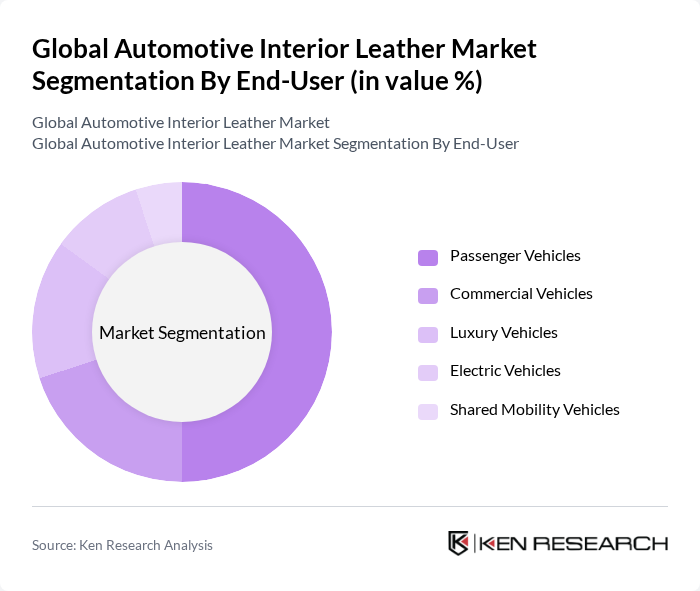

By End-User:The market is segmented based on end-users, including Passenger Vehicles, Commercial Vehicles, Luxury Vehicles, Electric Vehicles, and Shared Mobility Vehicles. Passenger vehicles account for the largest share, driven by high production volumes and consumer demand for comfort and aesthetics. Luxury vehicles and electric vehicles are rapidly increasing their share, reflecting trends toward premiumization and sustainability. Shared mobility vehicles are a growing segment, with a focus on durable, easy-to-clean interior materials.

The Global Automotive Interior Leather Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lear Corporation, Faurecia (now FORVIA), Adient plc, Alcantara S.p.A., BASF SE, Covestro AG, Toyota Boshoku Corporation, Hyundai Transys Inc., International Automotive Components Group (IAC Group), Sage Automotive Interiors, TACHI-S Co., Ltd., KURZ Group, Bader GmbH & Co. KG, GST AutoLeather Inc. (Pangea), BOXMARK Leather GmbH & Co KG, Seiren Co., Ltd., Wollsdorf Leather GmbH, Eagle Ottawa LLC, Tannery of the Future contribute to innovation, geographic expansion, and service delivery in this space.

The automotive interior leather market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As the demand for luxury vehicles continues to rise, manufacturers are likely to invest in high-quality leather and sustainable alternatives. Additionally, the integration of smart technologies in vehicle interiors will create new opportunities for leather applications. The focus on aesthetic appeal and customization will further enhance market dynamics, fostering innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Genuine Leather Synthetic Leather (PU, PVC, Microfiber) Full Grain Leather Top Grain Leather Split Leather Bonded Leather Bio-based Leather Others |

| By End-User | Passenger Vehicles Commercial Vehicles Luxury Vehicles Electric Vehicles Shared Mobility Vehicles |

| By Application | Seats Door Panels Dashboard Steering Wheels Center Stack/Console Headliners |

| By Distribution Channel | OEMs Aftermarket |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Budget |

| By Sustainability Certification | Eco-Friendly Certified Fair Trade Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Vehicle Manufacturers | 60 | Product Development Managers, Material Sourcing Specialists |

| Mid-range Automotive Brands | 50 | Procurement Managers, Design Engineers |

| Leather Suppliers and Tanneries | 40 | Sales Directors, Quality Assurance Managers |

| Automotive Interior Designers | 40 | Lead Designers, Material Innovation Specialists |

| Regulatory Bodies and Sustainability Experts | 40 | Policy Makers, Environmental Compliance Officers |

The Global Automotive Interior Leather Market is valued at approximately USD 35 billion, driven by increasing demand for luxury vehicles and advancements in synthetic leather technology, alongside a growing preference for sustainable materials in automotive interiors.