Region:Asia

Author(s):Geetanshi

Product Code:KRAC2440

Pages:86

Published On:October 2025

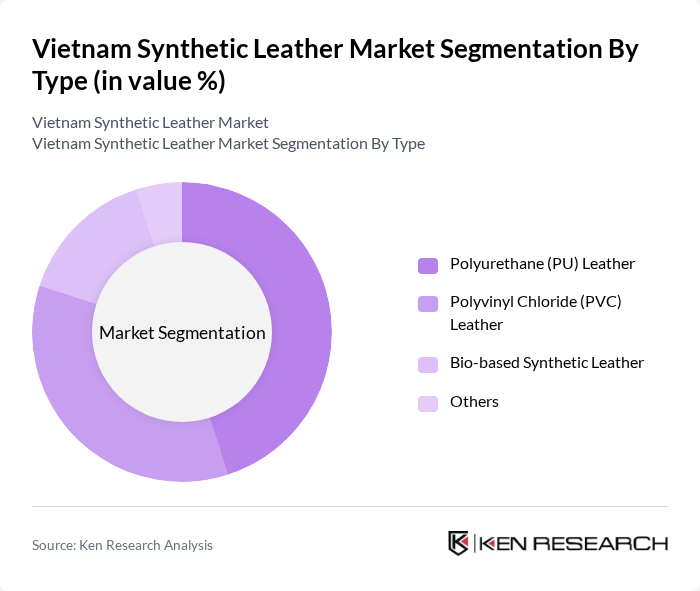

By Type:The synthetic leather market can be segmented into four main types: Polyurethane (PU) Leather, Polyvinyl Chloride (PVC) Leather, Bio-based Synthetic Leather, and Others. PU Leather is gaining traction due to its superior quality, flexibility, and eco-friendliness, often preferred for footwear and automotive interiors. PVC Leather remains popular for its cost-effectiveness and robust physical properties, making it suitable for furniture and some apparel. Bio-based Synthetic Leather is emerging as a sustainable alternative, driven by consumer demand for environmentally friendly products and increasing regulatory pressure for greener materials .

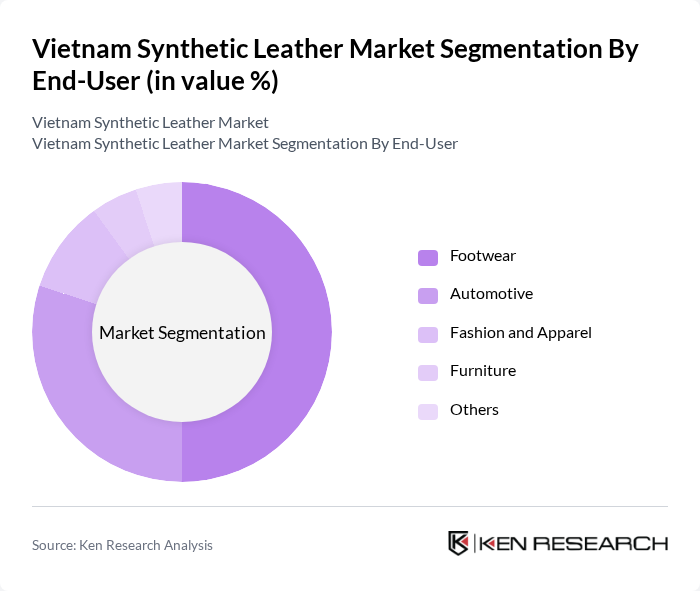

By End-User:The end-user segmentation includes Footwear, Automotive, Fashion and Apparel, Furniture, and Others. The footwear segment is the largest consumer of synthetic leather, driven by the growing demand for stylish and affordable footwear options, as well as Vietnam's strong export orientation in this sector. The automotive sector is also a significant user, utilizing synthetic leather for upholstery and interior finishes, supported by the rising production of vehicles and consumer preference for premium interiors. Fashion and apparel, along with furniture, continue to adopt synthetic leather for its versatility and cost advantages .

The Vietnam Synthetic Leather Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viet Tien Garment Joint Stock Company, Phuoc An Leather Co., Ltd., Tien Dat Plastic Co., Ltd., Dong Nai Plastic Company, Binh Minh Plastic Company, An Phat Holdings, Huu Nghi Leather Co., Ltd., Tan Thanh Plastic Co., Ltd., Long An Leather Co., Ltd., Minh Tuan Leather Co., Ltd., Viet Leather Co., Ltd., Hoang Ha Leather Co., Ltd., Gia Dinh Leather Co., Ltd., Thanh Cong Leather Co., Ltd., An Phu Leather Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam synthetic leather market appears promising, driven by a strong focus on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in sustainable production methods. Additionally, the rise of e-commerce platforms will facilitate broader market access, enabling brands to reach a wider audience. Collaborations with fashion brands will further enhance product visibility, positioning synthetic leather as a viable alternative in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyurethane (PU) Leather Polyvinyl Chloride (PVC) Leather Bio-based Synthetic Leather Others |

| By End-User | Footwear Automotive Fashion and Apparel Furniture Others |

| By Application | Upholstery Bags and Accessories Clothing Industrial Uses |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Economy Mid-Range Premium |

| By Region | Northern Vietnam (Hanoi, Hai Phong) Southern Vietnam (Ho Chi Minh City, Binh Duong, Dong Nai) Central Vietnam |

| By Policy Support | Subsidies for Sustainable Production Tax Incentives for Manufacturers Grants for Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Synthetic Leather Manufacturers | 50 | Production Managers, Quality Control Supervisors |

| Footwear Retailers | 60 | Store Managers, Merchandising Directors |

| Automotive Upholstery Suppliers | 50 | Procurement Managers, Product Development Leads |

| Textile Distributors | 40 | Sales Managers, Supply Chain Coordinators |

| End-Users in Fashion Industry | 50 | Designers, Brand Managers |

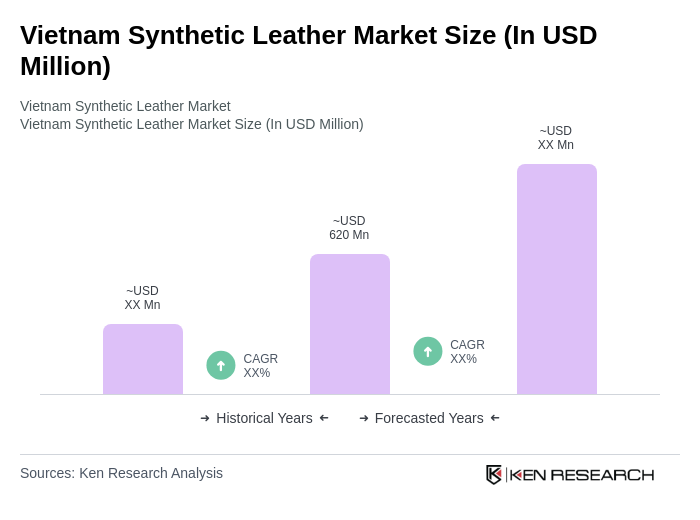

The Vietnam Synthetic Leather Market is valued at approximately USD 620 million, reflecting significant growth driven by increasing demand for affordable and durable alternatives to genuine leather, particularly in the footwear and automotive sectors.