Region:Global

Author(s):Rebecca

Product Code:KRAA2936

Pages:82

Published On:August 2025

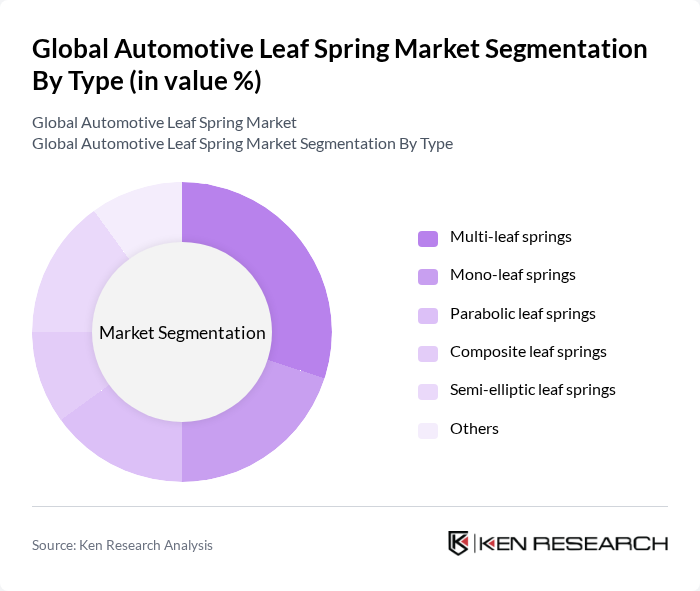

By Type:The market is segmented into various types of leaf springs, including multi-leaf springs, mono-leaf springs, parabolic leaf springs, composite leaf springs, semi-elliptic leaf springs, and others. Each type serves different applications and vehicle requirements, influencing their market presence .

The multi-leaf springs segment dominates the market due to their widespread use in heavy-duty vehicles, offering superior load-bearing capacity and durability. Their ability to absorb shocks and maintain stability under heavy loads makes them a preferred choice for commercial applications. The growing demand for heavy commercial vehicles and the need for robust, reliable suspension systems further support the growth of this segment. Advancements in material science, such as the adoption of high-strength steel and composite materials, are enhancing the performance and longevity of multi-leaf springs .

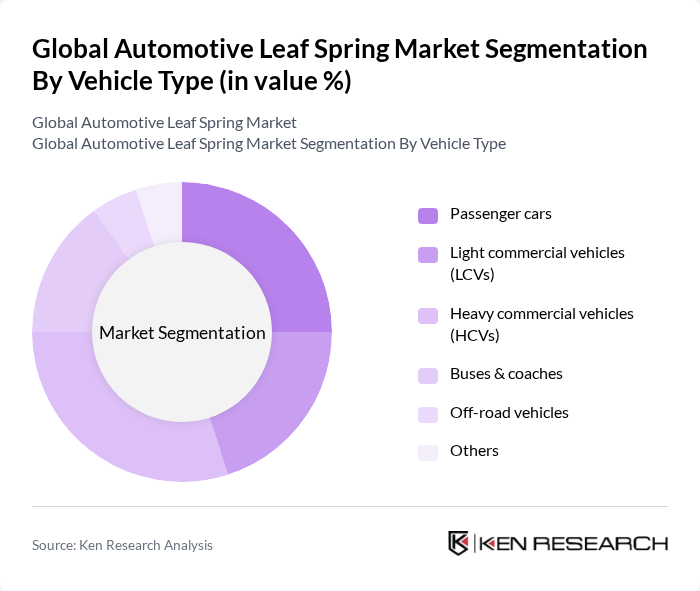

By Vehicle Type:The market is segmented based on vehicle types, including passenger cars, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), buses & coaches, off-road vehicles, and others. Each vehicle type has specific requirements for leaf springs, influencing their market dynamics .

The heavy commercial vehicles (HCVs) segment leads the market due to the increasing demand for freight transportation and logistics services. HCVs require robust suspension systems to handle heavy loads and ensure stability during transit. The expansion of e-commerce, infrastructure development, and the need for efficient supply chain solutions have further propelled the demand for HCVs, thereby driving the need for high-performance leaf springs. This trend is expected to continue as the logistics and construction sectors expand globally .

The Global Automotive Leaf Spring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jamna Auto Industries Ltd., Rassini S.A.B. de C.V., Hendrickson USA, L.L.C., Mitsubishi Steel Mfg. Co., Ltd., NHK Spring Co., Ltd., Sogefi S.p.A., EATON Detroit Spring, Inc., Mack Springs Pvt. Ltd., EMCO Industries Ltd., Dendoff Springs Ltd., ZF Friedrichshafen AG, Thyssenkrupp AG, Tenneco Inc., APM Automotive Holdings Berhad, ROC Springs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive leaf spring market appears promising, driven by ongoing technological advancements and a shift towards sustainability. As manufacturers increasingly adopt lightweight materials and advanced manufacturing processes, the efficiency and performance of leaf springs will improve. Additionally, the growing trend of electric and hybrid vehicles will create new opportunities for innovation in suspension systems, ensuring that leaf springs remain a vital component in modern automotive design and engineering.

| Segment | Sub-Segments |

|---|---|

| By Type | Multi-leaf springs Mono-leaf springs Parabolic leaf springs Composite leaf springs Semi-elliptic leaf springs Others |

| By Vehicle Type | Passenger cars Light commercial vehicles (LCVs) Heavy commercial vehicles (HCVs) Buses & coaches Off-road vehicles Others |

| By Application | Suspension systems Axle assemblies Aftermarket replacement Performance and specialty vehicles Others |

| By Material | Steel Composite materials (including fiberglass, carbon fiber) Aluminum Others |

| By Manufacturing Process | Hot rolling Cold rolling Molding (for composites) Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Online sales Distributors/Dealers Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low price range Mid price range High price range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Engineers, Procurement Managers |

| Commercial Vehicle Manufacturers | 80 | Supply Chain Managers, Quality Assurance Specialists |

| Leaf Spring Suppliers | 50 | Sales Directors, Technical Support Engineers |

| Automotive Aftermarket Retailers | 60 | Store Managers, Inventory Control Specialists |

| Research and Development Firms | 40 | R&D Managers, Innovation Officers |

The Global Automotive Leaf Spring Market is valued at approximately USD 8.4 billion, reflecting a robust growth trajectory driven by increasing demand for commercial vehicles and advancements in suspension technology.