Region:Middle East

Author(s):Dev

Product Code:KRAD1782

Pages:93

Published On:November 2025

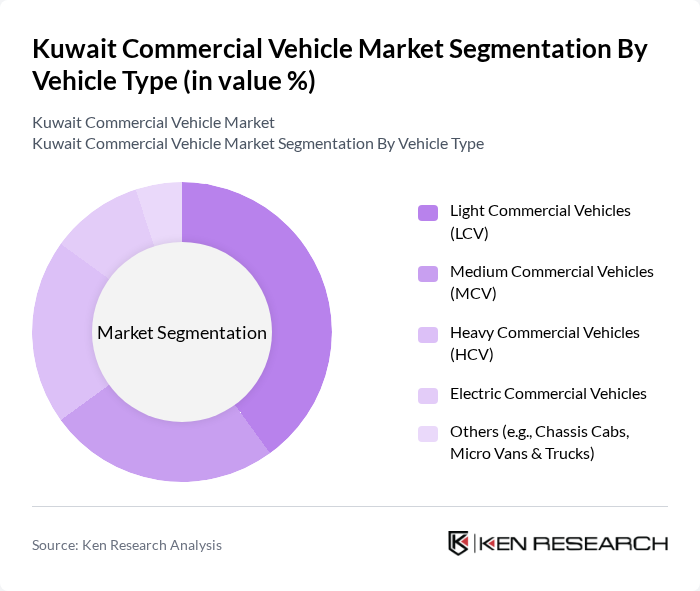

By Vehicle Type:The vehicle type segmentation includes Light Commercial Vehicles (LCV), Medium Commercial Vehicles (MCV), Heavy Commercial Vehicles (HCV), Electric Commercial Vehicles, and Others (e.g., Chassis Cabs, Micro Vans & Trucks). Each sub-segment plays a crucial role in catering to different transportation needs across various industries.

The Light Commercial Vehicles (LCV) segment dominates the market due to their versatility and suitability for various applications, including delivery services and small-scale logistics. The increasing trend of e-commerce has significantly boosted the demand for LCVs, as businesses seek efficient and cost-effective transportation solutions. Additionally, the growing urban population and the need for last-mile delivery services have further solidified the LCV's position as the leading sub-segment in the commercial vehicle market. The adoption of electric LCVs is also on the rise, driven by government incentives and sustainability initiatives .

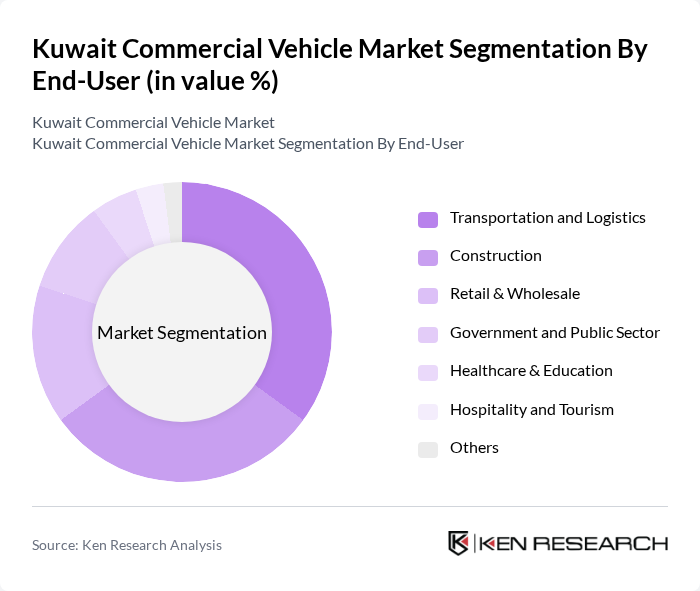

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Retail & Wholesale, Government and Public Sector, Healthcare & Education, Hospitality and Tourism, and Others. Each sector has unique requirements that drive the demand for various types of commercial vehicles.

The Transportation and Logistics sector is the leading end-user of commercial vehicles, driven by the rapid growth of e-commerce and the need for efficient supply chain solutions. Companies in this sector require a diverse fleet to handle various types of cargo, which has led to increased investments in LCVs and MCVs. The construction industry also plays a significant role, as it demands heavy-duty vehicles for transporting materials and equipment to job sites, further contributing to the overall market growth. The retail and wholesale sector is also expanding, driven by the rise of online shopping and the need for efficient distribution networks .

The Kuwait Commercial Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Automotive Imports Co. (KAICO), Alghanim Industries (Automotive Division), Abdulmohsen Abdulaziz Al-Babtain Co., Al-Futtaim Automotive (Kuwait), Al Mulla Group (Automotive Division), Al-Sayer Group Holding, Al-Jazeera Automobile Co., Behbehani Motors Company, Mohamed Naser Al Sayer & Sons, Yusuf A. Alghanim & Sons Automotive, United Motors Company, Al-Bahar & Sons Co., Al-Ghanim & Al-Mutawa Group, Arabian Motors Group, National Agencies Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait commercial vehicle market appears promising, driven by ongoing infrastructure projects and a growing logistics sector. As the government continues to invest in economic diversification, the demand for modern, efficient vehicles is expected to rise. Additionally, the increasing focus on sustainability and technological advancements will likely shape the market landscape, encouraging the adoption of electric and hybrid vehicles, as well as smart transportation solutions that enhance operational efficiency and reduce environmental impact.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Light Commercial Vehicles (LCV) Medium Commercial Vehicles (MCV) Heavy Commercial Vehicles (HCV) Electric Commercial Vehicles Others (e.g., Chassis Cabs, Micro Vans & Trucks) |

| By End-User | Transportation and Logistics Construction Retail & Wholesale Government and Public Sector Healthcare & Education Hospitality and Tourism Others |

| By Payload Capacity | Up to 1 Ton to 3 Tons to 5 Tons Above 5 Tons Others |

| By Fuel Type | Diesel Petrol Alternate Fuel (CNG, LPG, etc.) Electric Others |

| By Application | Freight Transport Passenger Transport Construction and Mining Waste Management Others (e.g., Refrigeration, Utility, etc.) |

| By Distribution Channel | Direct Sales Dealerships Online Sales Auctions Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Transportation Companies | 100 | Fleet Managers, Operations Directors |

| Commercial Vehicle Dealerships | 60 | Sales Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| End-User Businesses | 50 | Procurement Officers, Logistics Coordinators |

| Industry Experts and Analysts | 20 | Market Analysts, Industry Consultants |

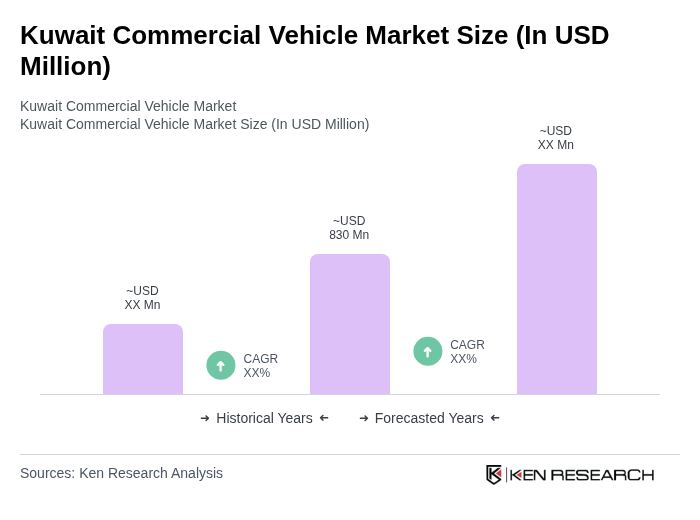

The Kuwait Commercial Vehicle Market is valued at approximately USD 830 million, driven by increasing demand for transportation and logistics services, infrastructure investments, and the growth of e-commerce, making it a crucial part of the country's economy.