Region:Global

Author(s):Rebecca

Product Code:KRAB0193

Pages:89

Published On:August 2025

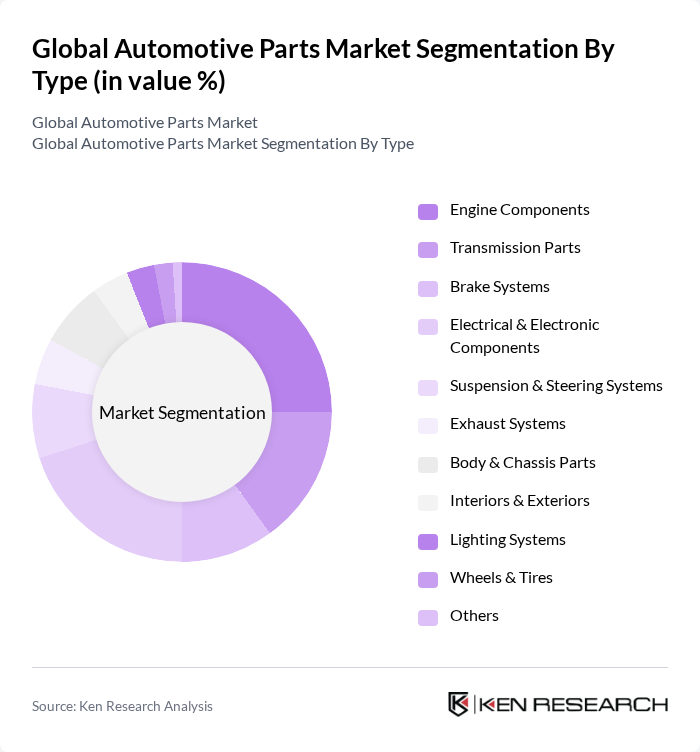

By Type:The automotive parts market is segmented into engine components, transmission parts, brake systems, electrical & electronic components, suspension & steering systems, exhaust systems, body & chassis parts, interiors & exteriors, lighting systems, wheels & tires, and others. Among these, engine components and electrical & electronic components are particularly significant, reflecting the increasing complexity of modern vehicles, the integration of advanced driver-assistance systems (ADAS), and the growing demand for fuel efficiency and performance .

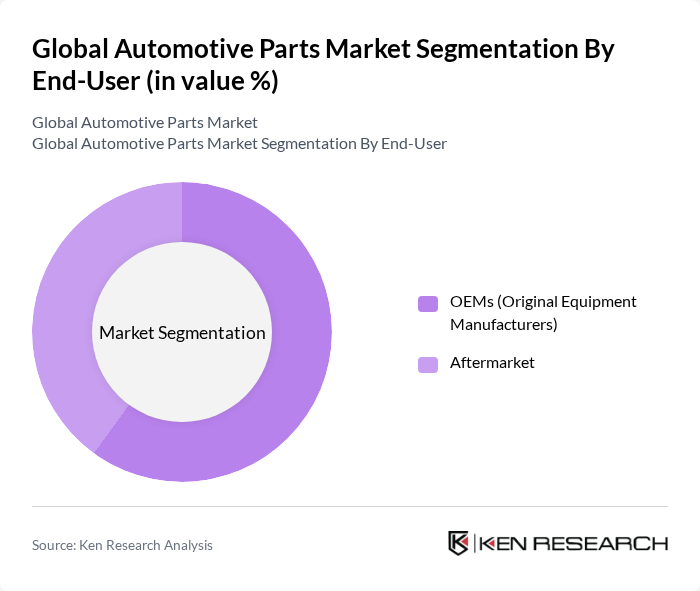

By End-User:The market is divided into two primary end-user segments: OEMs (Original Equipment Manufacturers) and the aftermarket. The OEM segment is essential for integrating parts into new vehicles, while the aftermarket segment is expanding due to the increasing age of vehicles in operation and the popularity of vehicle customization. The aftermarket is further propelled by the growth of e-commerce platforms and "right-to-repair" legislation, which broadens access to parts and services .

The Global Automotive Parts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Denso Corporation, Magna International Inc., ZF Friedrichshafen AG, Aisin Corporation, Valeo SA, Continental AG, Lear Corporation, Faurecia S.E., Johnson Controls International plc, NTN Corporation, Schaeffler AG, Tenneco Inc., Hitachi Astemo, Ltd., and Hyundai Mobis Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive parts market is poised for transformative growth driven by technological advancements and a shift towards sustainability. As electric vehicle adoption accelerates, manufacturers will increasingly focus on developing innovative components that enhance performance and reduce environmental impact. Additionally, the integration of IoT technologies in automotive parts will create new opportunities for smart features, improving vehicle safety and efficiency. The market landscape in the None region will evolve, emphasizing collaboration between traditional automotive companies and tech firms to meet emerging consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Components Transmission Parts Brake Systems Electrical & Electronic Components Suspension & Steering Systems Exhaust Systems Body & Chassis Parts Interiors & Exteriors Lighting Systems Wheels & Tires Others |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket |

| By Component | Mechanical Parts Electrical/Electronic Parts Body Parts Interior Parts |

| By Sales Channel | Direct Sales Distributors/Dealers Online Retail/E-commerce Auto Parts Stores |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Automotive Parts Manufacturers | 60 | Production Managers, Quality Control Engineers |

| Aftermarket Parts Distributors | 50 | Sales Directors, Inventory Managers |

| Automotive Component Suppliers | 40 | Procurement Managers, Supply Chain Analysts |

| Electric Vehicle Parts Manufacturers | 40 | R&D Engineers, Product Managers |

| Automotive Repair Shops | 50 | Service Managers, Technicians |

The Global Automotive Parts Market is valued at approximately USD 733 billion, driven by factors such as rising vehicle production, technological advancements, and the growing electric vehicle segment.