Region:Global

Author(s):Rebecca

Product Code:KRAD4898

Pages:93

Published On:December 2025

By Type:The market is segmented into various types of automotive tinting films, each catering to different consumer needs and preferences. The primary types include Dyed Films, Metalized Films, Hybrid Films, Ceramic Films, Carbon Films, Crystalline / IR-Reflective Films, and Others. Each type offers unique benefits, such as heat rejection, UV protection, glare reduction, shatter resistance, and aesthetic appeal, influencing consumer choices.

The Dyed Films segment remains significant in volume terms due to its cost-effectiveness and aesthetic appeal, and these films are popular among consumers looking for affordable options that provide basic UV protection and privacy. However, recent industry analyses indicate a faster shift in value terms toward higher-performance products such as ceramic and advanced IR-reflective films, which offer superior heat rejection, signal-friendly performance, and longer durability, especially in premium and mid-range vehicle segments. Metalized Films continue to be used where strong heat rejection and glare reduction are prioritized, while the growing trend towards customization and performance in vehicle aesthetics is driving demand for Hybrid, Ceramic, and Carbon Films that combine enhanced durability, color stability, and higher infrared rejection.

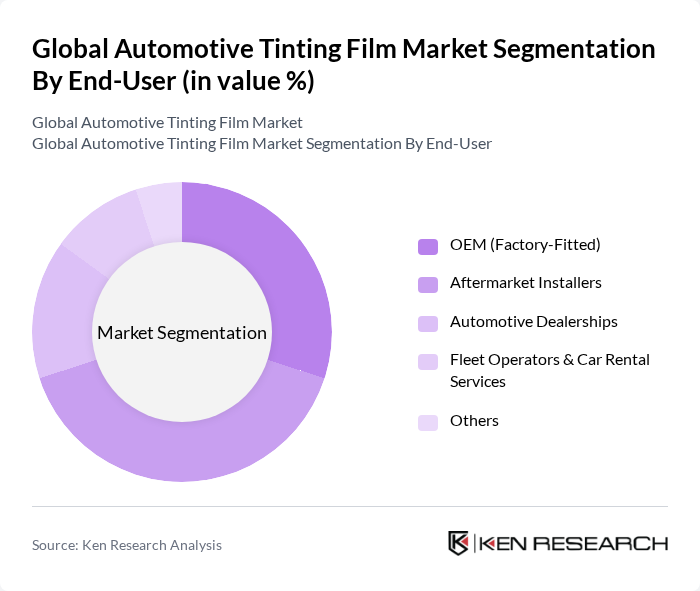

By End-User:The automotive tinting film market is segmented by end-user categories, including OEM (Factory-Fitted), Aftermarket Installers, Automotive Dealerships, Fleet Operators & Car Rental Services, and Others. Each segment plays a crucial role in the distribution and application of tinting films, catering to different consumer needs across new vehicle production, dealer-installed options, and the aftermarket service ecosystem.

The Aftermarket Installers segment is widely recognized as the leading channel, supported by the large global vehicle parc and the increasing trend of vehicle customization, retrofits, and replacement tinting for older vehicles. This segment benefits from a broad price spectrum and technology range, allowing consumers to choose from entry-level dyed films to high-end ceramic and IR-reflective solutions tailored to local climate and regulatory conditions. OEM installations are also significant and are gaining importance as automakers integrate solar control glazing and factory-tinted glass to improve thermal comfort and reduce air-conditioning load, aligned with energy-efficiency and emissions targets.

The Global Automotive Tinting Film Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Eastman Chemical Company (LLumar, SunTek), Saint-Gobain Performance Plastics (Solar Gard), Madico, Inc., Avery Dennison Corporation, XPEL, Inc., Johnson Window Films, Inc., Garware Hi-Tech Films Ltd., Nexfil Co., Ltd., Global Window Films, Huper Optik USA, V-KOOL International Pte Ltd (Eastman Group), Solar Free Window Film (Mogul Film Co., Ltd.), Tint World, LLC, Klingshield / Sunshield Glass Tinting contribute to innovation, geographic expansion, and service delivery in this space.

The automotive tinting film market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As smart technologies integrate into vehicles, the demand for innovative tinting solutions that offer enhanced functionality is expected to rise. Additionally, the trend towards eco-friendly products will likely shape future offerings, with manufacturers focusing on sustainable materials. The increasing popularity of DIY installation kits will also empower consumers, making tinting films more accessible and appealing, thus expanding the market further.

| Segment | Sub-Segments |

|---|---|

| By Type | Dyed Films Metalized Films Hybrid Films Ceramic Films Carbon Films Crystalline / IR-Reflective Films Others |

| By End-User | OEM (Factory-Fitted) Aftermarket Installers Automotive Dealerships Fleet Operators & Car Rental Services Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Buses & Coaches Others |

| By Application | Side Windows Rear Windows Windshields Sunroofs & Panoramic Roofs Others |

| By Distribution Channel | OEM Supply Aftermarket Retail Stores Specialty Tinting Studios & Franchises Online (E-commerce & Brand Websites) Distributors & Wholesalers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Ultra-Premium / Ceramic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Tinting Film Manufacturers | 45 | Production Managers, Sales Directors |

| Automotive Dealerships | 60 | Service Managers, Parts Managers |

| Automotive Customization Shops | 50 | Shop Owners, Technicians |

| End-Users (Vehicle Owners) | 120 | Car Enthusiasts, General Consumers |

| Industry Experts and Consultants | 40 | Market Analysts, Automotive Consultants |

The Global Automotive Tinting Film Market is valued at approximately USD 7.5 billion, driven by consumer demand for aesthetics, UV protection, and heat reduction. This market is expected to grow as awareness of the benefits of tinting films increases.