Region:Global

Author(s):Dev

Product Code:KRAA3061

Pages:89

Published On:August 2025

Software Market.png)

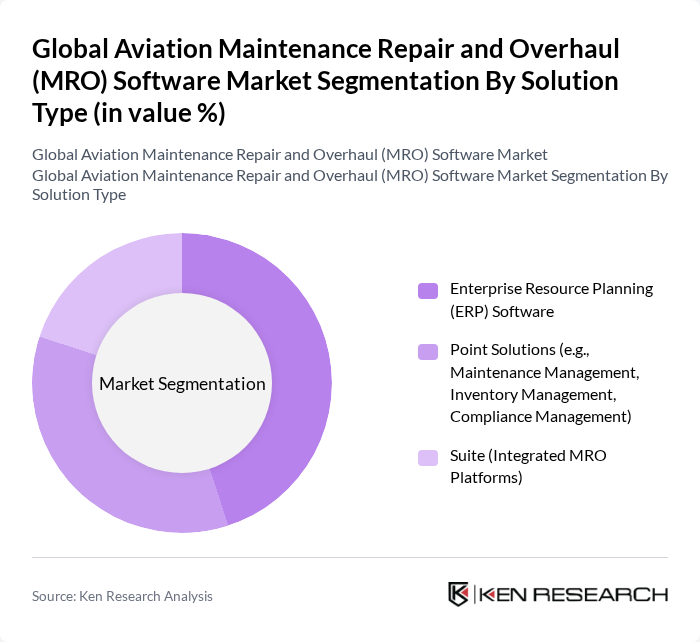

By Solution Type:The solution type segment includes various software solutions tailored for MRO operations. The leading sub-segment is Enterprise Resource Planning (ERP) Software, which integrates all facets of an operation, including planning, purchasing, inventory, sales, marketing, finance, and human resources. Point Solutions, which focus on specific areas like maintenance management and compliance management, are also gaining traction due to their targeted functionalities. Suite (Integrated MRO Platforms) is emerging as a comprehensive solution that combines multiple functionalities into a single platform, appealing to larger enterprises seeking streamlined operations. The market is witnessing increased adoption of cloud-based and AI-powered platforms for predictive maintenance and real-time data access .

By End-User:The end-user segment is primarily driven by Airlines, which include commercial, cargo, and low-cost carriers. Airlines are the largest consumers of MRO software due to their need for efficient maintenance operations to ensure safety and compliance. MRO Service Providers also represent a significant portion of the market, as they require robust software solutions to manage their operations effectively. OEMs (Original Equipment Manufacturers) and Government and Defense Operators are also key players, utilizing MRO software to maintain their fleets and ensure operational readiness. The increasing complexity of fleet operations and regulatory requirements is prompting all end-user segments to adopt digital MRO solutions .

The Global Aviation Maintenance Repair and Overhaul (MRO) Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Boeing Company, Airbus S.A.S., Honeywell International Inc., Dassault Systèmes SE, Collins Aerospace (Raytheon Technologies), Ramco Systems Limited, IFS AB, Mxi Technologies (an IFS company), Swiss AviationSoftware Ltd. (Swiss-AS), Ultramain Systems, Inc., AAR Corp., Rusada contribute to innovation, geographic expansion, and service delivery in this space.

The future of MRO software in the None region is poised for significant transformation, driven by technological advancements and evolving industry needs. The shift towards predictive maintenance will enhance operational efficiency, while sustainability initiatives will shape software development. Additionally, the growing emphasis on user experience will lead to more intuitive interfaces, making MRO solutions accessible to a broader range of users. These trends indicate a dynamic market landscape that will adapt to the changing demands of the aviation industry.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Enterprise Resource Planning (ERP) Software Point Solutions (e.g., Maintenance Management, Inventory Management, Compliance Management) Suite (Integrated MRO Platforms) |

| By End-User | Airlines (Commercial, Cargo, Low-Cost Carriers) MRO Service Providers OEMs (Original Equipment Manufacturers) Government and Defense Operators |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Component | Software Services (Implementation, Support, Training) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Ownership/License Fee Pay-Per-Use |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Airlines MRO Software Usage | 120 | IT Managers, Maintenance Directors |

| Business Aviation MRO Solutions | 90 | Operations Managers, Fleet Managers |

| Helicopter MRO Software Applications | 60 | Maintenance Engineers, Safety Officers |

| Military Aviation MRO Software Needs | 50 | Procurement Officers, Technical Managers |

| Regional Airlines MRO Software Adoption | 70 | IT Specialists, Compliance Managers |

The Global Aviation Maintenance Repair and Overhaul (MRO) Software Market is valued at approximately USD 7.7 billion, driven by the increasing demand for efficient maintenance solutions and compliance with stringent aviation regulations.