Region:Global

Author(s):Shubham

Product Code:KRAC0639

Pages:83

Published On:August 2025

By Type:The market is segmented into various types, including Account & Ledger Services, Payments & Money Movement, Card Issuing & Processing, Lending & Credit-as-a-Service, KYC/KYB, Compliance & Risk Orchestration, Banking & Core Platforms, Treasury, FX & Cross-Border Services, Analytics, Reporting & Fraud Management, and Embedded Finance Tooling. Among these, Payments & Money Movement is currently the leading sub-segment due to the increasing demand for seamless transaction solutions and the rise of e-commerce, consistent with findings that payment-related BaaS components hold the largest share in recent assessments .

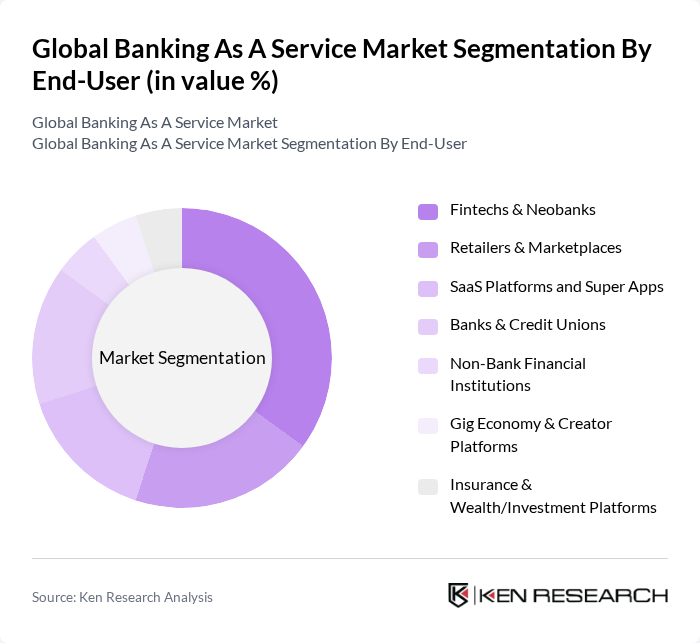

By End-User:The end-user segmentation includes Fintechs & Neobanks, Retailers & Marketplaces, SaaS Platforms and Super Apps, Banks & Credit Unions, Non-Bank Financial Institutions, Gig Economy & Creator Platforms, and Insurance & Wealth/Investment Platforms. Fintechs & Neobanks are leading this segment due to their agility and ability to offer innovative financial solutions that cater to the evolving needs of consumers, benefiting from API-first infrastructures and embedded finance use cases .

The Global Banking As A Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solaris SE (formerly Solarisbank), Mambu, Thought Machine, Marqeta, Inc., Galileo Financial Technologies (SoFi Technologies), Stripe, Inc., Adyen N.V., FIS (Fidelity National Information Services), Fiserv, Inc., Temenos AG, Finastra, Q2 Holdings, Inc., Rapyd, Nium, Railsbank (Railsr) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Banking as a Service market appears promising, driven by technological advancements and evolving consumer preferences. As digital transformation accelerates, BaaS providers will increasingly focus on enhancing customer experiences through personalized services and innovative solutions. The integration of artificial intelligence and machine learning will further streamline operations, enabling providers to offer tailored financial products. Additionally, the collaboration between banks and fintechs will continue to reshape the landscape, fostering a more competitive and dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Account & Ledger Services (virtual IBANs, account issuance) Payments & Money Movement (cards, ACH/SEPA, real-time rails) Card Issuing & Processing (debit/credit, BIN sponsorship) Lending & Credit-as-a-Service (BNPL, SME lending, underwriting) KYC/KYB, Compliance & Risk Orchestration Banking & Core Platforms (cloud core, ledger, orchestration) Treasury, FX & Cross-Border Services Analytics, Reporting & Fraud Management Embedded Finance Tooling (SDKs, orchestration, sandbox) |

| By End-User | Fintechs & Neobanks Retailers & Marketplaces SaaS Platforms and Super Apps Banks & Credit Unions (incumbents offering/consuming BaaS) Non-Bank Financial Institutions (lenders, PSPs, FX) Gig Economy & Creator Platforms Insurance & Wealth/Investment Platforms |

| By Service Model | API-Only BaaS (self-serve APIs) Licensed BaaS with Sponsorship (bank-of-record) White-Label/Program Management Compliance-as-a-Service (KYC/KYB/AML, transaction monitoring) End-to-End Embedded Finance (banking, cards, lending bundle) |

| By Deployment Type | Cloud-Native (single-tenant and multi-tenant) On-Premises Hybrid |

| By Customer Segment | Startups & Early-Stage SMEs Large Enterprises Regulated Financial Institutions |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Usage-Based (per API call/transaction) Subscription (platform fee) Revenue Share/Interchange Share Tiered & Custom Enterprise Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fintech BaaS Providers | 120 | CEOs, Product Managers, Business Development Leads |

| Traditional Banks Adopting BaaS | 90 | Digital Transformation Officers, IT Managers |

| Regulatory Bodies and Compliance Experts | 50 | Regulatory Affairs Managers, Compliance Officers |

| End-User Experience in BaaS | 70 | Small Business Owners, Startup Founders |

| Investors in Fintech and BaaS | 60 | Venture Capitalists, Private Equity Analysts |

The Global Banking As A Service Market is valued at approximately USD 24.5 billion, reflecting significant growth driven by the increasing demand for digital banking solutions, fintech innovations, and the adoption of cloud-based services and APIs.