Region:Asia

Author(s):Shubham

Product Code:KRAD0929

Pages:87

Published On:November 2025

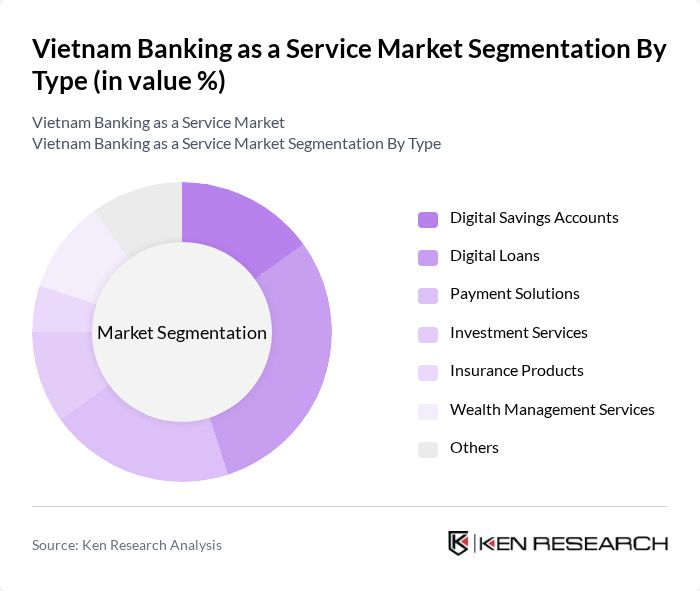

By Type:The market is segmented into Digital Savings Accounts, Digital Loans, Payment Solutions, Investment Services, Insurance Products, Wealth Management Services, and Others. Among these, Digital Loans have emerged as a leading sub-segment, driven by the rising demand for fast, accessible credit—especially among younger consumers and small businesses. The convenience of digital onboarding, streamlined application processes, and rapid disbursement are key factors fueling this trend .

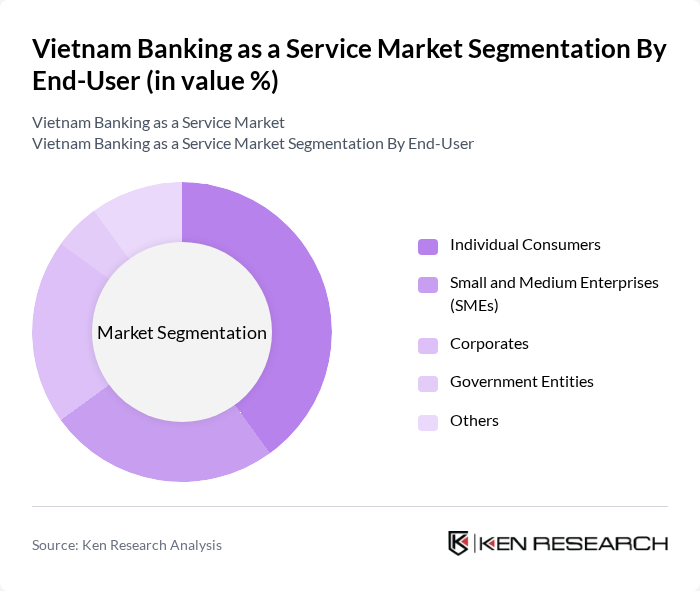

By End-User:This segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, Government Entities, and Others. Individual Consumers represent the largest segment, propelled by high smartphone penetration, widespread internet access, and a growing preference for digital-first financial services. The accessibility and convenience of these platforms are key to meeting the evolving needs of Vietnamese consumers, driving robust market growth .

The Vietnam Banking as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietcombank, Techcombank, BIDV, ACB, VPBank, MBBank, Sacombank, HDBank, MSB (Maritime Bank), SeABank, LienVietPostBank, OCB (Orient Commercial Joint Stock Bank), SHB (Saigon-Hanoi Bank), Nam A Bank, VietCapital Bank, Timo Digital Bank, Cake by VPBank, Ubank, TNEX (by MSB), MoMo (M_Service JSC), ZaloPay (VNG Corporation), Moca (Grab Vietnam), and Payoo (VietUnion) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Banking as a Service market appears promising, driven by ongoing digital transformation and increasing consumer demand for innovative financial solutions. As the government continues to support digital banking initiatives, the integration of advanced technologies like AI and machine learning will enhance service delivery. Furthermore, the rise of open banking models is expected to foster collaboration between banks and fintechs, creating a more competitive and customer-centric financial ecosystem that meets evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Savings Accounts Digital Loans Payment Solutions Investment Services Insurance Products Wealth Management Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities Others |

| By Customer Segment | Millennials Gen Z Professionals Retirees Others |

| By Service Model | SaaS (Software as a Service) PaaS (Platform as a Service) IaaS (Infrastructure as a Service) Others |

| By Deployment Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Payment Method | Credit/Debit Cards Mobile Payments Bank Transfers E-wallets Others |

| By Regulatory Compliance | PCI DSS Compliance GDPR Compliance Local Regulatory Standards Others |

| By Service Channel | Mobile Applications Web Platforms Customer Support Centers |

| By Geographic Presence | Urban Areas Rural Areas |

| By Pricing Model | Subscription-Based Transaction-Based Freemium |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Services | 100 | Branch Managers, Customer Relationship Officers |

| Fintech Partnerships | 60 | Business Development Managers, Product Managers |

| Digital Payment Solutions | 80 | IT Managers, Digital Transformation Leads |

| Consumer Lending Platforms | 50 | Loan Officers, Risk Assessment Analysts |

| Regulatory Compliance in BaaS | 40 | Compliance Officers, Legal Advisors |

The Vietnam Banking as a Service market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital banking solutions and the rise of fintech companies in the region.