Region:Global

Author(s):Dev

Product Code:KRAC2761

Pages:88

Published On:October 2025

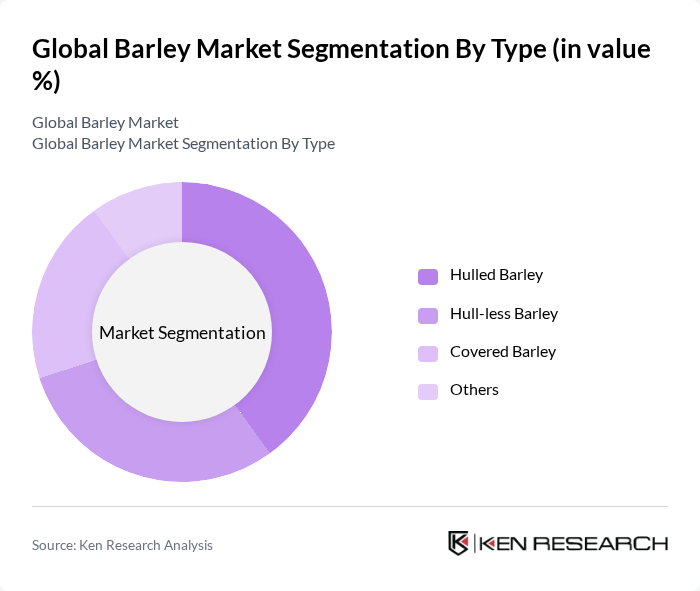

By Type:The barley market is segmented into hulled barley, hull-less barley, covered barley, and others. Hulled barley continues to gain traction due to its nutritional benefits and versatility in food applications. Hull-less barley is increasingly popular among health-conscious consumers for its digestibility and higher nutrient profile. Covered barley remains important in specific brewing and animal feed applications, especially where resilience to environmental stressors is valued .

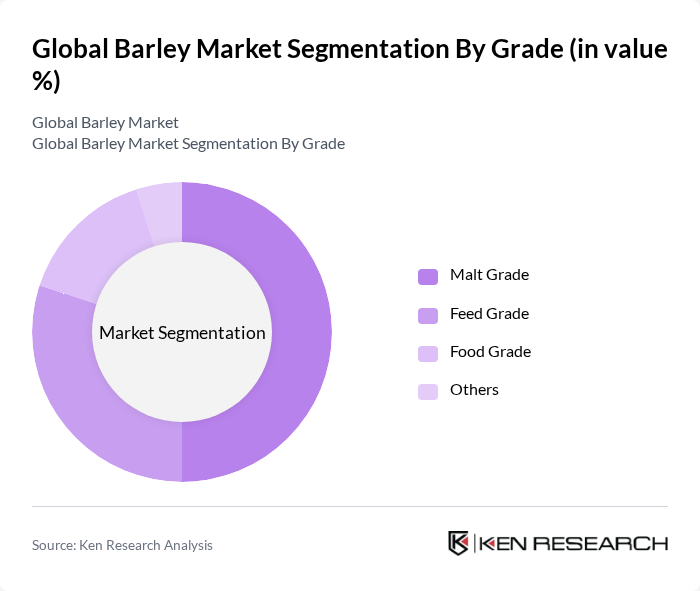

By Grade:The barley market is categorized into malt grade, feed grade, food grade, and others. Malt grade barley is the most dominant segment, driven by its essential role in the brewing and distilling industries. The proliferation of craft breweries and the demand for high-quality malt continue to propel this segment. Feed grade barley is also significant, serving as a primary ingredient in animal feed and supporting the expanding livestock sector .

The Global Barley Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Limited, GrainCorp Limited, Olam International Limited, Anheuser-Busch InBev (AB InBev), Carlsberg Group, Diageo plc, Molson Coors Beverage Company, Trouw Nutrition, KWS SAAT SE & Co. KGaA, Syngenta AG, Bayer AG, BASF SE, and Agrial Cooperative contribute to innovation, geographic expansion, and service delivery in this space .

The future of the barley market appears promising, driven by increasing consumer awareness of health benefits and a shift towards sustainable farming practices. Innovations in barley varieties are expected to enhance yield and resilience against climate change. Additionally, the growth of e-commerce platforms is likely to facilitate barley sales, making it more accessible to consumers. As demand for organic and health-focused products rises, barley's role in the food industry will continue to expand, presenting new avenues for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Hulled Barley Hull-less Barley Covered Barley Others |

| By Grade | Malt Grade Feed Grade Food Grade Others |

| By Application | Brewing & Distilling Animal Feed Food & Beverages Pharmaceuticals & Cosmetics Others |

| By Distribution Channel | Supermarkets & Hypermarkets Direct Sales Online Retail Wholesale & B2B Others |

| By Region | Europe North America Asia-Pacific Latin America Middle East & Africa |

| By Quality Grade | Organic Conventional Regenerative/Sustainable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Barley Farmers | 100 | Farm Owners, Agricultural Managers |

| Maltsters and Brewers | 60 | Production Managers, Quality Control Specialists |

| Barley Exporters | 40 | Export Managers, Trade Analysts |

| Food and Feed Manufacturers | 50 | Procurement Officers, Product Development Managers |

| Research Institutions | 40 | Agricultural Researchers, Policy Analysts |

The Global Barley Market is valued at approximately USD 24 billion, driven by increasing demand in brewing, animal feed, and health food sectors. This valuation is based on a comprehensive five-year historical analysis of market trends and growth factors.