Region:Middle East

Author(s):Shubham

Product Code:KRAA8884

Pages:99

Published On:November 2025

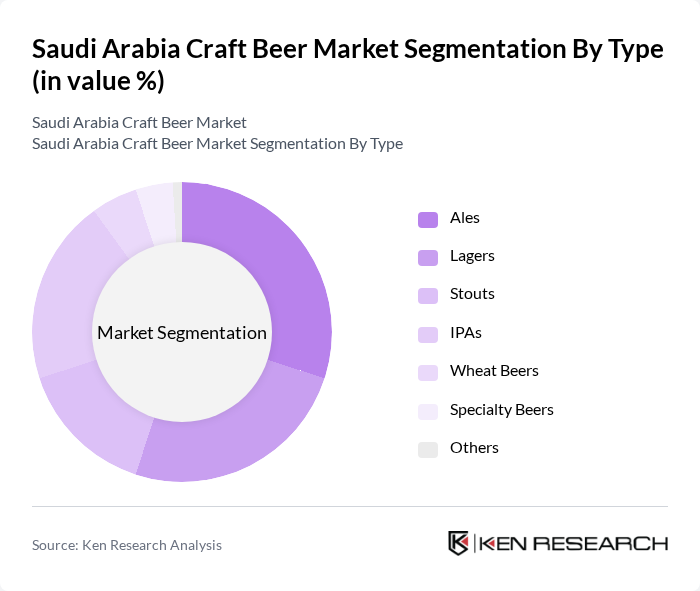

By Type:The craft beer market can be segmented into various types, including Ales, Lagers, Stouts, IPAs, Wheat Beers, Specialty Beers, and Others. Among these, Ales and IPAs are particularly popular due to their diverse flavor profiles and the growing trend of craft brewing. Consumers are increasingly drawn to unique and innovative flavors, which has led to a rise in the production of specialty beers as well. The market is also witnessing growing interest in non-alcoholic and low-alcohol craft beer variants, driven by health-conscious consumers seeking sophisticated beverage alternatives.

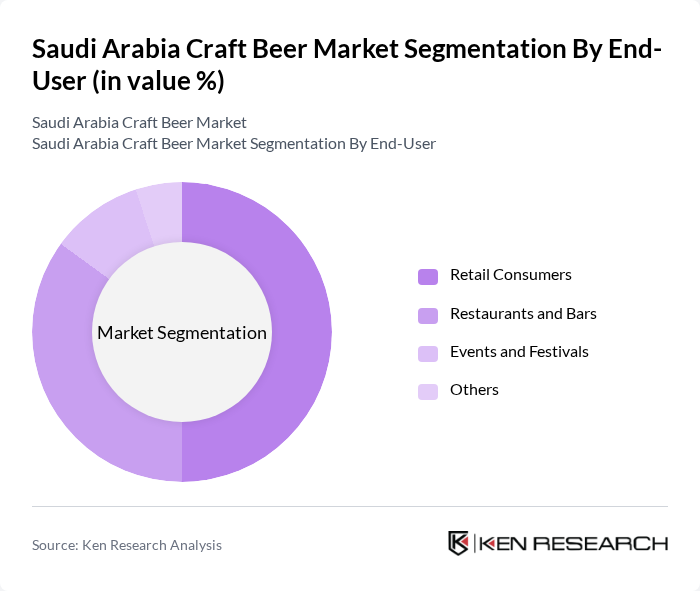

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Bars, Events and Festivals, and Others. Retail Consumers represent a significant portion of the market, driven by the increasing availability of craft beer in supermarkets and specialty stores. Restaurants and bars are also crucial as they provide a platform for consumers to experience a variety of craft beers, often leading to higher sales during social gatherings and events.

The Saudi Arabia Craft Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Ahli Brewery, Brewed Awakening, MBC Group, Saudi Beer Company, Al-Faisal Brewery, Crafty Brew Co., Hops & Barley, Oasis Brewing, Desert Craft Brewery, Riyadh Craft Beer Co., Jeddah Brewing Co., Eastern Province Brewery, Al-Madina Craft Beers, and Saudi Craft Beer Collective contribute to innovation, geographic expansion, and service delivery in this space.

The future of the craft beer market in Saudi Arabia appears promising, driven by evolving consumer preferences and a burgeoning tourism sector. As disposable incomes rise, more consumers are likely to explore craft beer options, leading to increased sales. Additionally, the government's efforts to promote tourism and local production will create a conducive environment for craft breweries. However, addressing regulatory challenges and cultural perceptions will be crucial for sustained growth in this emerging market.

| Segment | Sub-Segments |

|---|---|

| By Type | Ales Lagers Stouts IPAs Wheat Beers Specialty Beers Others |

| By End-User | Retail Consumers Restaurants and Bars Events and Festivals Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Others |

| By Packaging Type | Bottles Cans Kegs Others |

| By Flavor Profile | Hoppy Malty Fruity Spicy Others |

| By Alcohol Content | Low Alcohol Regular Alcohol High Alcohol Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Craft Brewery Owners | 50 | Founders, Operations Managers |

| Retail Outlets Selling Craft Beer | 75 | Store Managers, Beverage Buyers |

| Craft Beer Consumers | 150 | Regular Craft Beer Drinkers, Occasional Consumers |

| Industry Experts and Analysts | 40 | Market Analysts, Beverage Consultants |

| Event Organizers for Craft Beer Festivals | 20 | Event Coordinators, Marketing Managers |

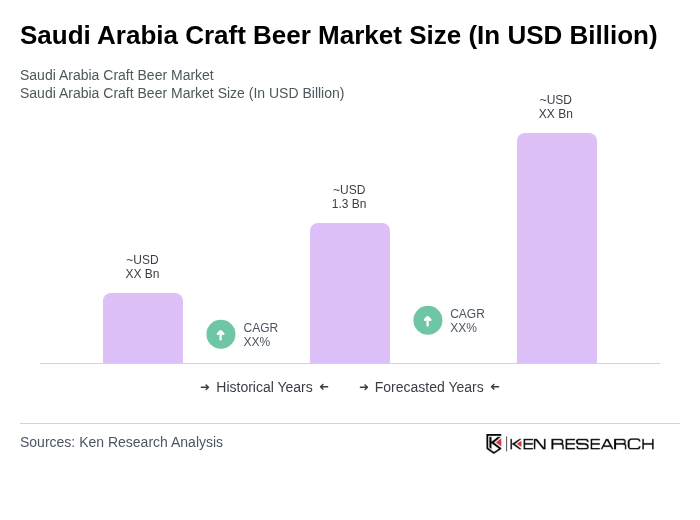

The Saudi Arabia Craft Beer Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing consumer demand for diverse beverage options and a cultural shift towards more relaxed attitudes regarding alcohol consumption.