Region:Global

Author(s):Shubham

Product Code:KRAD0647

Pages:98

Published On:August 2025

By Type (API Group):The base oil market is segmented into various types based on the API classification. The primary subsegments include Group I (Solvent-refined), Group II (Hydroprocessed), Group III (Severely hydrocracked), Group IV (PAO – Polyalphaolefins), and Group V (Esters, PAG, Naphthenic, others). Each type serves different applications and industries, with Group II and III gaining popularity due to their superior performance characteristics, better oxidation stability and volatility control for modern engine and industrial lubricant specifications.

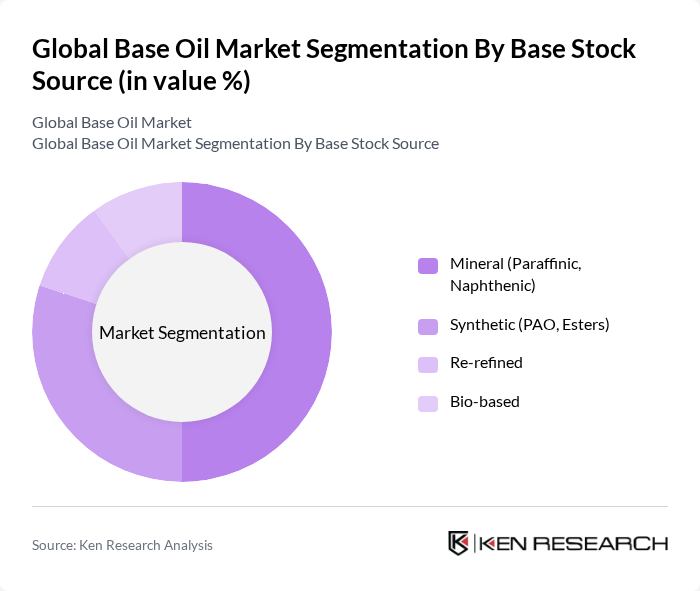

By Base Stock Source:The base oil market is also categorized by the source of the base stock, which includes Mineral (Paraffinic, Naphthenic), Synthetic (PAO, Esters), Re-refined, and Bio-based oils. Mineral oils remain widely used due to cost-effectiveness and established supply chains, while synthetic and re-refined/bio-based oils are gaining traction as OEM lubricant specifications tighten and sustainability initiatives expand in major regions.

The Global Base Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chevron Corporation, Shell plc, TotalEnergies SE, China Petroleum & Chemical Corporation (Sinopec), SK Enmove Co., Ltd. (formerly SK Lubricants), S-Oil Corporation, Saudi Aramco (Luberef – Saudi Aramco Base Oil Company), PetroChina Company Limited, Neste Oyj, H&R Group (H&R GmbH & Co. KGaA), Phillips 66 Company, Lukoil Oil Company (PJSC LUKOIL), Idemitsu Kosan Co., Ltd., GS Caltex Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the base oil market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological innovation. As environmental regulations tighten, manufacturers are likely to invest in eco-friendly production methods and renewable base oils. Additionally, the digitalization of supply chain management will enhance operational efficiencies, allowing for better inventory control and reduced costs. These trends indicate a shift towards more sustainable practices, positioning the market for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (API Group) | Group I (Solvent-refined) Group II (Hydroprocessed) Group III (Severely hydrocracked) Group IV (PAO – Polyalphaolefins) Group V (Esters, PAG, Naphthenic, others) |

| By Base Stock Source | Mineral (Paraffinic, Naphthenic) Synthetic (PAO, Esters) Re-refined Bio-based |

| By Application | Engine Oils Hydraulic Oils Gear Oils Metalworking Fluids Process Oils Greases Others |

| By End-Use Industry | Automotive & Transportation Industrial Manufacturing Power Generation Marine Construction & Mining Aerospace Others |

| By Distribution Channel | Direct (OEMs and Large Accounts) Authorized Distributors/Blenders Traders/Spot Sales Online Procurement Retail Others |

| By Region | Asia-Pacific North America Europe Middle East & Africa Latin America Others |

| By Quality/Performance Grade | Standard (Group I) Premium (Group II/III) Specialty (Group IV/V) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricants | 120 | Procurement Managers, Product Development Engineers |

| Industrial Oils | 100 | Operations Managers, Maintenance Supervisors |

| Marine Lubricants | 80 | Fleet Managers, Marine Engineers |

| Base Oil Refining | 70 | Refinery Managers, Chemical Engineers |

| Environmental Regulations Impact | 60 | Compliance Officers, Environmental Managers |

The Global Base Oil Market is valued at approximately USD 42 billion, based on a five-year historical analysis. This market size reflects the significant demand for base oils across various industries, particularly in the Asia-Pacific region, which holds the largest share.