Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1261

Pages:87

Published On:November 2025

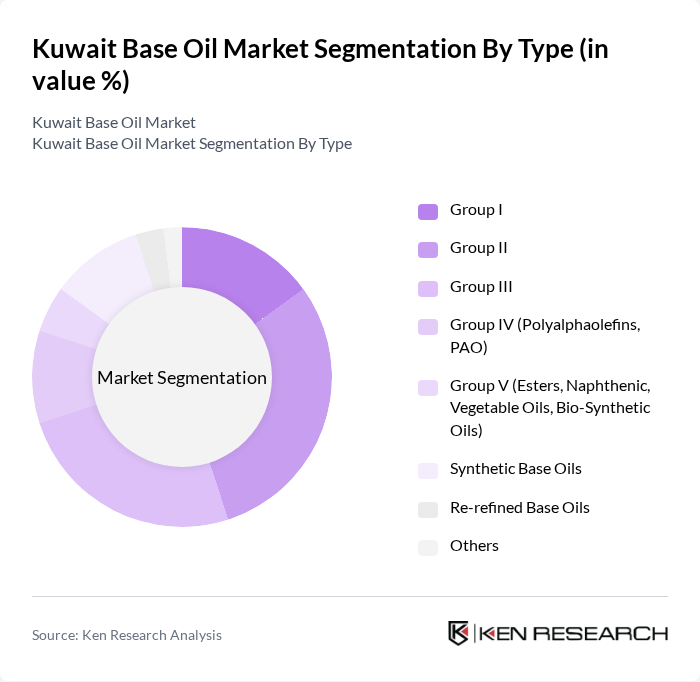

By Type:The base oil market is segmented into Group I, Group II, Group III, Group IV (Polyalphaolefins, PAO), Group V (Esters, Naphthenic, Vegetable Oils, Bio-Synthetic Oils), Synthetic Base Oils, Re-refined Base Oils, and Others. Group II and Group III base oils are increasingly favored due to their higher purity, better performance in modern engines, and compliance with evolving environmental standards. The demand for synthetic and re-refined base oils is also rising, driven by technological advancements, sustainability initiatives, and the need for lubricants that support longer drain intervals and improved fuel efficiency.

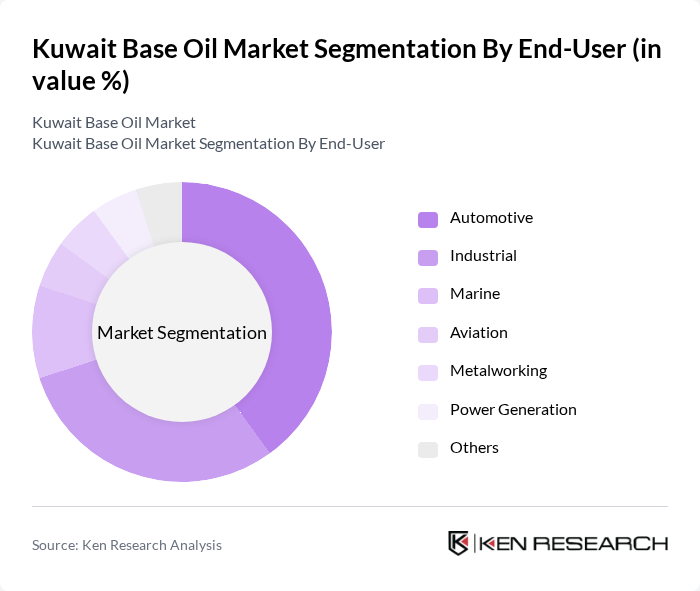

By End-User:The end-user segmentation includes Automotive, Industrial, Marine, Aviation, Metalworking, Power Generation, and Others. The automotive sector is the largest consumer of base oils, propelled by the country’s high vehicle density and demand for premium lubricants. The industrial segment is also substantial, with base oils used extensively in manufacturing, heavy equipment, and power generation. Marine and aviation applications are supported by Kuwait’s active logistics and transportation sectors, while metalworking and power generation require specialized lubricants for operational efficiency and equipment longevity.

The Kuwait Base Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Kuwait National Petroleum Company (KNPC), Petrochemical Industries Company (PIC), Gulf Oil International, Al Sanea Chemical Products, TotalEnergies Kuwait, Kuwait Oil Company (KOC), Al-Babtain Group, Al-Dhow Engineering, Al-Mutlaa Group, Al-Mansoori Specialized Engineering, KPC International, Al-Futtaim Group, Al-Hazm Group, SK Enmove Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait base oil market is poised for significant transformation, driven by increasing demand for sustainable and high-quality lubricants. As the automotive and industrial sectors expand, local producers are likely to invest in advanced refining technologies to enhance production efficiency. Additionally, the shift towards eco-friendly products will encourage innovation in bio-based lubricants, creating new market segments. Strategic partnerships with international players may further bolster Kuwait's position in the regional base oil landscape, fostering growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Group I Group II Group III Group IV (Polyalphaolefins, PAO) Group V (Esters, Naphthenic, Vegetable Oils, Bio-Synthetic Oils) Synthetic Base Oils Re-refined Base Oils Others |

| By End-User | Automotive Industrial Marine Aviation Metalworking Power Generation Others |

| By Application | Engine Oils Hydraulic Fluids Gear Oils Process Oils Greases Compressor Oils Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Packaging Type | Bulk Packaging Drums Pails Bottles Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Eastern Kuwait Western Kuwait Others |

| By Customer Type | OEMs Aftermarket Government Industrial Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricants Market | 45 | Procurement Managers, Automotive Engineers |

| Industrial Oil Applications | 38 | Plant Managers, Maintenance Supervisors |

| Marine Lubricants Sector | 32 | Marine Operations Managers, Fleet Supervisors |

| Base Oil Distribution Channels | 42 | Logistics Coordinators, Sales Directors |

| Environmental Regulations Impact | 35 | Compliance Officers, Environmental Managers |

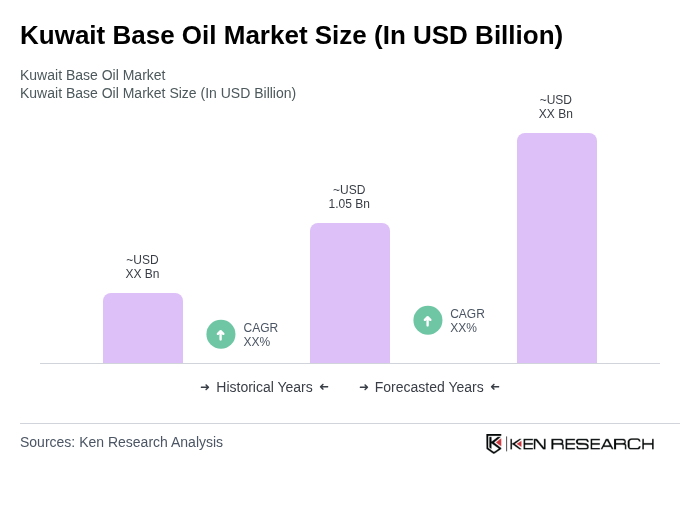

The Kuwait Base Oil Market is valued at approximately USD 1.05 billion, reflecting strong demand for high-quality lubricants in automotive and industrial sectors, supported by Kuwait's significant role as a regional oil producer and refiner.