Region:Global

Author(s):Geetanshi

Product Code:KRAA1296

Pages:97

Published On:August 2025

By Type:The beverages market is segmented into carbonated soft drinks, alcoholic beverages, bottled water, juices & nectars, tea and coffee, functional & energy drinks, dairy-based beverages, plant-based & alternative beverages, and others. Among these, carbonated soft drinks and bottled water remain prominent due to their widespread consumption and strong brand loyalty. Functional beverages and plant-based alternatives are experiencing accelerated growth, driven by consumer health awareness and demand for innovative products .

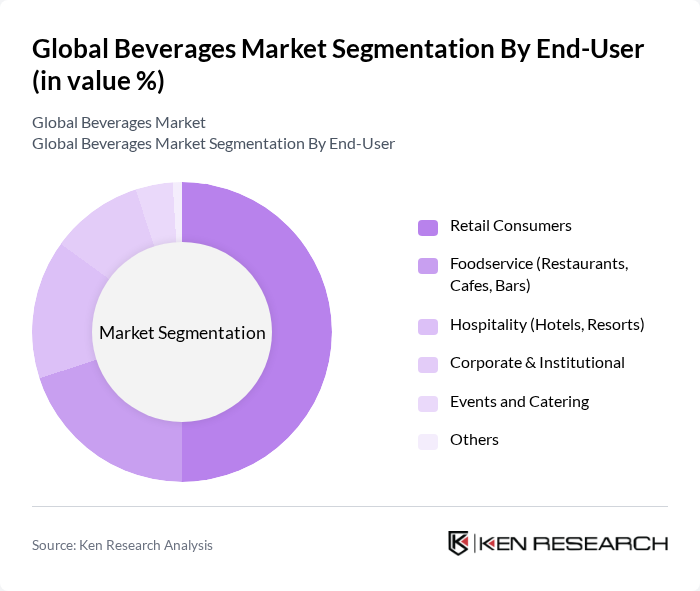

By End-User:The end-user segmentation includes retail consumers, foodservice (restaurants, cafes, bars), hospitality (hotels, resorts), corporate & institutional, events and catering, and others. Retail consumers dominate the market, driven by the increasing trend of on-the-go consumption, rising demand for convenience, and the expansion of digital platforms influencing purchasing behavior .

The Global Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Anheuser-Busch InBev, Diageo plc, Heineken N.V., Red Bull GmbH, Keurig Dr Pepper Inc., Monster Beverage Corporation, Suntory Holdings Limited, Constellation Brands, Inc., Molson Coors Beverage Company, Asahi Group Holdings, Ltd., Kirin Holdings Company, Limited, Coca-Cola HBC AG, Britvic plc, Danone S.A., Tata Consumer Products Limited, Pernod Ricard S.A., Carlsberg Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the beverage market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, companies are likely to innovate with new product formulations that cater to this demand. Additionally, the integration of technology in distribution and marketing strategies will enhance consumer engagement. The focus on sustainability will also shape product development, as brands strive to meet eco-friendly standards and consumer expectations for responsible sourcing and packaging.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Soft Drinks Alcoholic Beverages Bottled Water Juices & Nectars Tea and Coffee Functional & Energy Drinks Dairy-Based Beverages Plant-Based & Alternative Beverages Others |

| By End-User | Retail Consumers Foodservice (Restaurants, Cafes, Bars) Hospitality (Hotels, Resorts) Corporate & Institutional Events and Catering Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail/E-commerce Direct-to-Consumer Vending Machines Foodservice & On-Premise Others |

| By Packaging Type | Glass Bottles Plastic Bottles (PET) Cans Cartons (Tetra Pak) Pouches Others |

| By Price Range | Economy Mid-Range Premium Luxury Others |

| By Flavor Profile | Citrus Berry Tropical Herbal/Spiced Classic/Cola Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Non-Alcoholic Beverage Consumption | 100 | Consumers aged 18-45, Beverage Retailers |

| Alcoholic Beverage Trends | 80 | Bar Managers, Beverage Distributors |

| Health Drink Market Insights | 60 | Nutritionists, Health-Conscious Consumers |

| Packaging Innovations in Beverages | 50 | Product Development Managers, Packaging Engineers |

| Consumer Preferences in Beverage Choices | 90 | Market Researchers, Brand Managers |

The Global Beverages Market is valued at approximately USD 1,600 billion, reflecting a significant growth driven by consumer demand for diverse beverage options and health-conscious choices.