Region:Global

Author(s):Rebecca

Product Code:KRAC0253

Pages:98

Published On:August 2025

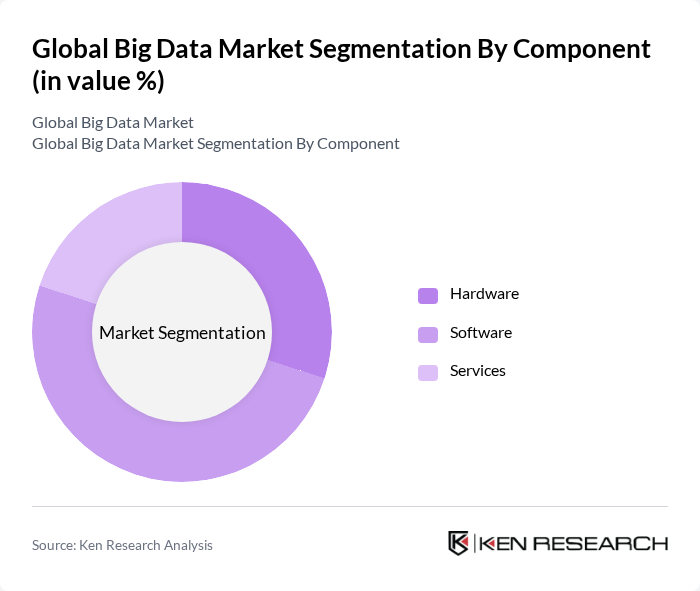

By Component:The market is segmented into Hardware, Software, and Services. Hardware includes physical devices used for data storage and processing, such as servers and storage arrays. Software encompasses analytics platforms, data management tools, and applications for processing and analyzing large datasets. Services refer to consulting, implementation, integration, and support services provided to organizations to maximize the value of their big data investments .

The Software segment is dominating the market due to the increasing adoption of advanced analytics tools and platforms that enable organizations to derive actionable insights from vast amounts of data. Businesses are investing in software solutions that facilitate real-time data processing, machine learning, and artificial intelligence, which are essential for maintaining competitiveness in a data-driven environment. The ongoing digital transformation across industries further accelerates the demand for sophisticated software solutions .

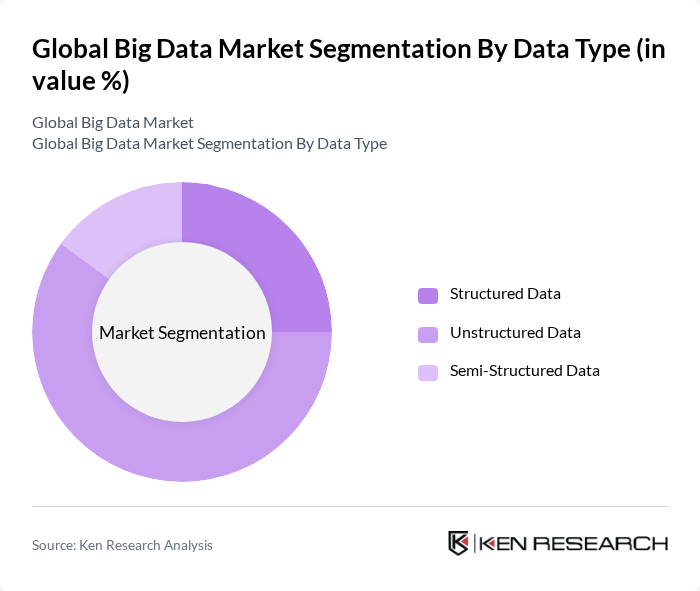

By Data Type:The market is segmented into Structured Data, Unstructured Data, and Semi-Structured Data. Structured Data refers to highly organized, easily searchable data typically stored in relational databases. Unstructured Data includes information without a predefined format, such as text, images, videos, and social media content. Semi-Structured Data contains elements of both structured and unstructured data, such as JSON, XML files, and emails with metadata .

The Unstructured Data segment is leading the market as organizations increasingly recognize the value of unstructured data generated from sources such as social media, emails, multimedia content, and IoT devices. This data type holds significant insights that can drive strategic decisions, making it essential for businesses to invest in technologies capable of analyzing and extracting value from unstructured data. The proliferation of big data analytics tools that can process diverse data types further supports this trend .

The Global Big Data Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Amazon Web Services, Inc., Google LLC, SAS Institute Inc., Cloudera, Inc., Teradata Corporation, Snowflake Inc., Domo, Inc., Palantir Technologies Inc., Informatica LLC, MicroStrategy Incorporated, TIBCO Software Inc., QlikTech International AB, Splunk Inc., Hitachi Vantara LLC, Hewlett Packard Enterprise (HPE), Dell Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the big data market is poised for transformative growth, driven by advancements in AI and machine learning technologies. As organizations increasingly adopt predictive analytics, the demand for sophisticated data management solutions will rise. Furthermore, the integration of edge computing is expected to enhance data processing capabilities, allowing for faster insights. Companies that embrace these trends will likely gain a competitive edge, positioning themselves to capitalize on the evolving landscape of big data analytics.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Data Type | Structured Data Unstructured Data Semi-Structured Data |

| By Application | Customer Analytics Fraud Detection & Risk Management Supply Chain & Operations Analytics Marketing Analytics Compliance & Data Warehouse Optimization Predictive Maintenance Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | BFSI (Banking, Financial Services & Insurance) Healthcare & Life Sciences Retail & E-commerce IT & Telecom Manufacturing Government & Public Sector Energy & Utilities Transportation & Logistics Media & Entertainment Education Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Big Data Solutions | 100 | Healthcare IT Managers, Data Analysts |

| Financial Services Data Analytics | 80 | Risk Managers, Compliance Officers |

| Retail Customer Insights | 90 | Marketing Directors, Data Scientists |

| Manufacturing Process Optimization | 60 | Operations Managers, Supply Chain Analysts |

| Telecommunications Network Management | 50 | Network Engineers, Data Operations Managers |

The Global Big Data Market is valued at approximately USD 244 billion, driven by the increasing data volumes generated by businesses and consumers, advancements in AI and machine learning, and the demand for real-time analytics across various industries.