Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4110

Pages:95

Published On:December 2025

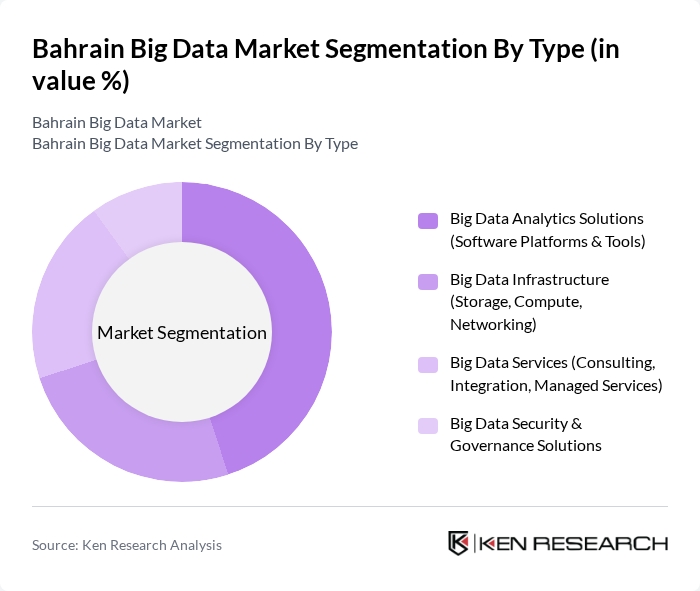

By Type:The market is segmented into various types, including Big Data Analytics Solutions, Big Data Infrastructure, Big Data Services, and Big Data Security & Governance Solutions. Among these, Big Data Analytics Solutions are leading the market due to the increasing demand for data-driven insights across industries. Organizations are investing in advanced analytics tools to enhance decision-making processes and improve operational efficiency.

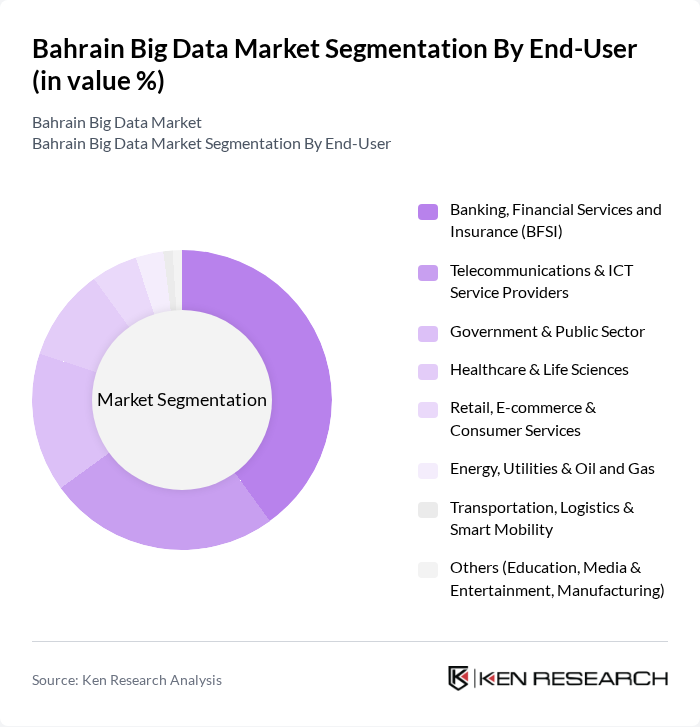

By End-User:The end-user segmentation includes Banking, Financial Services and Insurance (BFSI), Telecommunications & ICT Service Providers, Government & Public Sector, Healthcare & Life Sciences, Retail, E-commerce & Consumer Services, Energy, Utilities & Oil and Gas, Transportation, Logistics & Smart Mobility, and Others. The BFSI sector is the dominant end-user, driven by the need for enhanced risk management, customer insights, and regulatory compliance.

The Bahrain Big Data Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Telecommunications Company (Batelco), Zain Bahrain B.S.C., stc Bahrain (Saudi Telecom Company Bahrain), Amazon Web Services (AWS) Middle East (Bahrain Region), Gulf Business Machines (GBM Bahrain), Microsoft Gulf – Bahrain, Oracle Bahrain, IBM Middle East – Bahrain, SAP Middle East & North Africa – Bahrain, Huawei Technologies Bahrain, Dell Technologies Bahrain, Cisco Systems Bahrain, Infor Middle East – Bahrain, Injazat / G42 Cloud and Regional MSPs Active in Bahrain, Local Analytics & Data Services Firms (e.g., Silah Gulf, regional system integrators) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain big data market appears promising, driven by ongoing advancements in technology and increasing investments in digital infrastructure. As organizations continue to recognize the strategic importance of data analytics, the adoption of real-time processing and predictive analytics is expected to rise. Furthermore, the integration of artificial intelligence and machine learning will enhance data-driven decision-making, positioning Bahrain as a regional leader in big data innovation and application.

| Segment | Sub-Segments |

|---|---|

| By Type | Big Data Analytics Solutions (Software Platforms & Tools) Big Data Infrastructure (Storage, Compute, Networking) Big Data Services (Consulting, Integration, Managed Services) Big Data Security & Governance Solutions |

| By End-User | Banking, Financial Services and Insurance (BFSI) Telecommunications & ICT Service Providers Government & Public Sector Healthcare & Life Sciences Retail, E-commerce & Consumer Services Energy, Utilities & Oil and Gas Transportation, Logistics & Smart Mobility Others (Education, Media & Entertainment, Manufacturing) |

| By Industry Vertical | Financial Services & Fintech Telecom & Digital Infrastructure Government, Smart City & Public Safety Healthcare, Hospitals & Insurers Retail, Hospitality & Tourism Industrial, Manufacturing & Utilities Others |

| By Deployment Model | On-premises Public Cloud Private Cloud Hybrid & Multi-cloud |

| By Analytics Type | Descriptive Analytics Diagnostic Analytics Predictive Analytics Prescriptive & Real-time Analytics |

| By Data Source | Enterprise Applications & Transactional Systems Social Media & Web Data IoT, Sensors & Machine Data Mobile, Network & Clickstream Data Open Data & Third-party Data Feeds |

| By Geographic Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Big Data Applications | 100 | Data Analysts, IT Managers 2 |

| Healthcare Data Management Solutions | 80 | Healthcare IT Directors, Data Scientists 5 |

| Telecommunications Data Analytics | 70 | Network Engineers, Business Analysts 7 |

| Government Data Initiatives | 60 | Policy Makers, IT Administrators 6 |

| Retail Sector Big Data Utilization | 90 | Marketing Managers, Operations Directors 8 |

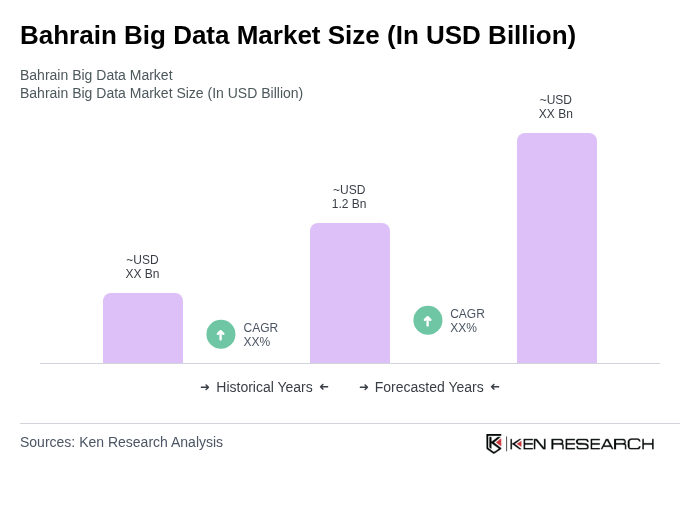

The Bahrain Big Data Market is valued at approximately USD 1.2 billion, reflecting strong growth driven by increased investments in digital and data technologies across various sectors, including finance, government, telecommunications, and healthcare.