Region:Global

Author(s):Rebecca

Product Code:KRAD0169

Pages:83

Published On:August 2025

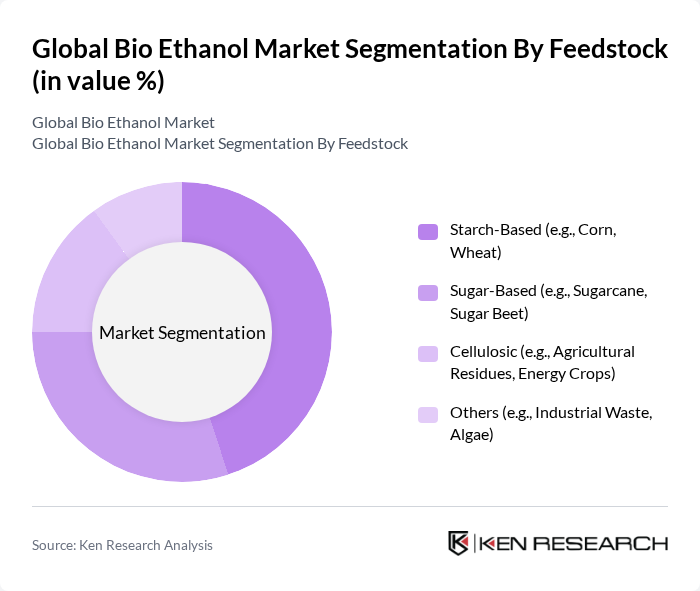

By Feedstock:The bioethanol market can be segmented based on feedstock into four main categories: Starch-Based (e.g., Corn, Wheat), Sugar-Based (e.g., Sugarcane, Sugar Beet), Cellulosic (e.g., Agricultural Residues, Energy Crops), and Others (e.g., Industrial Waste, Algae). Among these, Starch-Based feedstock is currently dominating the market due to its high availability and established processing technologies. The consumer preference for cost-effective and readily available feedstock has led to a significant increase in the production of starch-based bioethanol .

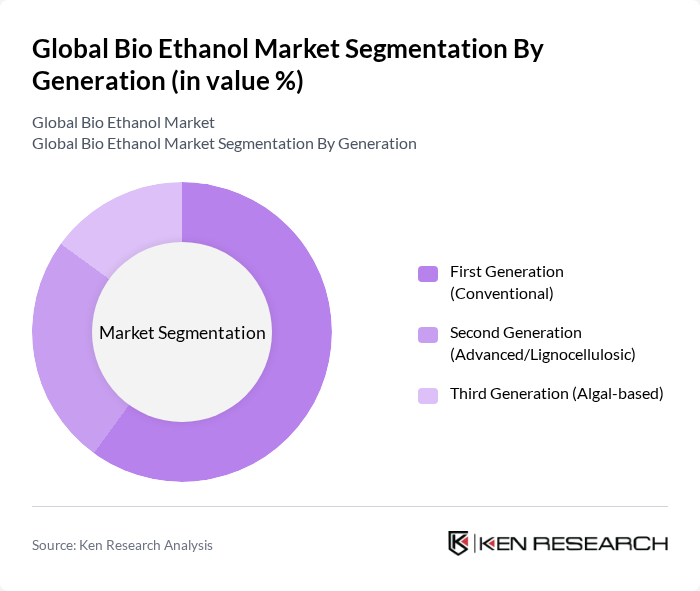

By Generation:The bioethanol market is also segmented by generation into three categories: First Generation (Conventional), Second Generation (Advanced/Lignocellulosic), and Third Generation (Algal-based). The First Generation bioethanol is leading the market due to its established production processes and widespread acceptance. However, the Second Generation is gaining traction as advancements in technology make it more viable, appealing to consumers and industries focused on sustainability .

The Global Bio Ethanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as POET, LLC, Archer Daniels Midland Company, Green Plains Inc., Valero Energy Corporation, The Andersons, Inc., Alto Ingredients, Inc., Flint Hills Resources, LLC, Cargill, Incorporated, Tereos S.A., Raízen S.A., Novozymes A/S, BASF SE, Lallemand Inc., DSM (Royal DSM N.V.), Abengoa Bioenergy S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioethanol market appears promising, driven by increasing global emphasis on sustainability and renewable energy. As countries implement stricter emission regulations and renewable energy targets, bioethanol is likely to play a crucial role in meeting these goals. Innovations in production technologies and the expansion of biofuel blending mandates will further enhance market penetration. Additionally, the growing consumer preference for green products will likely drive demand, creating a favorable environment for bioethanol producers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Feedstock | Starch-Based (e.g., Corn, Wheat) Sugar-Based (e.g., Sugarcane, Sugar Beet) Cellulosic (e.g., Agricultural Residues, Energy Crops) Others (e.g., Industrial Waste, Algae) |

| By Generation | First Generation (Conventional) Second Generation (Advanced/Lignocellulosic) Third Generation (Algal-based) |

| By Fuel Blend | E5 E10 E15 to E70 E75 to E85 Others |

| By End-Use Industry | Transportation Alcoholic Beverages Cosmetics Pharmaceuticals Others (e.g., Industrial Solvents, Chemical Feedstock) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bioethanol Production Facilities | 100 | Plant Managers, Production Supervisors |

| Agricultural Feedstock Suppliers | 70 | Farm Owners, Supply Chain Managers |

| Biofuel Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Transportation Sector Stakeholders | 60 | Fleet Managers, Sustainability Officers |

| Research Institutions and Academia | 50 | Researchers, Professors in Renewable Energy |

The Global Bio Ethanol Market is valued at approximately USD 89 billion, reflecting a significant growth trend driven by the increasing demand for renewable energy sources and supportive government policies promoting biofuels.