Region:North America

Author(s):Shubham

Product Code:KRAB0682

Pages:99

Published On:August 2025

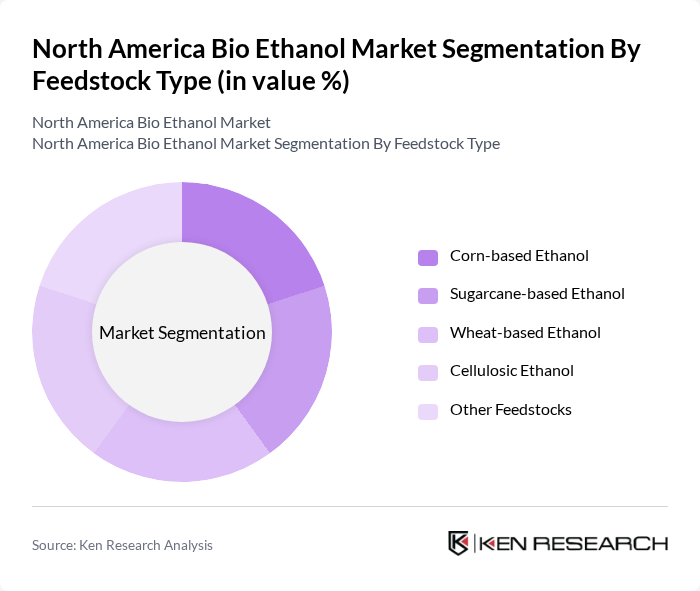

By Feedstock Type:The feedstock segmentation covers the main sources for bioethanol production: corn-based ethanol, sugarcane-based ethanol, wheat-based ethanol, cellulosic ethanol, and other feedstocks. Corn-based ethanol is the leading segment, underpinned by the U.S.’s extensive corn output and established supply chains. Growing emphasis on sustainability is increasing interest in cellulosic ethanol, which utilizes agricultural residues and non-food biomass.

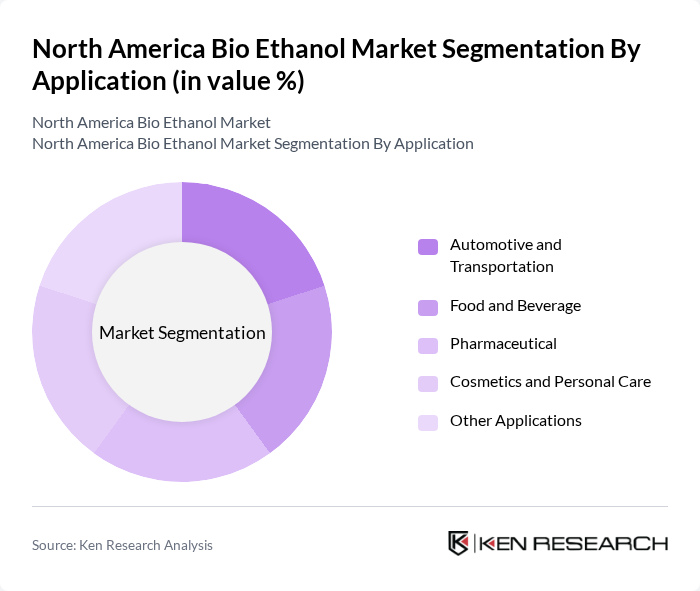

By Application:Application segmentation includes automotive and transportation, food and beverage, pharmaceutical, cosmetics and personal care, and other sectors. The automotive and transportation segment is the largest, driven by the widespread adoption of ethanol-blended fuels and regulatory mandates. Bioethanol’s role in eco-friendly product formulations is expanding its use in cosmetics and personal care, while food and beverage and pharmaceutical applications remain steady.

The North America Bio Ethanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as POET, LLC, Archer Daniels Midland Company, Green Plains Inc., Valero Energy Corporation, Pacific Ethanol, Inc. (now known as Alto Ingredients, Inc.), Flint Hills Resources, LLC, Cargill, Incorporated, The Andersons, Inc., Biofuel Energy Corp., Big River Resources, LLC, Aemetis, Inc., Gevo, Inc., Sunoco LP, Algenol Biotech LLC, Renewable Energy Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American bioethanol market is poised for significant transformation driven by increasing environmental awareness and technological advancements. As consumers demand greener energy solutions, the market is expected to see a shift towards sustainable practices, with bioethanol production becoming more efficient and cost-effective. Additionally, strategic partnerships among industry players will likely enhance innovation and distribution capabilities, positioning bioethanol as a key player in the renewable energy landscape. The focus on reducing carbon footprints will further bolster market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Feedstock Type | Corn-based Ethanol Sugarcane-based Ethanol Wheat-based Ethanol Cellulosic Ethanol Other Feedstocks |

| By Application | Automotive and Transportation Food and Beverage Pharmaceutical Cosmetics and Personal Care Other Applications |

| By Blend | E10 (10% Ethanol Blend) E15 (15% Ethanol Blend) E85 (85% Ethanol Blend) Other Blends |

| By Region | United States Canada Mexico |

| By Production Technology | Fermentation Gasification Other Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bioethanol Production Facilities | 100 | Plant Managers, Production Supervisors |

| Bioethanol Distribution Networks | 60 | Logistics Coordinators, Supply Chain Managers |

| End-User Applications in Transportation | 50 | Fleet Managers, Transportation Directors |

| Retail Sector Bioethanol Sales | 40 | Retail Managers, Product Category Specialists |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The North America Bio Ethanol Market is valued at approximately USD 18 billion, reflecting its significant share in the global bioethanol market, driven by increasing demand for renewable energy and government mandates for biofuels.