Region:Global

Author(s):Shubham

Product Code:KRAA1818

Pages:93

Published On:August 2025

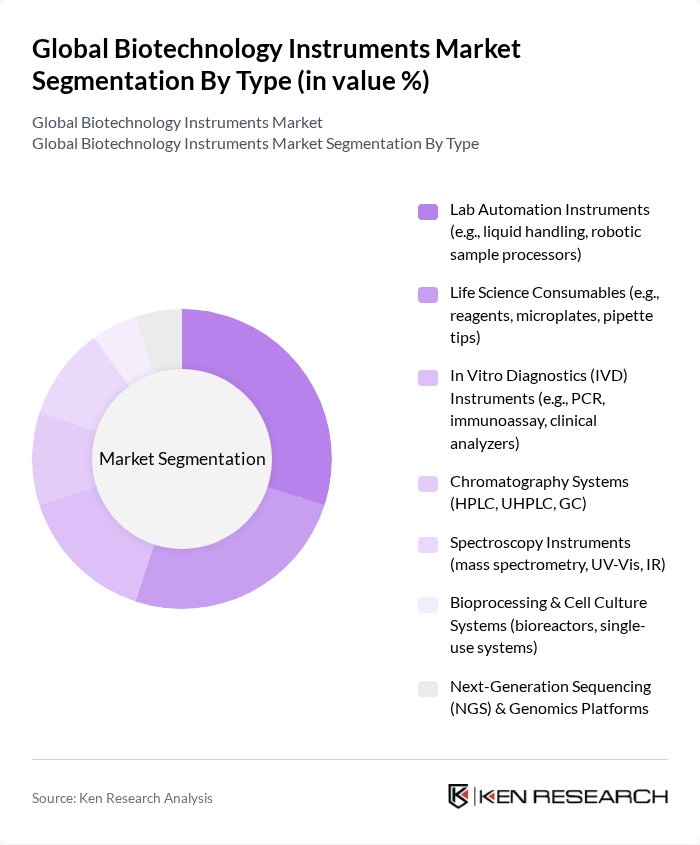

By Type:The biotechnology instruments market can be segmented into various types, including Lab Automation Instruments, Life Science Consumables, In Vitro Diagnostics (IVD) Instruments, Chromatography Systems, Spectroscopy Instruments, Bioprocessing & Cell Culture Systems, and Next-Generation Sequencing (NGS) & Genomics Platforms. Among these, Lab Automation Instruments and Life Science Consumables are particularly significant due to their essential roles in enhancing laboratory efficiency and supporting research activities.

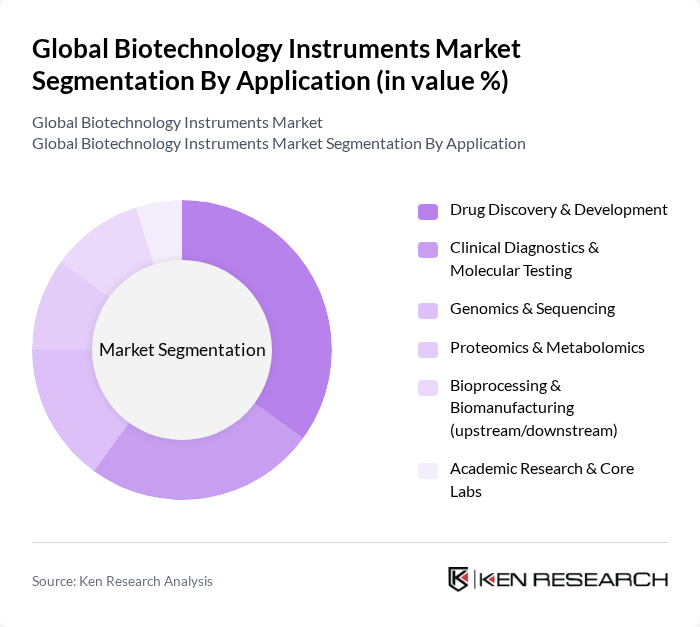

By Application:The applications of biotechnology instruments encompass Drug Discovery & Development, Clinical Diagnostics & Molecular Testing, Genomics & Sequencing, Proteomics & Metabolomics, Bioprocessing & Biomanufacturing, and Academic Research & Core Labs. The Drug Discovery & Development segment is particularly dominant, driven by the increasing need for innovative therapies and the growing investment in pharmaceutical research; rising use of molecular and cell analysis tools, high IVD adoption, and expanding sequencing in clinical and research settings underpin these applications.

The Global Biotechnology Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bio-Rad Laboratories, Inc., Revvity, Inc. (formerly PerkinElmer’s life sciences), Eppendorf SE, Sartorius AG, Merck KGaA (Merck Life Science), Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Illumina, Inc., QIAGEN N.V., Siemens Healthineers AG, Abbott Laboratories, Becton, Dickinson and Company (BD), Danaher Corporation (Beckman Coulter, Cytiva, Cepheid), Waters Corporation, Bruker Corporation, Shimadzu Corporation, Tecan Group AG, Hamilton Company, Oxford Nanopore Technologies plc contribute to innovation, geographic expansion, and service delivery in this space.

The biotechnology instruments market is poised for significant evolution, driven by technological advancements and increasing demand for personalized healthcare solutions. As automation and artificial intelligence become integral to laboratory processes, efficiency and accuracy in research will improve. Furthermore, the rise of point-of-care testing is expected to enhance accessibility to diagnostic tools, particularly in emerging markets. These trends indicate a dynamic future for the biotechnology instruments sector, with opportunities for innovation and growth on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Lab Automation Instruments (e.g., liquid handling, robotic sample processors) Life Science Consumables (e.g., reagents, microplates, pipette tips) In Vitro Diagnostics (IVD) Instruments (e.g., PCR, immunoassay, clinical analyzers) Chromatography Systems (HPLC, UHPLC, GC) Spectroscopy Instruments (mass spectrometry, UV-Vis, IR) Bioprocessing & Cell Culture Systems (bioreactors, single-use systems) Next-Generation Sequencing (NGS) & Genomics Platforms |

| By Application | Drug Discovery & Development Clinical Diagnostics & Molecular Testing Genomics & Sequencing Proteomics & Metabolomics Bioprocessing & Biomanufacturing (upstream/downstream) Academic Research & Core Labs |

| By End-User | Pharmaceutical & Biotechnology Companies Government & Academic Institutes Hospitals, Clinical & Diagnostic Laboratories Contract Research & Manufacturing Organizations (CROs/CMOs/CDMOs) Others (industrial labs, environmental, food testing) |

| By Distribution Channel | Direct Sales Authorized Distributors/Value-Added Resellers Online/ eCommerce Tender/Institutional Procurement |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) Others |

| By Price Range | Low-End Instruments Mid-Range Instruments High-End Instruments |

| By Service Type | Maintenance & Repair Services Calibration & Validation Services Installation, Training & Consulting Services Managed Services & Service Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Biotechnology Instruments | 120 | R&D Managers, Quality Control Analysts |

| Diagnostic Equipment in Biotechnology | 100 | Laboratory Technicians, Clinical Researchers |

| Research and Development Tools | 80 | Biotech Scientists, Product Development Managers |

| Biotechnology Instrumentation for Agriculture | 70 | Agricultural Scientists, Field Researchers |

| Environmental Biotechnology Instruments | 60 | Environmental Analysts, Sustainability Officers |

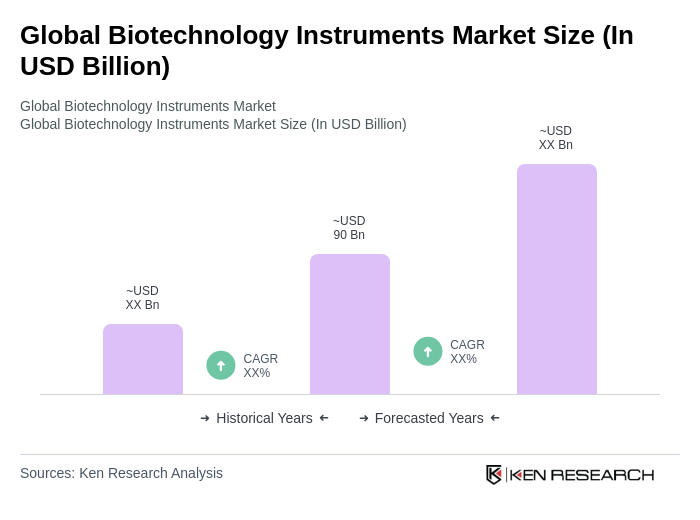

The Global Biotechnology Instruments Market is valued at approximately USD 90 billion, driven by technological advancements, increased R&D investments, and the growing demand for personalized medicine, particularly in areas like IVD, genomics, and proteomics.