Region:North America

Author(s):Geetanshi

Product Code:KRAE0722

Pages:96

Published On:December 2025

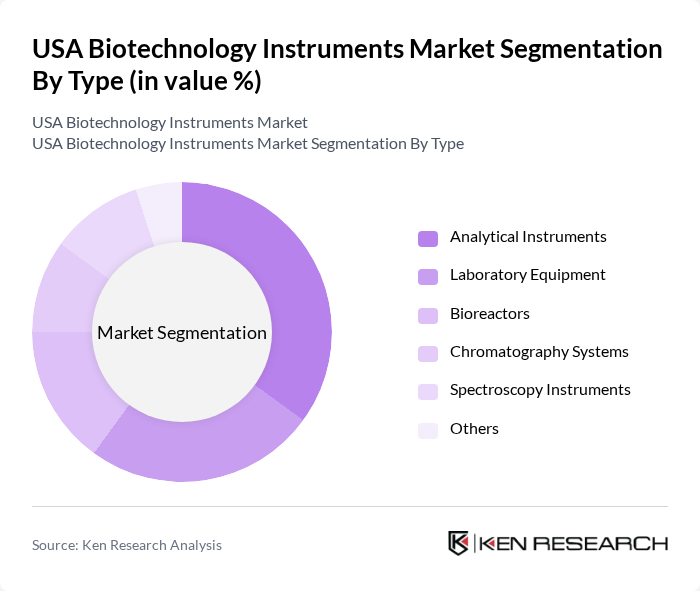

By Type:The biotechnology instruments market is segmented into various types, including analytical instruments, laboratory equipment, bioreactors, chromatography systems, spectroscopy instruments, and others. Among these, analytical instruments are leading the market due to their critical role in research and development, particularly in drug discovery and diagnostics. The demand for precision and accuracy in biological analysis drives the growth of this segment, as researchers and companies seek reliable tools for their experiments.

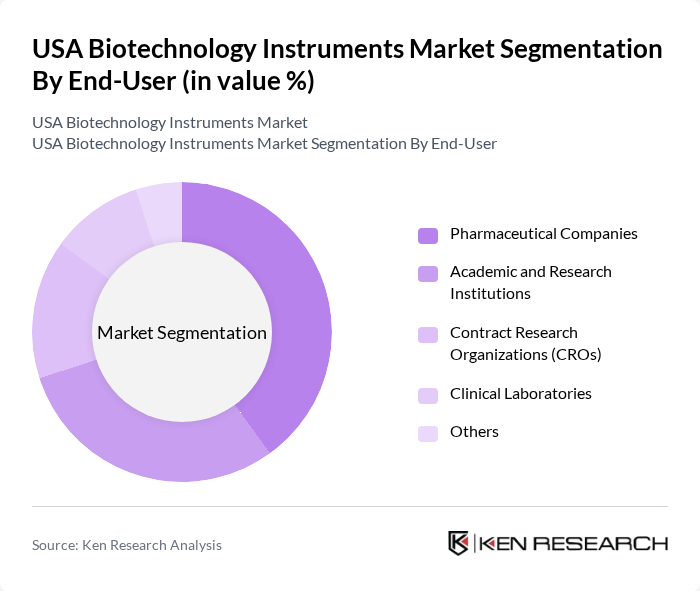

By End-User:The end-user segmentation includes pharmaceutical companies, academic and research institutions, contract research organizations (CROs), clinical laboratories, and others. Pharmaceutical companies dominate this segment, driven by their need for advanced instruments to support drug development and regulatory compliance. The increasing focus on biopharmaceuticals and personalized medicine further propels the demand for sophisticated biotechnology instruments in this sector.

The USA Biotechnology Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, Illumina, Roche Diagnostics, Merck KGaA, Siemens Healthineers, Abbott Laboratories, GE Healthcare, Becton, Dickinson and Company, QIAGEN, Eppendorf AG, Waters Corporation, Sartorius AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA biotechnology instruments market appears promising, driven by ongoing advancements in technology and increasing investments in personalized medicine. As the demand for innovative diagnostic tools and therapeutic solutions grows, companies are likely to focus on integrating AI and automation into their offerings. Additionally, the expansion of biopharmaceutical production will further enhance the need for sophisticated instruments, ensuring sustained growth in the sector over the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Analytical Instruments Laboratory Equipment Bioreactors Chromatography Systems Spectroscopy Instruments Others |

| By End-User | Pharmaceutical Companies Academic and Research Institutions Contract Research Organizations (CROs) Clinical Laboratories Others |

| By Application | Drug Discovery Genomics Proteomics Cell Culture Others |

| By Region | Northeast Midwest South West |

| By Technology | Microarray Technology Next-Generation Sequencing PCR Technology Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| By Policy Support | Research Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratory Instruments | 150 | Laboratory Managers, Clinical Technologists |

| Research & Development Instruments | 100 | R&D Directors, Principal Investigators |

| Biotechnology Manufacturing Equipment | 80 | Production Managers, Quality Assurance Officers |

| Environmental Biotechnology Instruments | 70 | Environmental Scientists, Compliance Officers |

| Bioprocessing Equipment | 90 | Process Engineers, Operations Managers |

The USA Biotechnology Instruments Market is valued at approximately USD 35 billion, reflecting significant growth driven by the demand for analytical instruments essential for biological sample characterization and advancements in personalized medicine and cell-based therapies.