Region:Global

Author(s):Dev

Product Code:KRAC0440

Pages:84

Published On:August 2025

By Type:The market is segmented into various types of blood components, including Whole Blood, Red Blood Cells, Plasma, Platelets, Cryoprecipitate, Pathogen-Reduced Components, Apheresis Collections, and Others. Each of these components plays a crucial role in medical treatments and procedures, with specific applications in surgeries, trauma care, oncology, hematology, and critical care. Growing adoption of pathogen reduction, particularly for platelet components, and wider use of apheresis collections are notable trends in modern blood banking .

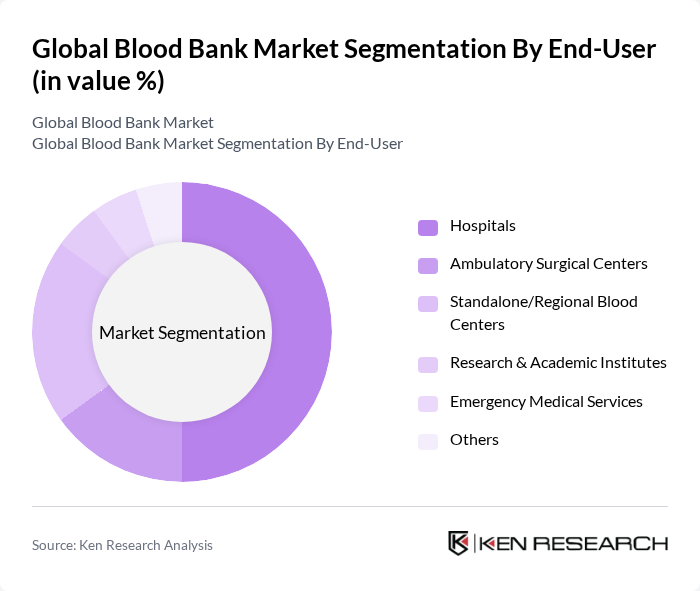

By End-User:The market is segmented based on end-users, including Hospitals, Ambulatory Surgical Centers, Standalone/Regional Blood Centers, Research & Academic Institutes, Emergency Medical Services, and Others. Hospitals remain the primary end-users due to high volumes of surgical and critical care transfusions, while regional blood centers manage collection, testing, and distribution to healthcare providers; research and academic institutes contribute to product development and transfusion medicine training .

The Global Blood Bank Market is characterized by a dynamic mix of regional and international players. Leading participants such as American Red Cross, America’s Blood Centers, Vitalant, NHS Blood and Transplant (NHSBT), Canadian Blood Services, Terumo BCT, Fresenius Kabi, Grifols, Haemonetics Corporation, Octapharma, CSL Behring, Biotest AG, Cerus Corporation, Macopharma, Immucor, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the blood bank market is poised for transformation, driven by technological advancements and increased collaboration with healthcare providers. As automated blood collection and storage technologies become more prevalent, efficiency and safety will improve significantly. Additionally, the rise of public-private partnerships is expected to enhance resource sharing and innovation, ultimately leading to better blood supply management and increased donor engagement. These trends will be crucial in addressing current challenges and meeting future demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Blood Red Blood Cells Plasma Platelets Cryoprecipitate Pathogen-Reduced Components Apheresis Collections Others |

| By End-User | Hospitals Ambulatory Surgical Centers Standalone/Regional Blood Centers Research & Academic Institutes Emergency Medical Services Others |

| By Distribution Channel | Direct Supply to Hospitals/ASCs Government Procurement/Contracts Group Purchasing Organizations (GPOs) Third-Party Logistics (3PL) & Cold Chain Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Surgical Procedures Trauma & Emergency Care Oncology Hematology (e.g., Thalassemia, SCD, Aplastic Anemia) Obstetrics & Neonatology Others |

| By Storage Method | Refrigerated (RBCs, 1–6°C) Frozen (Plasma/Cryo, ??18°C) Room Temperature with Agitation (Platelets) Ultra-Low/Long-Term (e.g., ?65°C plasma) Others |

| By Regulatory Compliance | FDA (U.S.) EMA/EDQM (Europe) WHO Guidelines National Blood Policies (e.g., CBS, NHSBT) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Bank Operations | 120 | Blood Bank Managers, Transfusion Medicine Specialists |

| Blood Donation Drives | 100 | Community Outreach Coordinators, Donor Recruitment Officers |

| Regulatory Compliance in Blood Banking | 80 | Quality Assurance Managers, Compliance Officers |

| Technological Innovations in Blood Collection | 70 | Biomedical Engineers, IT Managers in Healthcare |

| Public Awareness and Education on Blood Donation | 90 | Health Educators, Public Relations Officers |

The Global Blood Bank Market is valued at approximately USD 18 billion, driven by increasing demand for blood products due to surgical procedures, trauma cases, chronic diseases, and an aging population requiring more transfusions.