Region:Global

Author(s):Geetanshi

Product Code:KRAA2367

Pages:84

Published On:August 2025

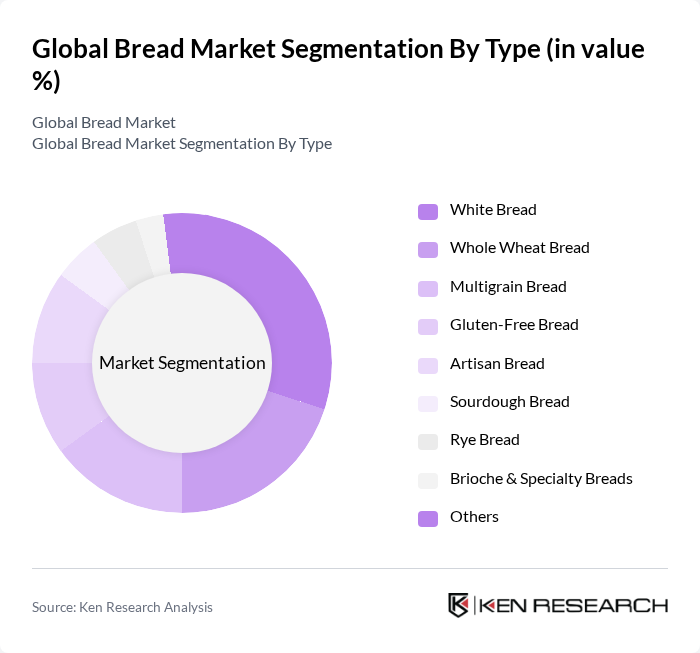

By Type:The bread market is segmented into various types, including White Bread, Whole Wheat Bread, Multigrain Bread, Gluten-Free Bread, Artisan Bread, Sourdough Bread, Rye Bread, Brioche & Specialty Breads, and Others. Each type caters to different consumer preferences and dietary needs. Gluten-free and artisan varieties are gaining popularity due to health trends, rising incidences of gluten intolerance, and increased demand for premium products. Whole grain and multigrain breads are also experiencing growth, driven by consumer interest in fiber-rich and nutrient-dense options.

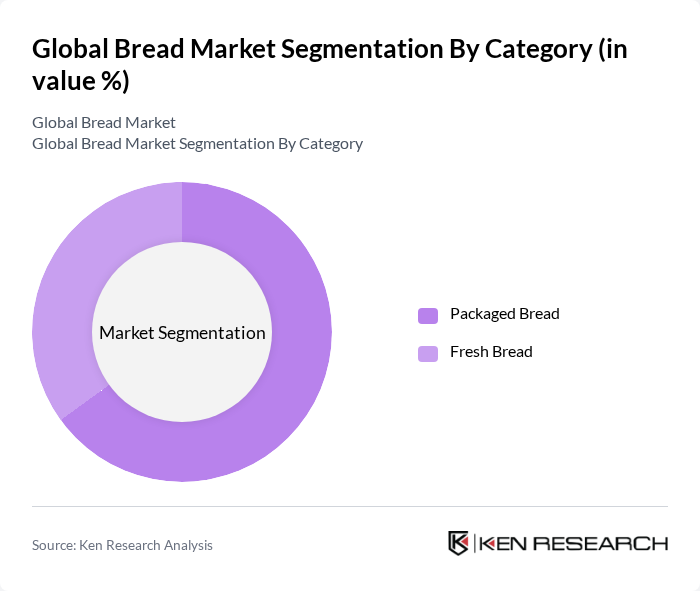

By Category:The market is also segmented by category into Packaged Bread and Fresh Bread. Packaged bread is preferred for its convenience, longer shelf life, and availability through supermarkets and hypermarkets. Fresh bread is favored for its taste, quality, and artisanal appeal, with strong demand in regions with rich baking cultures and traditions. Urbanization and busy lifestyles continue to drive packaged bread sales, while the premiumization trend supports growth in fresh and specialty bread segments.

The Global Bread Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Bimbo S.A.B. de C.V., Flowers Foods, Inc., Aryzta AG, Associated British Foods plc (ABF – incl. Allied Bakeries, Kingsmill), Campbell Soup Company (Pepperidge Farm), Mondelez International, Inc. (includes Nabisco, LU), General Mills, Inc. (includes Pillsbury, Nature Valley), Yamazaki Baking Co., Ltd., Barilla Group (includes Harrys, Mulino Bianco), Warburtons Ltd, Dave's Killer Bread, La Brea Bakery, Almarai Company, King Arthur Baking Company, Alvarado Street Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bread market appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, manufacturers are likely to focus on developing gluten-free and organic options to cater to diverse dietary needs. Additionally, the growth of e-commerce platforms will facilitate broader distribution, allowing consumers easier access to specialty breads. Collaborations with food service providers will also enhance market reach, ensuring that bread remains a staple in both retail and dining environments.

| Segment | Sub-Segments |

|---|---|

| By Type | White Bread Whole Wheat Bread Multigrain Bread Gluten-Free Bread Artisan Bread Sourdough Bread Rye Bread Brioche & Specialty Breads Others |

| By Category | Packaged Bread Fresh Bread |

| By End-User | Residential Commercial (Bakeries, Cafés, Restaurants) Industrial (Food Manufacturers) Food Service (Hotels, QSRs, Catering) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialty Stores Foodservice/On-Trade |

| By Packaging Type | Plastic Bags Paper Bags Boxes Eco-friendly Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Flavor | Traditional Sweet Savory |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Bread Types | 105 | General Consumers, Health-Conscious Shoppers |

| Bakery Production Practices | 90 | Bakery Owners, Production Managers |

| Market Trends in Gluten-Free Products | 80 | Health Food Retailers, Nutritionists |

| Impact of E-commerce on Bread Sales | 70 | E-commerce Managers, Online Retailers |

| Regional Bread Consumption Patterns | 100 | Market Analysts, Food Industry Experts |

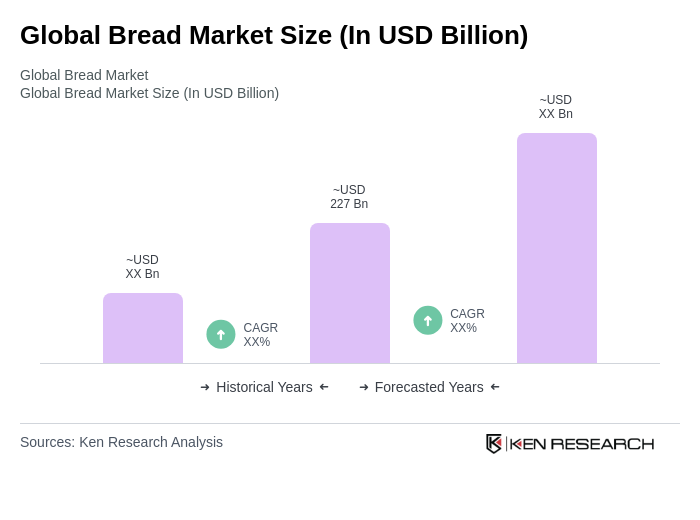

The Global Bread Market is valued at approximately USD 227 billion, reflecting a five-year historical analysis. This growth is driven by increasing consumer demand for convenience foods and health-conscious eating habits.