Region:Global

Author(s):Shubham

Product Code:KRAA1863

Pages:89

Published On:August 2025

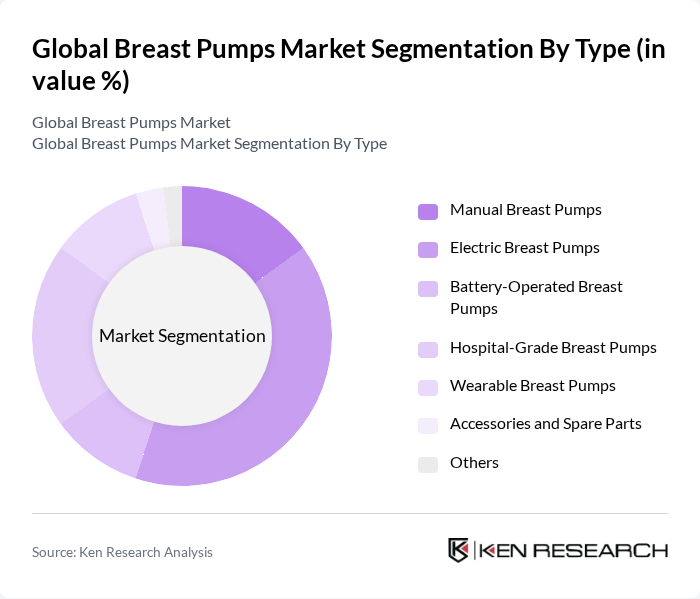

By Type:The breast pumps market is segmented into various types, including Manual Breast Pumps, Electric Breast Pumps, Battery-Operated Breast Pumps, Hospital-Grade Breast Pumps, Wearable Breast Pumps, Accessories and Spare Parts, and Others. Among these, Electric Breast Pumps are the most popular due to their efficiency and ease of use for frequent pumping, with strong adoption among working mothers. The demand for Hospital-Grade Breast Pumps is significant in clinical settings and rental programs due to superior performance, hygiene design, and multi-user capability.

By End-User:The market is segmented by end-users, including Hospitals & Maternity Clinics, Home Users, Lactation Consultants & Doulas, Employer Wellness/Corporate Programs, Childcare Facilities, and Others. Home Users represent the largest segment, driven by rising numbers of employed mothers, broader insurance coverage for personal-use pumps, and the convenience of portable and wearable devices. Hospitals & Maternity Clinics also play a crucial role through provision and rental of hospital-grade pumps and lactation support programs.

The Global Breast Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medela AG, Koninklijke Philips N.V. (Philips Avent), Spectra Baby (Uzin Medicare Co., Ltd.), Lansinoh Laboratories, Inc. (Pigeon Corporation), Ameda (International Biomedical, Ltd.), Evenflo Feeding, Inc., Haakaa, Chiaro Technology Ltd. (Elvie), Willow Innovations, Inc., Mayborn Group (Tommee Tippee), BabyBuddha, Artsana S.p.A. (Chicco), Ardo medical AG, Motif Medical, Momcozy (Shenzhen Lute Jiacheng Network Technology Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the breast pumps market in future appears promising, driven by ongoing technological innovations and a growing emphasis on maternal health. As smart and portable breast pumps gain traction, manufacturers are likely to focus on enhancing user experience and convenience. Additionally, the increasing collaboration between healthcare providers and breast pump manufacturers will facilitate better education and access, ultimately supporting breastfeeding initiatives and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Breast Pumps Electric Breast Pumps Battery-Operated Breast Pumps Hospital-Grade Breast Pumps Wearable Breast Pumps Accessories and Spare Parts Others |

| By End-User | Hospitals & Maternity Clinics Home Users Lactation Consultants & Doulas Employer Wellness/Corporate Programs Childcare Facilities Others |

| By Distribution Channel | Online Retail/E-commerce Marketplaces Pharmacies & Drug Stores Supermarkets/Hypermarkets Specialty Baby Stores Direct-to-Consumer (Brand Websites) Hospital/Clinic Supply & Rental Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand | Leading Brands Emerging Brands Private Labels Others |

| By Material | Plastic (BPA-free) Silicone Glass Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 140 | Lactation Consultants, Pediatricians |

| New Mothers | 150 | First-time Mothers, Mothers with Multiple Children |

| Retailers and Distributors | 100 | Store Managers, Supply Chain Coordinators |

| Breast Pump Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Market Analysts | 50 | Industry Analysts, Research Consultants |

The Global Breast Pumps Market is valued at approximately USD 3.5 billion, driven by factors such as increased awareness of breastfeeding benefits, rising disposable incomes, and higher female labor-force participation, particularly in developed markets.