Region:Global

Author(s):Rebecca

Product Code:KRAA2875

Pages:85

Published On:August 2025

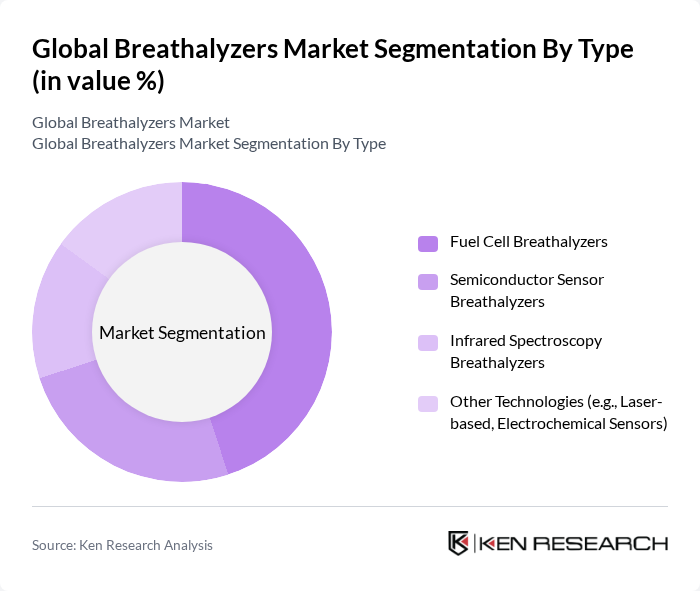

By Type:The breathalyzers market is segmented into Fuel Cell Breathalyzers, Semiconductor Sensor Breathalyzers, Infrared Spectroscopy Breathalyzers, and Other Technologies such as Laser-based and Electrochemical Sensors. Among these,Fuel Cell Breathalyzersare leading the market due to their high accuracy and reliability, making them the preferred choice for law enforcement agencies and personal use. The growing trend towards portable and user-friendly devices, as well as integration with smartphones and wearable technologies, has also contributed to the increasing adoption of these technologies.

By End-User:The market is further segmented by end-users, including Law Enforcement Agencies, Hospitals and Clinics, Workplace/Industrial, Personal Consumers, and Rehabilitation Centers.Law Enforcement Agenciesdominate the market due to the increasing need for accurate alcohol testing in traffic enforcement and public safety. The growing awareness of alcohol abuse and its consequences has also led to a rise in demand from rehabilitation centers and healthcare providers. The adoption of breathalyzers in workplace safety compliance and healthcare diagnostics is expanding, driven by regulatory requirements and the need for non-invasive testing.

The Global Breathalyzers Market is characterized by a dynamic mix of regional and international players. Leading participants such as AlcoPro, Inc., BACtrack (KHN Solutions Inc.), Drägerwerk AG & Co. KGaA, Lifeloc Technologies, Inc., Intoximeters, Inc., CMI, Inc., Quest Products, LLC, Soberlink, Inc., Alcohol Countermeasure Systems Corp., Guardian Interlock Systems, Smart Start, Inc., Alcohol Detection Systems, Inc., Alcolizer Technology, ALCOTEST (Draeger, Hanwei, etc.), Tokai Electronics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the breathalyzer market appears promising, driven by increasing awareness of alcohol-related risks and technological innovations. As governments continue to enforce stricter regulations, the demand for reliable breathalyzers will likely rise. Additionally, the trend towards personal safety devices is expected to bolster market growth. Companies that focus on developing affordable, user-friendly devices with advanced features will be well-positioned to capture emerging market segments, particularly in developing regions where awareness is growing.

| Segment | Sub-Segments |

|---|---|

| By Type | Fuel Cell Breathalyzers Semiconductor Sensor Breathalyzers Infrared Spectroscopy Breathalyzers Other Technologies (e.g., Laser-based, Electrochemical Sensors) |

| By End-User | Law Enforcement Agencies Hospitals and Clinics Workplace/Industrial Personal Consumers Rehabilitation Centers |

| By Distribution Channel | Direct Tender/Contracts Retail & Specialty Stores Online Stores & E-commerce Others |

| By Application | Alcohol Detection Drug-abuse Detection Disease Diagnostics (e.g., Liver, Metabolic) Other Medical Applications |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Digital Breathalyzers Analog Breathalyzers Smart/Connected Breathalyzers (e.g., Smartphone Integration) Wearable Breathalyzers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Law Enforcement Agencies | 100 | Police Officers, Traffic Safety Coordinators |

| Personal Breathalyzer Users | 60 | Consumers, Safety Advocates |

| Workplace Safety Managers | 50 | HR Managers, Occupational Health Specialists |

| Automotive Industry Stakeholders | 70 | Automotive Engineers, Fleet Managers |

| Retail Distributors of Breathalyzers | 40 | Retail Managers, Product Buyers |

The Global Breathalyzers Market is valued at approximately USD 4.5 billion, driven by increasing awareness of alcohol-related accidents, stringent government regulations, and advancements in breathalyzer technology. This market is expected to continue expanding as demand for accurate alcohol detection grows.