Region:Global

Author(s):Geetanshi

Product Code:KRAB0130

Pages:93

Published On:August 2025

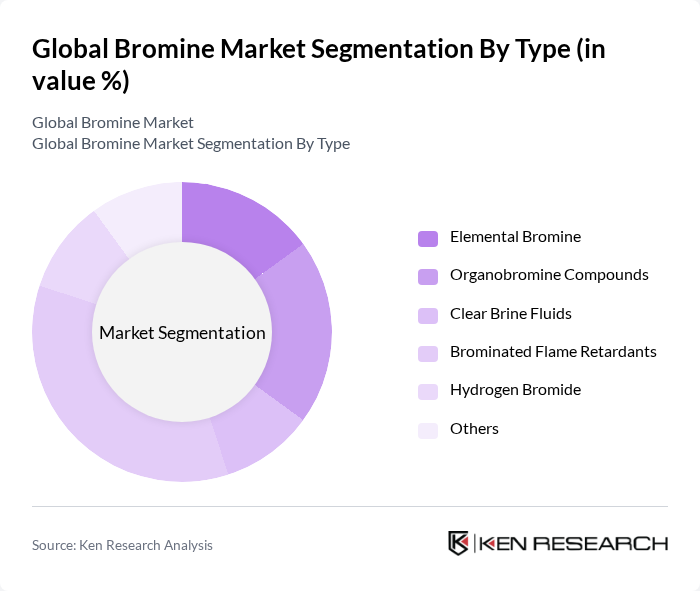

By Type:The bromine market is segmented into Elemental Bromine, Organobromine Compounds, Clear Brine Fluids, Brominated Flame Retardants, Hydrogen Bromide, and Others. Brominated Flame Retardants remain the most dominant segment, driven by their extensive use in construction materials, electronics, and automotive applications. The segment’s growth is fueled by increasingly stringent fire safety regulations and rising consumer demand for safer products .

By End-User:The bromine market is segmented by end-user industries including Chemical Manufacturing, Oil & Gas Industry, Pharmaceuticals & Cosmetics, Electronics & Consumer Goods, Agriculture & Pesticides, Automotive, Water Treatment, Textile, and Others. Chemical Manufacturing is the leading end-user sector, as bromine is a key ingredient in producing flame retardants, agricultural chemicals, and various specialty chemicals. The Oil & Gas Industry also represents a significant share, with bromine-based clear brine fluids critical for drilling and wellbore stabilization .

The Global Bromine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, Israel Chemicals Ltd. (ICL Group), Lanxess AG, Gulf Resources, Inc., Tosoh Corporation, Jordan Bromine Company Ltd., Shandong Haihua Group Co., Ltd., TETRA Technologies, Inc., Chemtrade Logistics Inc., Tata Chemicals Limited, Neogen Chemicals Ltd., Shandong Ocean Chemical Co., Ltd., Great Lakes Solutions (a brand of Lanxess), Sujay Synthorg Chemicals Pvt. Ltd., Merck KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bromine market appears promising, driven by increasing applications in various industries and a shift towards sustainable practices. Innovations in bromine extraction technologies are expected to enhance efficiency and reduce environmental impact. Additionally, the growing demand for specialty chemicals will likely create new avenues for bromine applications. Companies that adapt to regulatory changes and invest in eco-friendly products will be well-positioned to capitalize on emerging market trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Elemental Bromine Organobromine Compounds Clear Brine Fluids Brominated Flame Retardants Hydrogen Bromide Others |

| By End-User | Chemical Manufacturing Oil & Gas Industry Pharmaceuticals & Cosmetics Electronics & Consumer Goods Agriculture & Pesticides Automotive Water Treatment Textile Others |

| By Application | Flame Retardants Oil and Gas Drilling Fluids Water Treatment Chemicals Pharmaceuticals Energy Storage (e.g., batteries) Cooling Systems Disinfectants Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Product Form | Liquid Bromine Solid Bromine Gas Bromine Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Flame Retardant Applications | 100 | Product Managers, R&D Directors |

| Agricultural Chemicals | 60 | Agronomists, Procurement Managers |

| Pharmaceuticals and Biocides | 70 | Regulatory Affairs Specialists, Quality Control Managers |

| Oil and Gas Industry | 50 | Field Engineers, Supply Chain Coordinators |

| Water Treatment Solutions | 40 | Environmental Engineers, Operations Managers |

The Global Bromine Market is valued at approximately USD 4.8 billion, driven by increasing demand for bromine in applications such as flame retardants, oil and gas drilling fluids, and water treatment chemicals.