Region:Middle East

Author(s):Dev

Product Code:KRAC2670

Pages:92

Published On:October 2025

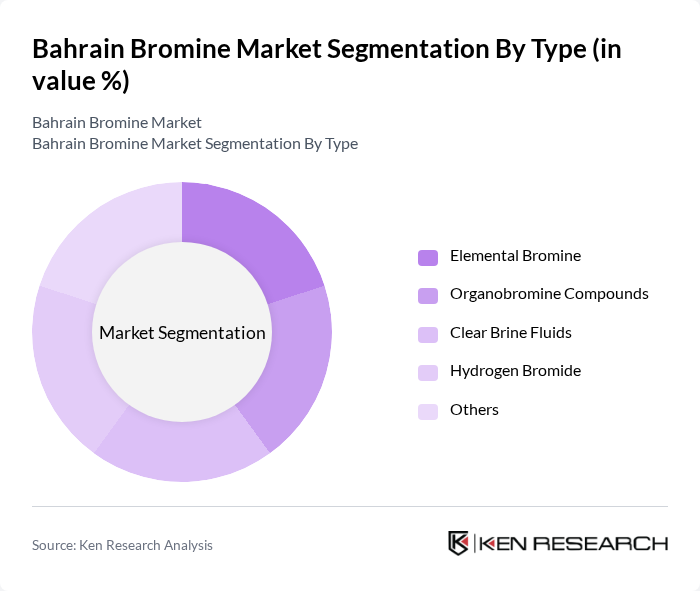

By Type:The market is segmented into various types of bromine products, including Elemental Bromine, Organobromine Compounds, Clear Brine Fluids, Hydrogen Bromide, and Others. Among these,Elemental Bromineis the leading subsegment, primarily due to its extensive use in flame retardants and chemical synthesis. The demand for Organobromine Compounds remains significant, driven by applications in pharmaceuticals, crop protection, and specialty chemicals.

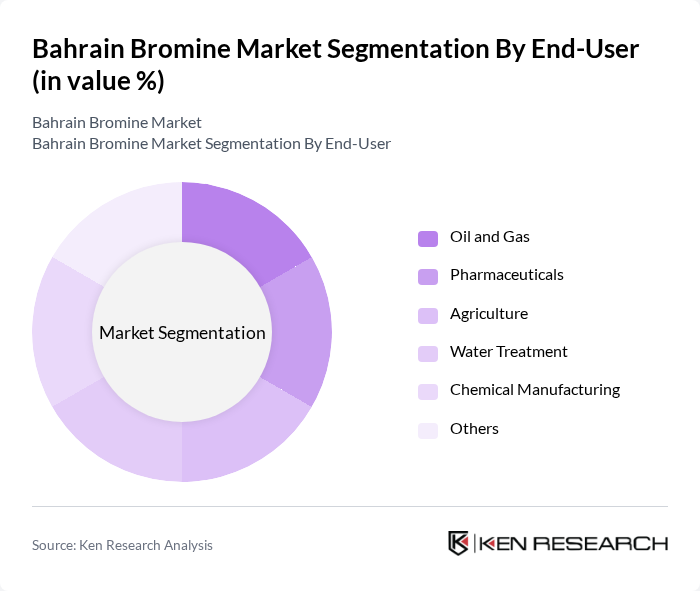

By End-User:The end-user segmentation includes Oil and Gas, Pharmaceuticals, Agriculture, Water Treatment, Chemical Manufacturing, and Others. TheOil and Gassector is the dominant end-user, utilizing bromine for oilfield drilling fluids and well completion operations. The Pharmaceuticals sector is also expanding, driven by the increasing demand for organobromine compounds in drug formulations and active pharmaceutical ingredients.

The Bahrain Bromine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Bromine W.L.L., Jordan Bromine Company, ICL Group Ltd., Albemarle Corporation, Lanxess AG, Tosoh Corporation, Shandong Haihua Group Co., Ltd., Zhejiang Jiangshan Chemical Co., Ltd., Solvay S.A., Great Lakes Solutions (a LANXESS company), Bromine Compounds Ltd., Gulf Resources Inc., TETRA Technologies, Inc., Chemtura Corporation (now part of LANXESS), Israel Chemicals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain bromine market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the demand for bromine in flame retardants and specialty chemicals increases, companies are likely to invest in innovative extraction techniques. Furthermore, the government's focus on environmental protection will encourage the development of eco-friendly bromine applications, fostering a more sustainable industry landscape. This evolution will create new avenues for growth and collaboration among market players.

| Segment | Sub-Segments |

|---|---|

| By Type | Elemental Bromine Organobromine Compounds Clear Brine Fluids Hydrogen Bromide Others |

| By End-User | Oil and Gas Pharmaceuticals Agriculture Water Treatment Chemical Manufacturing Others |

| By Application | Flame Retardants Oilfield Drilling Fluids Biocides Intermediates in Chemical Synthesis Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Packaging Type | Bulk Packaging Drums Bottles Others |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | REACH Compliance OSHA Standards Local Environmental Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bromine in Flame Retardants | 100 | Product Managers, Chemical Engineers |

| Bromine in Pharmaceuticals | 70 | R&D Managers, Regulatory Affairs Managers |

| Bromine in Water Treatment | 60 | Environmental Scientists, Operations Managers |

| Bromine in Agriculture | 50 | Agronomists, Supply Chain Managers |

| Bromine in Electronics | 80 | Manufacturing Engineers, Quality Control Managers |

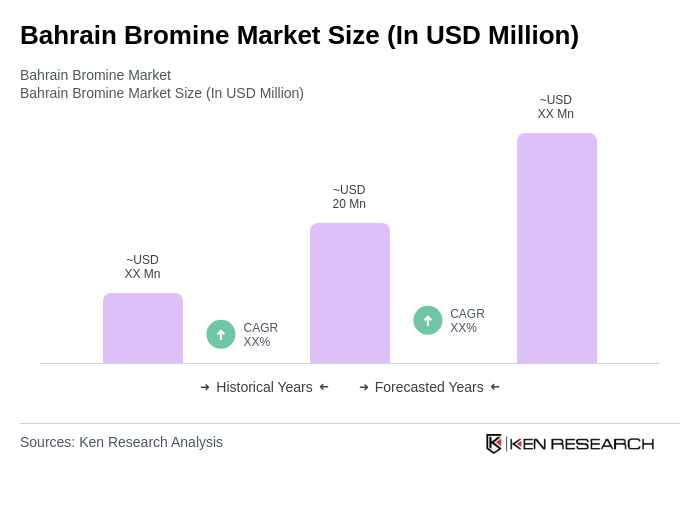

The Bahrain Bromine Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for bromine in applications such as flame retardants, oilfield drilling fluids, and water treatment solutions.