Region:Global

Author(s):Dev

Product Code:KRAA1600

Pages:96

Published On:August 2025

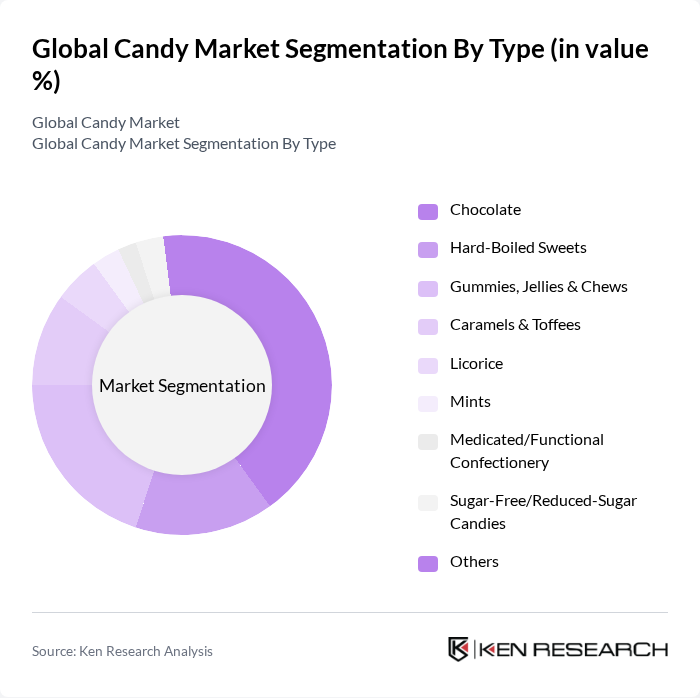

By Type:The candy market comprises chocolate, hard-boiled sweets, gummies, jellies & chews, caramels & toffees, licorice, mints, medicated/functional confectionery, sugar-free/reduced-sugar candies, and others. Chocolate remains the most popular segment, supported by strong consumer emotional attachment and the growth of dark and premium chocolate; non-chocolate candies such as gummies and chews are also expanding on the back of flavor and texture innovation .

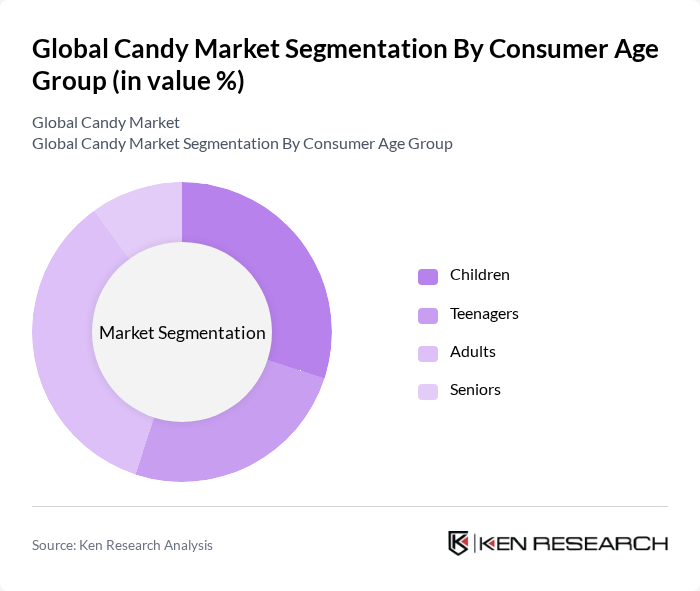

By Consumer Age Group:The market is segmented by children, teenagers, adults, and seniors. Children account for a substantial share due to preference for playful, colorful formats and seasonal occasions, while adults increasingly drive demand for premium, dark, and functional/sugar-reduced options, reinforcing a shift to quality and permissible indulgence .

The Global Candy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars, Incorporated, The Hershey Company, Mondel?z International, Inc., Ferrero Group, Nestlé S.A., Haribo GmbH & Co. KG, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle Group B.V., The Kellogg Company (Wm. Wrigley Jr. Company assets now Mars; Keebler exited), Tootsie Roll Industries, Inc., Jelly Belly Candy Company, Ghirardelli Chocolate Company, Cavendish & Harvey Confectionery GmbH, The Ferrara Candy Company, Spangler Candy Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the candy market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, brands are likely to invest in developing healthier options, including organic and vegan candies. Additionally, the rise of e-commerce will facilitate greater market penetration, allowing brands to reach a wider audience. Companies that adapt to these trends and leverage digital marketing strategies will likely thrive in the competitive landscape of future.

| Segment | Sub-Segments |

|---|---|

| By Type | Chocolate Hard-Boiled Sweets Gummies, Jellies & Chews Caramels & Toffees Licorice Mints Medicated/Functional Confectionery Sugar-Free/Reduced-Sugar Candies Others |

| By Consumer Age Group | Children Teenagers Adults Seniors |

| By Sales Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialty & Confectionery Stores Duty-Free and Travel Retail |

| By Distribution Mode | Direct to Retail Wholesalers Distributors Direct-to-Consumer (D2C) |

| By Price Point | Luxury/Premium Mid-Range Economy/Value |

| By Occasion/Usage | Seasonal & Festive (e.g., Halloween, Easter, Christmas, Diwali) Gifting Everyday Snacking Events & Parties |

| By Packaging Type | Bulk/Family Packs Single-Serve/Individual Wrappers Pouches & Resealable Bags Boxes & Gift Packs Sustainable/Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Candy Sales | 140 | Store Managers, Category Buyers |

| Consumer Preferences in Candy | 150 | General Consumers, Candy Enthusiasts |

| Trends in Sugar-Free Candy | 100 | Health-Conscious Consumers, Nutritionists |

| Seasonal Candy Purchases | 80 | Event Planners, Holiday Shoppers |

| Online Candy Shopping Behavior | 120 | E-commerce Managers, Digital Marketing Specialists |

The Global Candy Market is valued at approximately USD 214 billion, driven by factors such as premiumization, product innovation, and expanded distribution channels, including supermarkets and e-commerce platforms.