Region:Global

Author(s):Shubham

Product Code:KRAA1881

Pages:80

Published On:August 2025

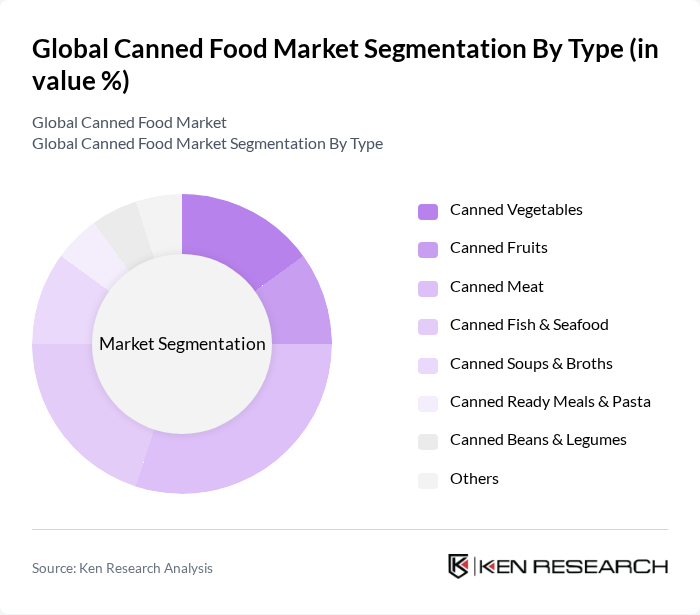

By Type:The canned food market is segmented into Canned Vegetables, Canned Fruits, Canned Meat, Canned Fish & Seafood, Canned Soups & Broths, Canned Ready Meals & Pasta, Canned Beans & Legumes, and Others. Canned Meat and Canned Fish & Seafood represent major protein-led segments; premium tinned fish trends and diversified protein preferences have notably lifted the Canned Fish & Seafood category in recent years, while convenience and protein density support Canned Meat demand.

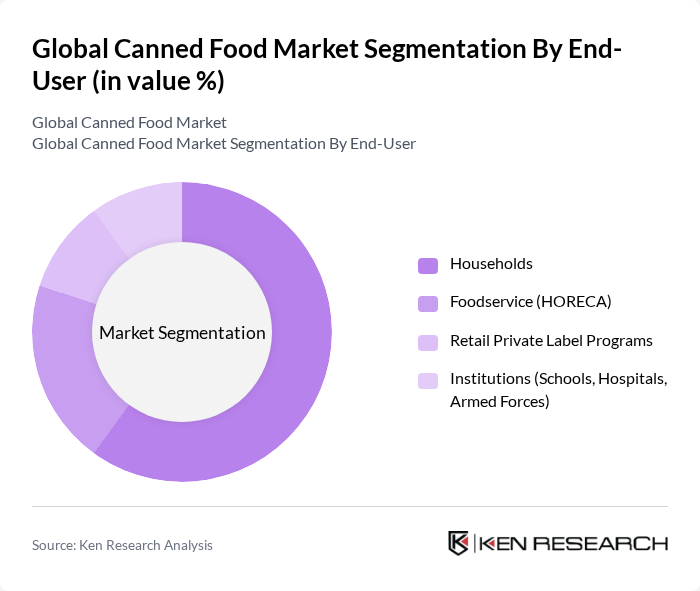

By End-User:The end-user segmentation includes Households, Foodservice (HORECA), Retail Private Label Programs, and Institutions (Schools, Hospitals, Armed Forces). Households dominate, supported by home cooking, pantry stocking of shelf-stable items, and quick-meal convenience; supermarkets, hypermarkets, and expanding e-commerce channels facilitate this demand.

The Global Canned Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., The Kraft Heinz Company, Del Monte Pacific Limited, Conagra Brands, Inc., Campbell Soup Company, General Mills, Inc., B&G Foods, Inc., Hormel Foods Corporation, Thai Union Group PCL, Bonduelle S.A., Ayam Brand (Ayam Sarl), Princes Limited, Dole plc, Apetit Oyj, Natura &Co (Maçarico S.A.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the canned food market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to rise, manufacturers are likely to innovate with organic and health-focused products. Additionally, the growth of e-commerce will facilitate broader market access, particularly in emerging regions. With sustainability becoming a priority, the adoption of eco-friendly packaging solutions will also play a crucial role in attracting environmentally aware consumers, ensuring the market remains competitive and relevant.

| Segment | Sub-Segments |

|---|---|

| By Type | Canned Vegetables Canned Fruits Canned Meat Canned Fish & Seafood Canned Soups & Broths Canned Ready Meals & Pasta Canned Beans & Legumes Others |

| By End-User | Households Foodservice (HORECA) Retail Private Label Programs Institutions (Schools, Hospitals, Armed Forces) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience & Grocery Stores Online Retail/E-commerce Specialty Stores Foodservice Distributors |

| By Packaging Type | Metal Cans (Tinplate/Aluminum) Glass Jars Flexible Pouches (Retort) Paper-based Composite Cans Others |

| By Price Range | Economy Mid-range Premium |

| By Brand Type | Private Label National Brands Regional/Local Brands |

| By Nutritional/Claim | Low/No Sodium Organic High Protein BPA-NI/BPA-free Packaging No Added Sugar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Canned Vegetables | 150 | Household Shoppers, Nutrition-Conscious Consumers |

| Market Insights from Canned Meat Producers | 100 | Production Managers, Quality Assurance Officers |

| Retail Distribution Channels for Canned Foods | 120 | Retail Managers, Supply Chain Coordinators |

| Health Trends Impacting Canned Food Consumption | 80 | Health Professionals, Dietitians |

| Export Market Dynamics for Canned Seafood | 90 | Export Managers, Seafood Industry Analysts |

The Global Canned Food Market is valued at approximately USD 102 billion, reflecting a significant growth trend driven by increasing consumer demand for convenient, shelf-stable food options and the rise in ready-to-eat meals among busy populations.