Region:Middle East

Author(s):Shubham

Product Code:KRAA8786

Pages:92

Published On:November 2025

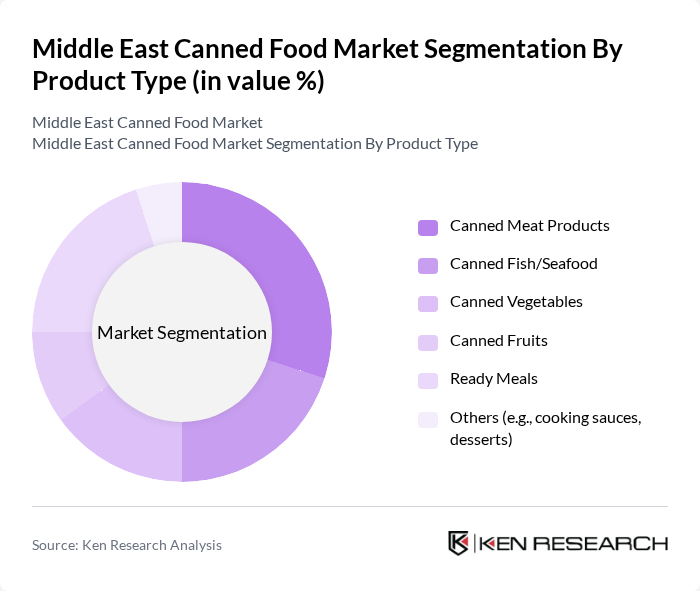

By Product Type:

The product type segmentation includes various categories such as Canned Meat Products, Canned Fish/Seafood, Canned Vegetables, Canned Fruits, Ready Meals, and Others (e.g., cooking sauces, desserts). Among these, Canned Meat Products and Ready Meals continue to lead the market due to their high demand for convenience and nutritional value. Consumers are increasingly opting for ready-to-eat meals that require minimal preparation time, which has significantly boosted the sales of these subsegments. The trend towards protein-rich diets and the growing popularity of international cuisines have also contributed to the sustained popularity of canned meat products and ready meals .

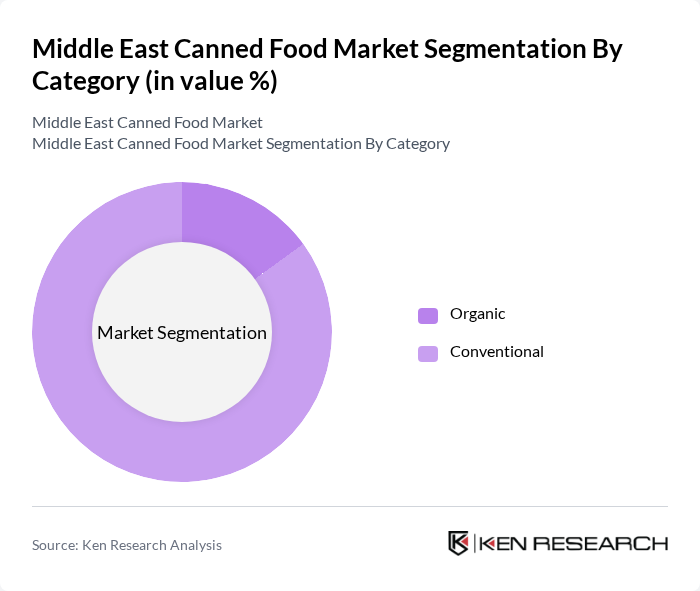

By Category:

This segmentation includes Organic and Conventional categories. The Conventional segment dominates the market due to its affordability and widespread availability. However, the Organic segment is gaining traction as consumers become more health-conscious and seek products with natural ingredients. The increasing awareness of health benefits associated with organic foods, along with the expansion of organic product offerings by major brands, is driving growth in this category, although it still represents a smaller portion of the overall market .

The Middle East Canned Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Americana Group, Del Monte Foods, Gulf Food Industries (California Garden), Almarai, Nestlé Middle East, Unilever, Al Watania Poultry, Heinz Middle East (The Kraft Heinz Company), Al Kabeer Group, Al Jazeera Food Processing Company, Halwani Bros, Siniora Food Industries, Dardanel, Chtoura Garden contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East canned food market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek nutritious options, the demand for organic and health-focused canned products is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to a diverse range of canned foods, enhancing market penetration. Companies that adapt to these trends will likely capture a larger share of the market, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Canned Meat Products Canned Fish/Seafood Canned Vegetables Canned Fruits Ready Meals Others (e.g., cooking sauces, desserts) |

| By Category | Organic Conventional |

| By End-User | Households Food Service Industry Retail Chains Institutional Buyers Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Packaging Type | Metal Cans Tetra Packs Glass Jars Pouches Others |

| By Price Range | Economy Mid-range Premium Others |

| By Country/Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain Turkey Egypt Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Canned Food Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Canned Foods | 120 | Household Decision Makers, Health-Conscious Consumers |

| Distribution Channel Insights | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Export and Import Dynamics | 40 | Trade Analysts, Import/Export Managers |

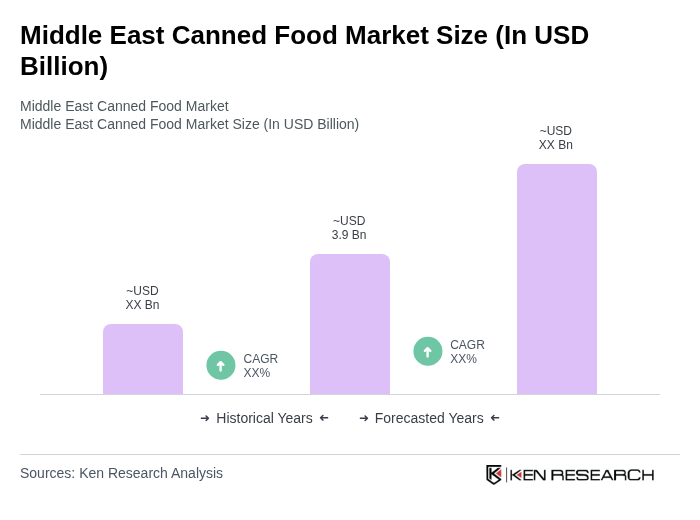

The Middle East Canned Food Market is valued at approximately USD 3.9 billion, driven by increasing demand for convenient food options, urbanization, and a growing population seeking ready-to-eat meals with extended shelf life.