Region:Global

Author(s):Dev

Product Code:KRAD0487

Pages:99

Published On:August 2025

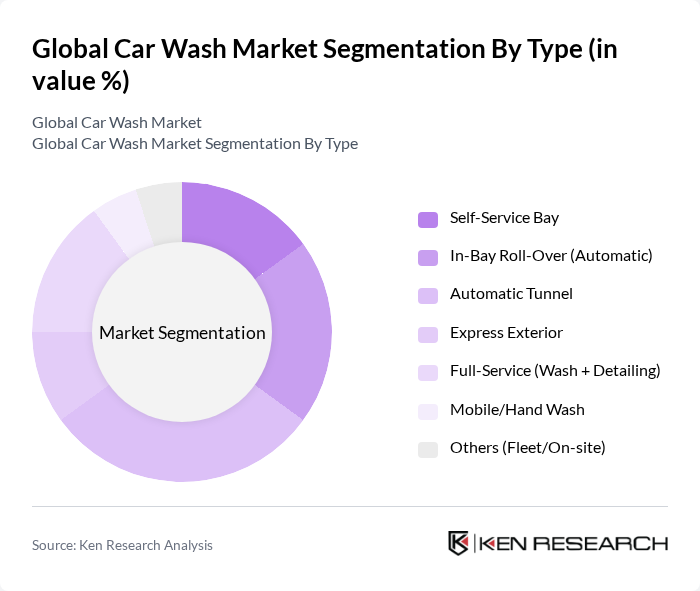

By Type:The car wash market is segmented into various types, including Self-Service Bay, In-Bay Roll-Over (Automatic), Automatic Tunnel, Express Exterior, Full-Service (Wash + Detailing), Mobile/Hand Wash, and Others (Fleet/On-site). Among these, theAutomatic Tunnelsegment is widely cited as a leading format in mature markets due to high throughput, consistency, and alignment with subscription models (unlimited plans), which has accelerated the consumer shift from manual/self-wash to automated formats.

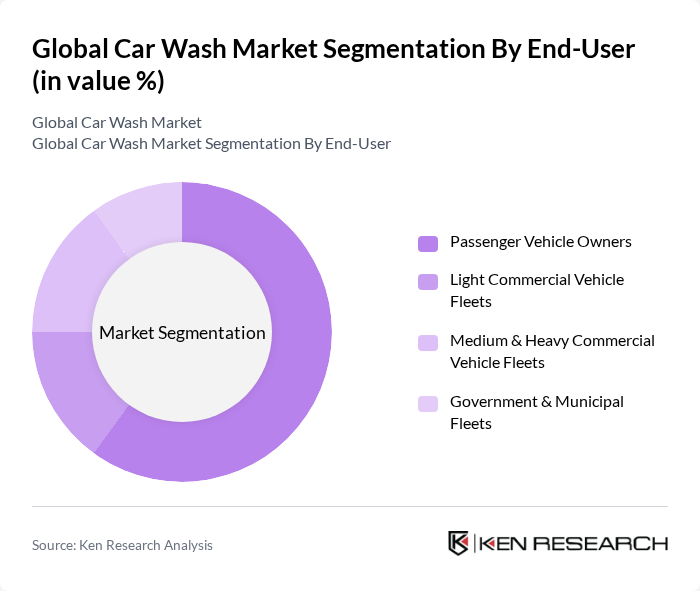

By End-User:The end-user segmentation includes Passenger Vehicle Owners, Light Commercial Vehicle Fleets, Medium & Heavy Commercial Vehicle Fleets, and Government & Municipal Fleets. ThePassenger Vehicle Ownerssegment remains the largest contributor, supported by professional wash preference over at-home washing in mature markets, growing vehicle parc, urbanization, and adoption of subscription plans that increase visit frequency and spend.

The Global Car Wash Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mister Car Wash, Inc., Zips Car Wash, Quick Quack Car Wash, Autobell Car Wash, IMO Car Wash Group, Tommy’s Express Car Wash, Super Star Car Wash, Splash Car Wash, True Blue Car Wash, LLC, Hoffman Car Wash, Wash Depot Holdings Inc., Driven Brands Car Wash (Take 5 Car Wash), Clean Streak Ventures, El Car Wash, International Car Wash Group (ICWG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car wash industry appears promising, driven by technological advancements and changing consumer preferences. As automated systems become more prevalent, efficiency and customer satisfaction will likely improve. Additionally, the increasing focus on sustainability will push operators to adopt eco-friendly practices, aligning with consumer demand for environmentally responsible services. The integration of mobile payment solutions will further enhance convenience, making car wash services more accessible and appealing to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Self-Service Bay In-Bay Roll-Over (Automatic) Automatic Tunnel Express Exterior Full-Service (Wash + Detailing) Mobile/Hand Wash Others (Fleet/On-site) |

| By End-User | Passenger Vehicle Owners Light Commercial Vehicle Fleets Medium & Heavy Commercial Vehicle Fleets Government & Municipal Fleets |

| By Service Model | Single-Service Wash Subscription-Based Unlimited Full-Service (Wash + Interior + Detailing) Add-on Services (Wax, Ceramic, Tire Shine) |

| By Mode of Payment | Cash Card/NFC (Cashless) Mobile App Payments Membership/Subscription |

| By Ownership | Independent Operators Franchised/Chain Operators |

| By Geography | North America Europe Asia-Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Car Wash Facilities | 100 | Owners, Operations Managers |

| Automatic Car Wash Systems | 80 | Equipment Suppliers, Service Technicians |

| Self-Service Car Wash Stations | 70 | Franchise Owners, Site Managers |

| Mobile Car Wash Services | 60 | Business Owners, Operations Managers |

| Consumer Preferences in Car Wash Services | 120 | Car Owners, Regular Users of Car Wash Services |

The Global Car Wash Market is valued at approximately USD 35 billion, based on a five-year historical analysis. This valuation reflects the growing demand for car wash services driven by increasing vehicle ownership and consumer preferences for professional cleaning.