Region:Global

Author(s):Shubham

Product Code:KRAA1910

Pages:86

Published On:August 2025

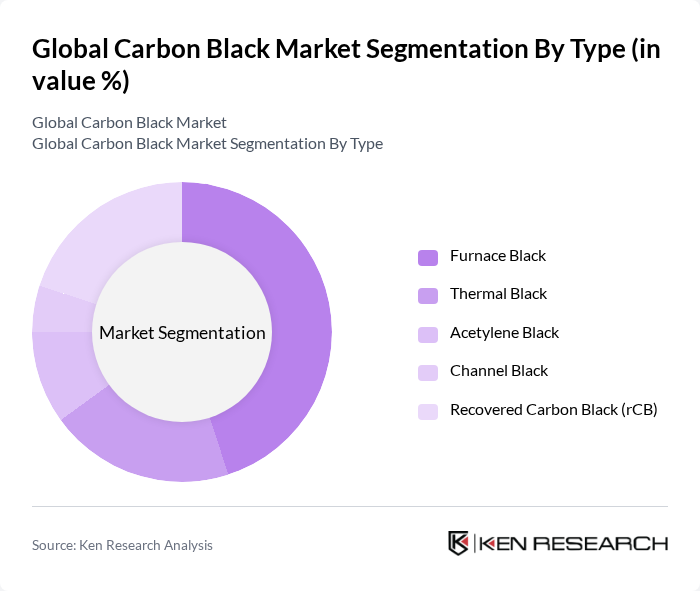

By Type:The carbon black market is segmented into five types: Furnace Black, Thermal Black, Acetylene Black, Channel Black, and Recovered Carbon Black (rCB). Each type serves different applications and industries, with Furnace Black being the most widely used due to its cost-effectiveness and reinforcement performance in tire manufacturing and mechanical rubber goods .

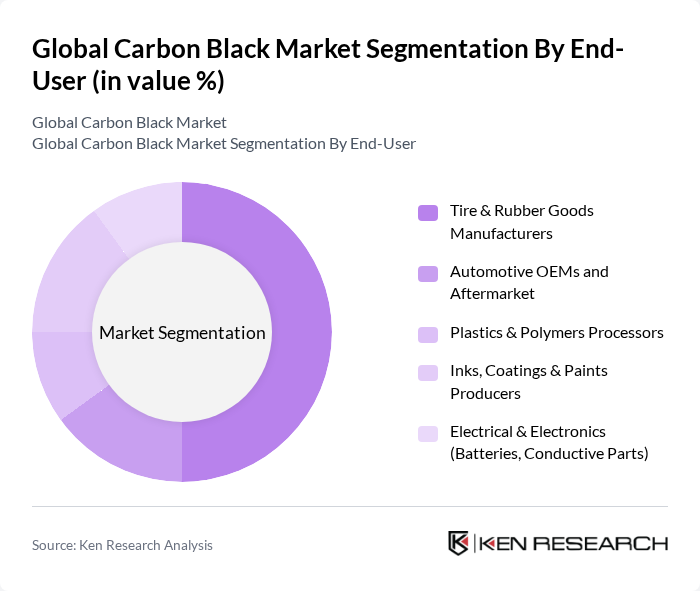

By End-User:The end-user segmentation includes Tire & Rubber Goods Manufacturers, Automotive OEMs and Aftermarket, Plastics & Polymers Processors, Inks, Coatings & Paints Producers, and Electrical & Electronics (Batteries, Conductive Parts). The tire and rubber goods segment dominates, reflecting carbon black’s role as a critical reinforcing filler in tread, carcass, and sidewall compounds; non-tire rubber, inks/coatings, plastics masterbatch, and conductive/battery grades account for the remaining demand .

The Global Carbon Black Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cabot Corporation, Birla Carbon (Aditya Birla Group), Orion Engineered Carbons S.A., Phillips Carbon Black Limited (PCBL Limited), Tokai Carbon Co., Ltd., Mitsubishi Chemical Group Corporation, China Synthetic Rubber Corporation (CSRC), Omsk Carbon Group, Jiangxi Black Cat Carbon Black Inc., Ltd., Longxing Chemical Stock Co., Ltd., Shandong Huadong Rubber Materials Co., Ltd., Himadri Speciality Chemical Ltd., Black Bear Carbon B.V., Birla Carbon Thailand Public Company Limited, Continental Carbon Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the carbon black market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production technologies are expected to enhance efficiency and reduce environmental impact, while the growing demand for eco-friendly products will likely reshape market dynamics. Additionally, the expansion into emerging markets presents significant growth potential, as these regions increasingly adopt carbon black in various applications, including automotive and construction, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Furnace Black Thermal Black Acetylene Black Channel Black Recovered Carbon Black (rCB) |

| By End-User | Tire & Rubber Goods Manufacturers Automotive OEMs and Aftermarket Plastics & Polymers Processors Inks, Coatings & Paints Producers Electrical & Electronics (Batteries, Conductive Parts) |

| By Application | Tires (Tread, Carcass, Sidewall) Mechanical Rubber Goods (Hoses, Belts, Seals) Plastics (Masterbatch, UV Stabilization, Conductive) Inks & Coatings (Printing, Architectural, Industrial) Batteries & Energy Storage (Conductive Additives) |

| By Distribution Channel | Direct (Contract/Key Accounts) Distributors/Traders Online B2B Retail/Stockists Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Specialty Grades Battery/High-Purity Grades |

| By Packaging Type | Bulk (Silo, Bulk Bags) Bagged (Paper/Poly 10–25 kg) Super Sacks/Big Bags Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tire Manufacturing Sector | 120 | Production Managers, Quality Control Engineers |

| Plastics Industry Applications | 100 | Product Development Managers, Procurement Specialists |

| Coatings and Inks Sector | 80 | Technical Directors, R&D Managers |

| Carbon Black Distributors | 70 | Sales Managers, Supply Chain Coordinators |

| Environmental Compliance Officers | 60 | Regulatory Affairs Managers, Sustainability Officers |

The Global Carbon Black Market is valued at approximately USD 20 billion, driven by demand from the tire and rubber industries, as well as applications in plastics and coatings. The market is expected to grow further due to recovery in automotive and construction sectors.