Region:Middle East

Author(s):Shubham

Product Code:KRAC4310

Pages:96

Published On:October 2025

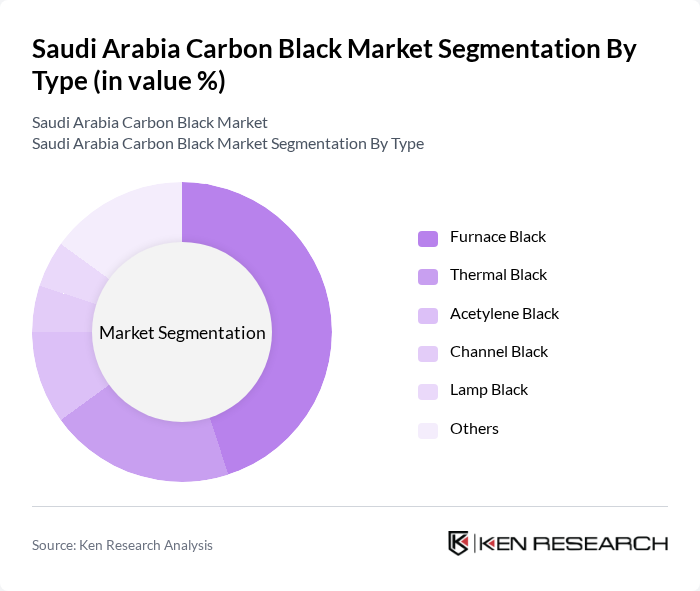

By Type:The carbon black market can be segmented into various types, including Furnace Black, Thermal Black, Acetylene Black, Channel Black, Lamp Black, and Others. Among these, Furnace Black is the most widely used due to its superior performance characteristics and cost-effectiveness, making it the preferred choice for tire manufacturing and other rubber products.

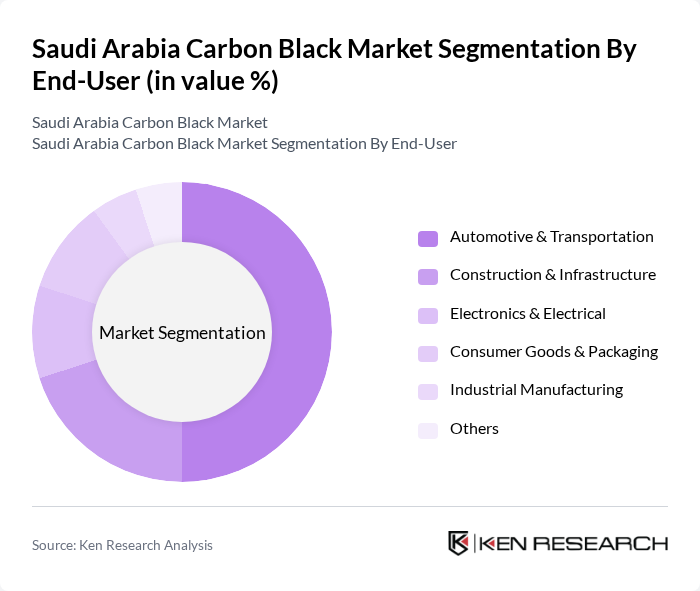

By End-User:The carbon black market is segmented by end-user industries, including Automotive & Transportation, Construction & Infrastructure, Electronics & Electrical, Consumer Goods & Packaging, Industrial Manufacturing, and Others. The Automotive & Transportation sector is the leading end-user, driven by the increasing production of vehicles and the demand for high-performance tires.

The Saudi Arabia Carbon Black Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Carbon Black Company (SCBC), Cabot Corporation, Orion Engineered Carbons S.A., Tokai Carbon Co., Ltd., Phillips Carbon Black Limited (PCBL), Omsk Carbon Group, Mitsubishi Chemical Corporation, Jiangxi Black Cat Carbon Black Inc., Longxing Chemical, Shandong Huadong Rubber Material Co., Ltd., Hainan Black Cat Carbon Black Co., Ltd., Epsilon Carbon Private Limited, China Synthetic Rubber Corporation (CSRC), Birla Carbon, Himadri Speciality Chemical Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia carbon black market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As manufacturers adopt eco-friendly production methods, the market is likely to see increased efficiency and reduced environmental impact. Additionally, the growing emphasis on circular economy practices will encourage innovation in carbon black applications, fostering new opportunities. With strategic partnerships emerging across industries, the market is set to evolve, aligning with global sustainability trends while meeting local demand.

| Segment | Sub-Segments |

|---|---|

| By Type | Furnace Black Thermal Black Acetylene Black Channel Black Lamp Black Others |

| By End-User | Automotive & Transportation Construction & Infrastructure Electronics & Electrical Consumer Goods & Packaging Industrial Manufacturing Others |

| By Application | Tires Non-Tire Rubber Products Plastics Paints & Coatings Inks Batteries Others |

| By Distribution Channel | Direct Sales Industrial Distributors Online Sales Retail Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | Standard Grade Premium Grade Specialty Grade |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Carbon Black Usage | 100 | Product Managers, Quality Control Engineers |

| Plastics Manufacturing Sector | 60 | Procurement Managers, Production Supervisors |

| Tyre Manufacturing Insights | 70 | Technical Directors, R&D Managers |

| Construction Material Applications | 50 | Project Managers, Material Engineers |

| Consumer Goods Sector | 40 | Product Development Managers, Marketing Executives |

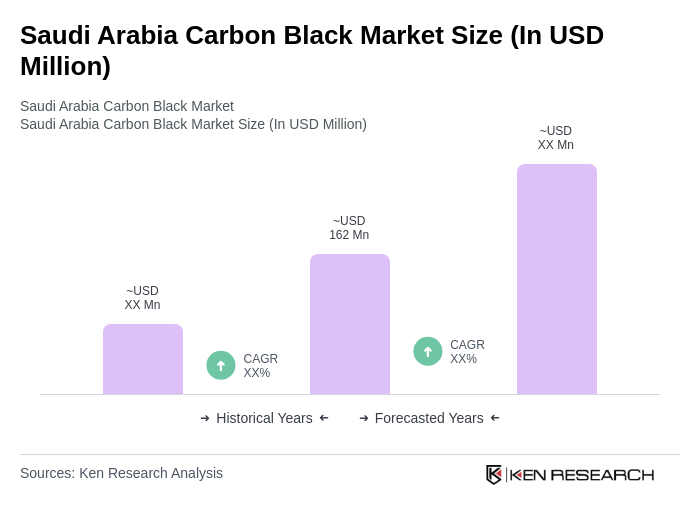

The Saudi Arabia Carbon Black Market is valued at approximately USD 162 million, reflecting a five-year historical analysis. This growth is driven by increasing demand across various industries, including automotive, construction, and electronics.