Region:Global

Author(s):Rebecca

Product Code:KRAA2169

Pages:95

Published On:August 2025

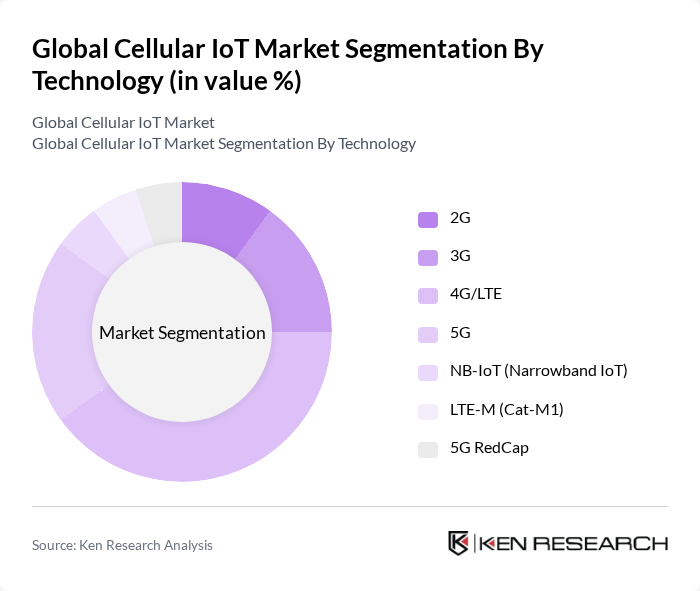

By Technology:

The technology segment of the cellular IoT market includes various subsegments such as 2G, 3G, 4G/LTE, 5G, NB-IoT (Narrowband IoT), LTE-M (Cat-M1), and 5G RedCap. Among these, 4G/LTE and its variants (especially 4G Cat 1 bis) are currently the leading technologies due to their widespread adoption, optimal balance of performance and cost, and ability to support a large number of connected devices with reliable data transfer. The demand for 5G technology is increasing rapidly, driven by its potential to enable advanced applications such as autonomous vehicles, industrial automation, and smart cities. The growing need for low-power, wide-area connectivity has led to the rise of NB-IoT and LTE-M, which are widely adopted for smart metering, asset tracking, and industrial IoT use cases .

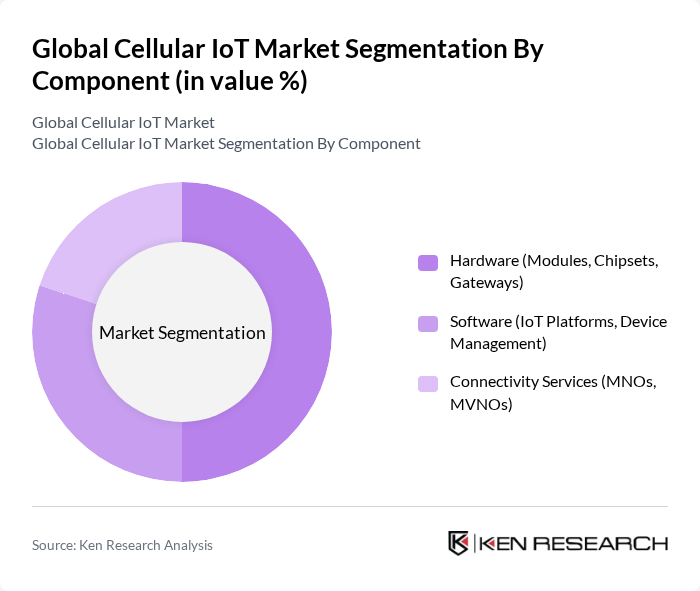

By Component:

The component segment encompasses hardware, software, and connectivity services. Hardware—including modules, chipsets, and gateways—remains the dominant subsegment, reflecting the essential role of physical devices in enabling connectivity and supporting the rapid expansion of IoT deployments. Software solutions, such as IoT platforms and device management systems, are gaining traction as enterprises seek to optimize device orchestration, security, and analytics. Connectivity services, provided by mobile network operators (MNOs) and mobile virtual network operators (MVNOs), are critical for seamless, secure, and scalable communication between devices. The increasing complexity of IoT ecosystems is driving demand for integrated solutions that combine hardware, software, and managed connectivity .

The Global Cellular IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vodafone Group Plc, AT&T Inc., Verizon Communications Inc., Deutsche Telekom AG, Orange S.A., Telstra Corporation Limited, China Mobile Ltd., Ericsson AB, Qualcomm Incorporated, Sierra Wireless, Inc., Gemalto N.V. (Thales Group), Nokia Corporation, Cisco Systems, Inc., MediaTek Inc., ZTE Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cellular IoT market appears promising, driven by technological advancements and increasing integration of IoT solutions across various sectors. The convergence of AI and IoT is expected to enhance data analytics capabilities, leading to smarter decision-making processes. Additionally, the growing emphasis on sustainability will likely propel the development of energy-efficient IoT devices, aligning with global environmental goals and fostering innovation in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology | G G G/LTE G NB-IoT (Narrowband IoT) LTE-M (Cat-M1) G RedCap |

| By Component | Hardware (Modules, Chipsets, Gateways) Software (IoT Platforms, Device Management) Connectivity Services (MNOs, MVNOs) |

| By Application | Asset Tracking & Fleet Management Smart Metering (Utilities) Smart Cities (Lighting, Parking, Waste Management) Industrial Automation Connected Health (Remote Monitoring) Smart Agriculture Consumer Electronics & Smart Home Others |

| By End-User Industry | Automotive & Transportation Healthcare Utilities Manufacturing Retail Agriculture Others |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Agriculture Solutions | 100 | Agricultural Technology Managers, Farm Operations Directors |

| Healthcare IoT Devices | 80 | Healthcare IT Managers, Medical Device Procurement Officers |

| Smart City Infrastructure | 90 | Urban Planners, City Infrastructure Managers |

| Automotive Telematics | 60 | Automotive Engineers, Fleet Management Executives |

| Logistics and Supply Chain IoT | 75 | Supply Chain Analysts, Logistics Operations Managers |

The Global Cellular IoT Market is valued at approximately USD 6.1 billion, driven by the increasing demand for connected devices and advancements in cellular technology across various industries, including automotive, healthcare, and smart cities.