Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4409

Pages:94

Published On:October 2025

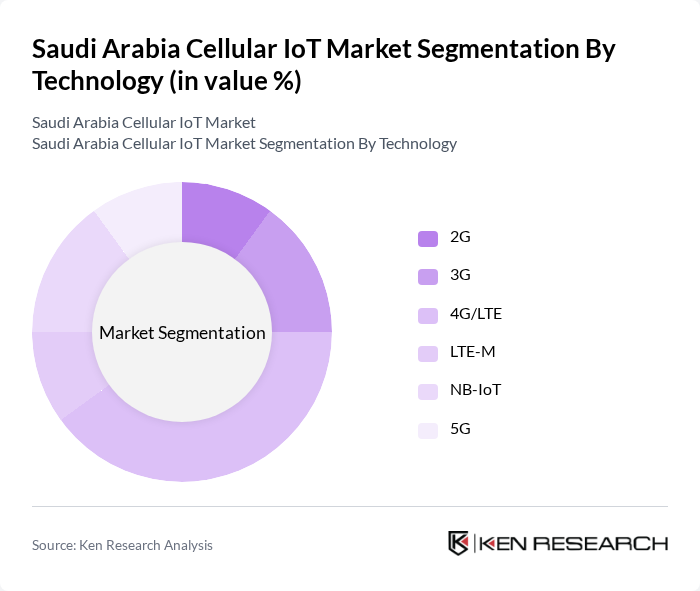

By Technology:The technology segment of the Cellular IoT Market includes various communication standards that facilitate connectivity for IoT devices. The subsegments are 2G, 3G, 4G/LTE, LTE-M, NB-IoT, and 5G. Among these, 4G/LTE has been the dominant technology due to its widespread adoption and ability to support a large number of devices with high-speed connectivity. The emergence of 5G technology is revolutionizing the market by providing ultra-reliable low-latency communication with high bandwidth and extensive device connectivity capabilities. The rapid deployment of 5G networks throughout Saudi Arabia, supported by governmental initiatives and private sector investment, has enabled more sophisticated IoT applications in autonomous vehicles, smart cities, and industrial automation. Advanced solutions like SuperLink technology have enhanced 5G connectivity speeds by 200 percent in remote regions, expanding high-speed network access across the kingdom.

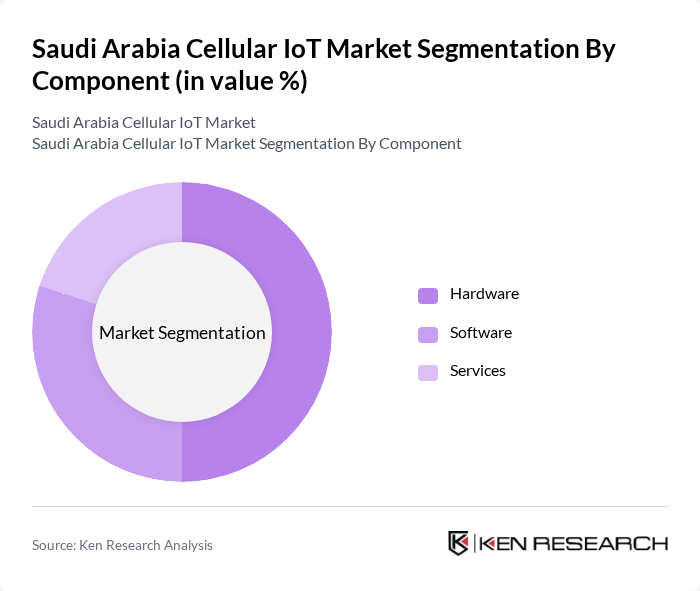

By Component:The component segment encompasses hardware, software, and services that are essential for the deployment and management of IoT solutions. Hardware includes devices and sensors, while software refers to applications and platforms that enable data processing and analytics. Services cover installation, maintenance, and support. The hardware subsegment is currently leading the market due to the increasing demand for IoT devices across various industries, particularly in manufacturing, transportation and logistics, utilities, and healthcare sectors. The growing implementation of device hardware solutions, combined with network connectivity infrastructure and software platforms, drives the need for robust and reliable hardware solutions that support extensive sensor networks, sophisticated automation systems, and cloud-edge integration capabilities.

The Saudi Arabia Cellular IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, Ericsson Saudi Arabia, Huawei Technologies Saudi Arabia Co. Ltd., Cisco Saudi Arabia Ltd., Nokia Solutions and Networks KSA, Siemens Saudi Arabia, IBM Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Cellular IoT market appears promising, driven by technological advancements and government initiatives. The integration of AI and machine learning into IoT applications is expected to enhance operational efficiency across industries. Additionally, the shift towards edge computing will facilitate real-time data processing, further propelling market growth. As the government continues to support digital transformation, the market is poised for significant advancements in connectivity and application development, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Technology | G G G/LTE LTE-M NB-IoT G |

| By Component | Hardware Software Services |

| By Application | Asset Tracking Alarms & Detectors Remote Monitoring Smart Metering Fleet Management Predictive Maintenance Smart Agriculture Others |

| By End-User | Manufacturing Transportation and Logistics Utilities Healthcare Retail Government Agriculture Others |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Purchase |

| By Policy Support | Government Subsidies Tax Incentives Grants for R&D |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Agriculture Solutions | 60 | Agricultural Managers, Technology Implementers |

| Healthcare IoT Applications | 50 | Healthcare Administrators, IT Directors |

| Smart City Infrastructure | 55 | Urban Planners, Municipal IT Managers |

| Asset Tracking Systems | 40 | Logistics Managers, Supply Chain Analysts |

| Telecommunications IoT Services | 65 | Telecom Executives, Product Development Managers |

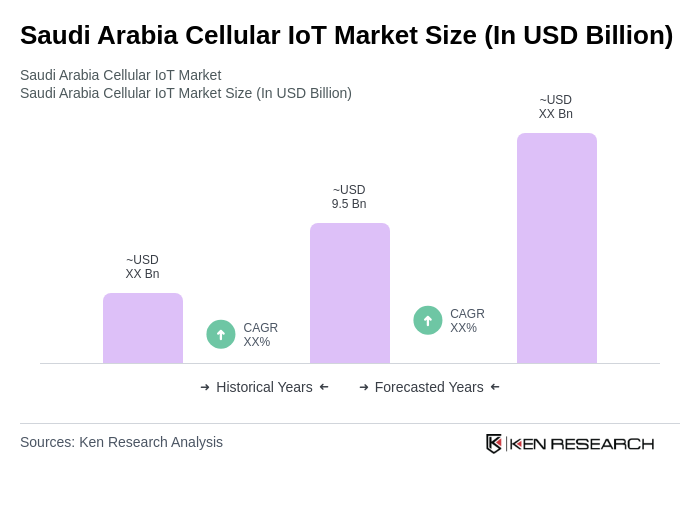

The Saudi Arabia Cellular IoT Market is valued at approximately USD 9.5 billion, driven by advancements in connectivity infrastructure and the rapid expansion of 5G networks, facilitating sophisticated IoT applications across various sectors.