Region:Global

Author(s):Rebecca

Product Code:KRAA2408

Pages:91

Published On:August 2025

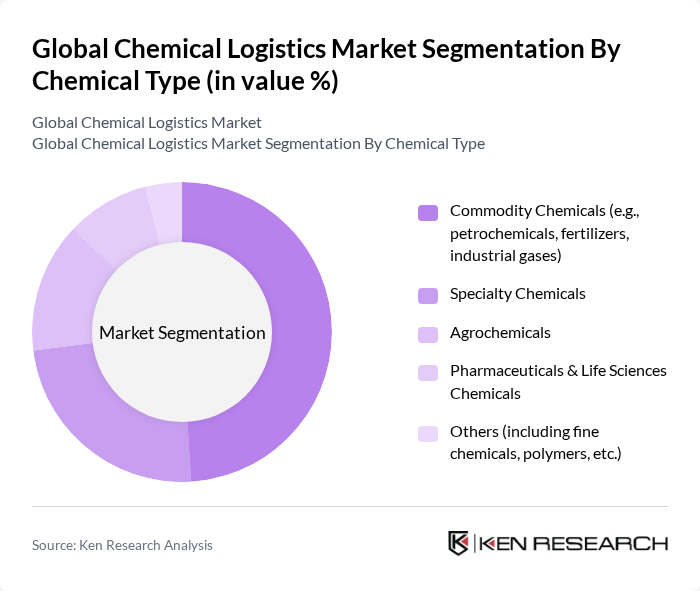

By Chemical Type:The chemical logistics market is segmented into Commodity Chemicals, Specialty Chemicals, Agrochemicals, Pharmaceuticals & Life Sciences Chemicals, and Others. Commodity Chemicals continue to dominate the market, accounting for nearly half of the total share, due to their essential role in manufacturing, construction, automotive, and consumer goods industries. The demand for these chemicals is driven by their bulk nature, widespread industrial applications, and the growing global population, which increases the need for basic chemical products.

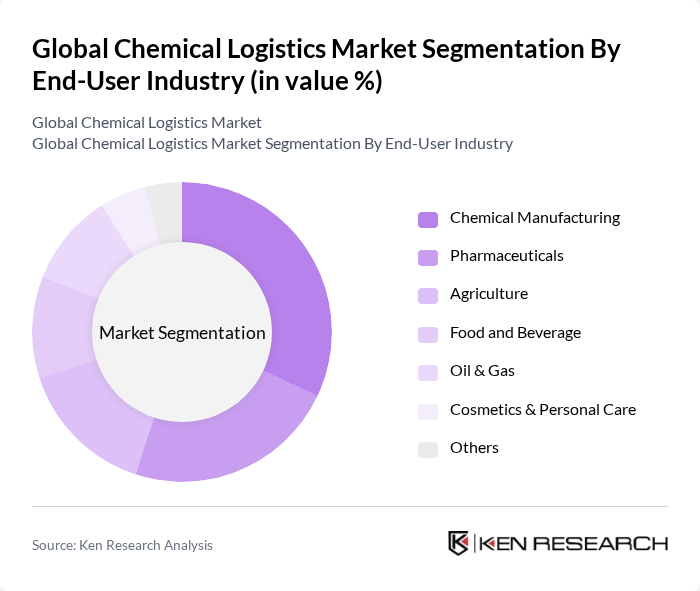

By End-User Industry:The end-user industries for chemical logistics include Chemical Manufacturing, Pharmaceuticals, Agriculture, Food and Beverage, Oil & Gas, Cosmetics & Personal Care, and Others. The Pharmaceutical sector is a major growth driver, requiring specialized handling and temperature-controlled transportation for sensitive products. Additionally, the food processing industry is increasingly reliant on chemical logistics for additives, preservatives, and packaging chemicals, reflecting broader trends in global consumption and supply chain sophistication.

The Global Chemical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, C.H. Robinson, XPO Logistics, Expeditors International, GEODIS, UPS Supply Chain Solutions, DSV A/S, CEVA Logistics, APL Logistics, Sinotrans Limited, Agility Logistics, Bolloré Logistics, Kintetsu World Express, Rhenus Logistics, Bertschi AG, Den Hartogh Logistics, TCI Chemicals, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chemical logistics market appears promising, driven by the increasing integration of digital solutions and a focus on sustainability. As companies prioritize eco-friendly practices, the demand for sustainable logistics solutions is expected to rise. Additionally, the ongoing digital transformation in logistics, including the use of IoT and real-time tracking, will enhance operational efficiency and transparency, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Chemical Type | Commodity Chemicals (e.g., petrochemicals, fertilizers, industrial gases) Specialty Chemicals Agrochemicals Pharmaceuticals & Life Sciences Chemicals Others (including fine chemicals, polymers, etc.) |

| By End-User Industry | Chemical Manufacturing Pharmaceuticals Agriculture Food and Beverage Oil & Gas Cosmetics & Personal Care Others |

| By Mode of Transportation | Roadways Railways Waterways (Sea Freight, Inland Waterways) Airways Pipelines |

| By Packaging Type | Drums & Barrels IBCs (Intermediate Bulk Containers) Tank Containers Bags & Sacks Others |

| By Service Type | Transportation & Distribution Storage & Warehousing Customs & Security Green Logistics Consulting & Management Services Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Southeast Asia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Customer Type | B2B B2C Government & Institutional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Logistics | 120 | Logistics Managers, Supply Chain Executives |

| Hazardous Material Transportation | 90 | Safety Officers, Compliance Managers |

| Bulk Chemical Distribution | 60 | Operations Directors, Fleet Managers |

| Specialty Chemical Supply Chain | 50 | Procurement Managers, Product Line Managers |

| Logistics Technology Adoption | 70 | IT Managers, Digital Transformation Leads |

The Global Chemical Logistics Market is valued at approximately USD 290 billion, driven by increasing demand for chemical products across various industries, including pharmaceuticals, agriculture, and manufacturing.