Region:Asia

Author(s):Geetanshi

Product Code:KRAA2055

Pages:99

Published On:August 2025

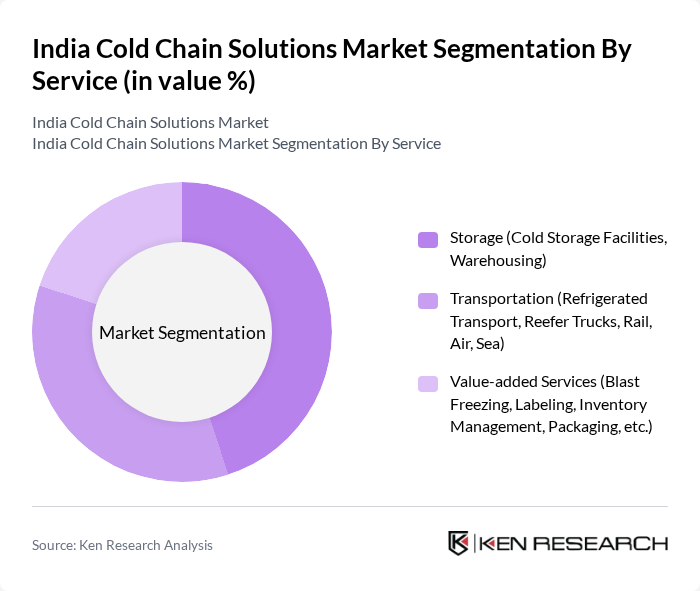

By Service:The service segment includes various sub-segments such as Storage (Cold Storage Facilities, Warehousing), Transportation (Refrigerated Transport, Reefer Trucks, Rail, Air, Sea), and Value-added Services (Blast Freezing, Labeling, Inventory Management, Packaging, etc.). Among these, theStoragesegment is currently leading the market due to the increasing need for efficient storage solutions for perishable goods. The demand for cold storage facilities has surged, driven by the growth in the food and beverage sector, expansion of organized retail, and the need to reduce post-harvest losses in agriculture. Cold storage also supports pharmaceutical distribution, especially for vaccines and biologics, requiring stringent temperature controls .

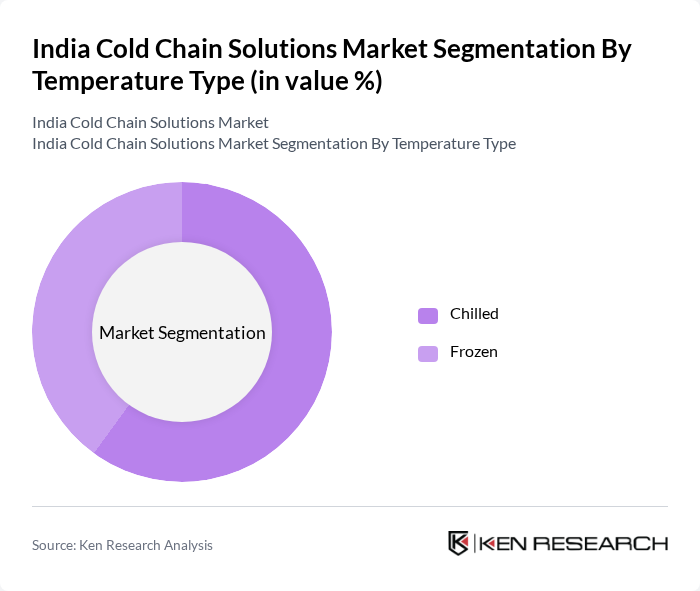

By Temperature Type:The temperature type segment is categorized intoChilledandFrozen. The Chilled segment is currently dominating the market, primarily due to the rising demand for fresh produce, dairy products, and ready-to-eat foods that require specific temperature controls. The increasing consumer preference for fresh and organic food options, coupled with the growth of quick commerce and online grocery delivery, has led to a significant rise in the need for chilled storage and transportation solutions, making it a critical area of focus for cold chain service providers .

The India Cold Chain Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Snowman Logistics Ltd., ColdEX Logistics Pvt. Ltd., Gati Kausar India Pvt. Ltd., Blue Star Ltd., Mahindra Logistics Ltd., TCI Cold Chain Solutions (Transport Corporation of India Ltd.), Future Supply Chain Solutions Ltd., Coldman Logistics Pvt. Ltd., Aegis Logistics Ltd., DHL Supply Chain India Pvt. Ltd., Xpressbees Logistics, Delhivery Ltd., Reefer Logistics Pvt. Ltd., Sical Logistics Ltd., Stellar Value Chain Solutions Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cold chain solutions market appears promising, driven by technological advancements and increasing investments in infrastructure. The integration of IoT and AI technologies is expected to enhance operational efficiency and reduce costs. Additionally, the growing emphasis on sustainability will likely lead to the adoption of eco-friendly practices in cold chain logistics. As consumer preferences shift towards fresh and safe food products, the demand for efficient cold chain solutions will continue to rise, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage Transportation Value-added Services |

| By Temperature Type | Chilled Frozen |

| By Application | Food and Beverage Pharmaceuticals and Life Sciences Chemicals Agriculture Others |

| By Region | North India South India East India West India Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Storage | 120 | Warehouse Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Logistics | 90 | Quality Assurance Managers, Logistics Directors |

| Retail Cold Chain Operations | 60 | Operations Managers, Inventory Control Specialists |

| Transport Services for Perishables | 50 | Fleet Managers, Logistics Analysts |

| Cold Chain Technology Providers | 40 | Product Development Managers, Sales Executives |

The India Cold Chain Solutions Market is valued at approximately USD 11.5 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with the growth of e-commerce and organized retail.