Region:Global

Author(s):Shubham

Product Code:KRAA2711

Pages:94

Published On:August 2025

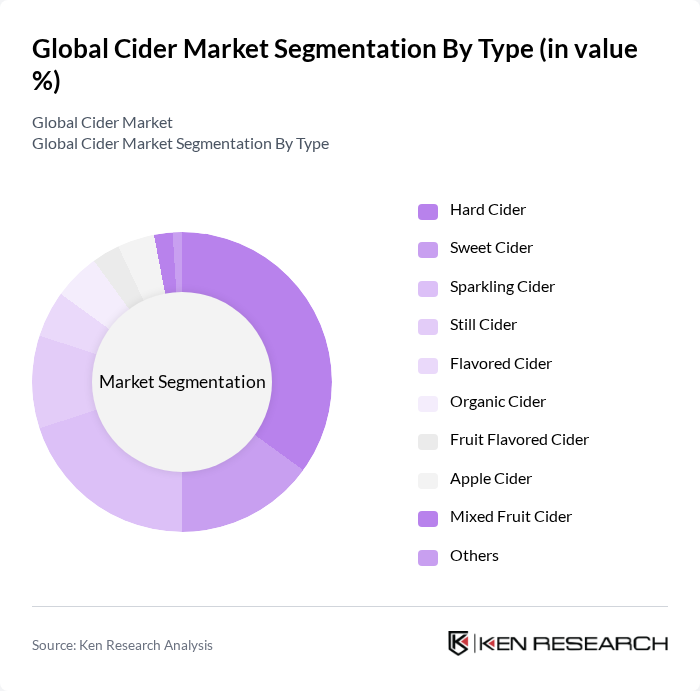

By Type:The cider market can be segmented into Hard Cider, Sweet Cider, Sparkling Cider, Still Cider, Flavored Cider, Organic Cider, Fruit Flavored Cider, Apple Cider, Mixed Fruit Cider, and Others. Among these, Hard Cider remains the most dominant segment, driven by its popularity among consumers seeking alcoholic beverages with lower sugar content. The trend towards craft and artisanal products, as well as the introduction of new fruit blends and seasonal flavors, has bolstered the growth of Hard Cider, with consumers increasingly drawn to unique flavors and local brands.

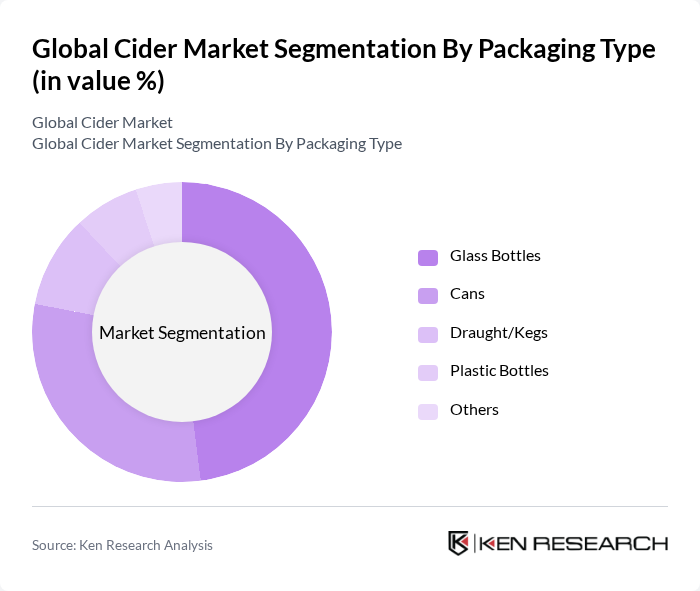

By Packaging Type:The cider market is also segmented by packaging type, which includes Glass Bottles, Cans, Draught/Kegs, Plastic Bottles, and Others. Glass Bottles are the leading packaging type, favored for their ability to preserve flavor and quality. The premium image associated with glass packaging appeals to consumers, particularly in the craft cider segment, where presentation and sustainability play a crucial role in purchasing decisions.

The Global Cider Market is characterized by a dynamic mix of regional and international players. Leading participants such as Heineken N.V. (Strongbow, Bulmers), C&C Group plc (Magners, Bulmers Ireland), Asahi Group Holdings, Ltd. (Somersby), Anheuser-Busch InBev (Stella Artois Cidre, Johnny Appleseed), Molson Coors Beverage Company (Rekorderlig, Aspall), Carlsberg Group (Somersby), Aston Manor Cider, Thatchers Cider Company Ltd, Kopparbergs Bryggeri AB, Westons Cider, Angry Orchard (Boston Beer Company), Woodchuck Hard Cider (Vermont Hard Cider Company), Ace Cider (California Cider Company), Crispin Cider Company, Seattle Cider Company contribute to innovation, geographic expansion, and service delivery in this space.

The cider market is poised for continued growth, driven by evolving consumer preferences towards craft and low-alcohol beverages. Innovations in flavor profiles and sustainable production practices are expected to attract a broader audience. Additionally, the rise of e-commerce will facilitate greater accessibility, allowing cider brands to reach consumers directly. As awareness of cider increases, particularly in emerging markets, the potential for market expansion remains significant, promising a dynamic future for the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Cider Sweet Cider Sparkling Cider Still Cider Flavored Cider Organic Cider Fruit Flavored Cider Apple Cider Mixed Fruit Cider Others |

| By Packaging Type | Glass Bottles Cans Draught/Kegs Plastic Bottles Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Retail Stores Bars and Restaurants (On-trade) Departmental Stores Convenience Stores Others |

| By Alcohol Content | Low Alcohol Medium Alcohol High Alcohol |

| By Region | North America (United States, Canada, Mexico) Europe (UK, France, Germany, Spain, Italy, Sweden, Poland, Belgium, Netherlands, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria, Turkey, Rest of MEA) |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level |

| By Occasion | Casual Gatherings Celebrations Seasonal Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cider Production Insights | 60 | Cider Makers, Production Managers |

| Retail Distribution Channels | 50 | Retail Managers, Beverage Buyers |

| Consumer Preferences Survey | 100 | End Consumers, Cider Enthusiasts |

| Market Trends Analysis | 40 | Market Analysts, Industry Experts |

| Export Market Dynamics | 40 | Export Managers, Trade Representatives |

The Global Cider Market is valued at approximately USD 16.4 billion, reflecting a significant growth trend driven by increasing consumer demand for low-alcohol and fruit-based beverages, particularly among younger demographics like millennials and Gen Z.