Region:Middle East

Author(s):Dev

Product Code:KRAD3315

Pages:83

Published On:November 2025

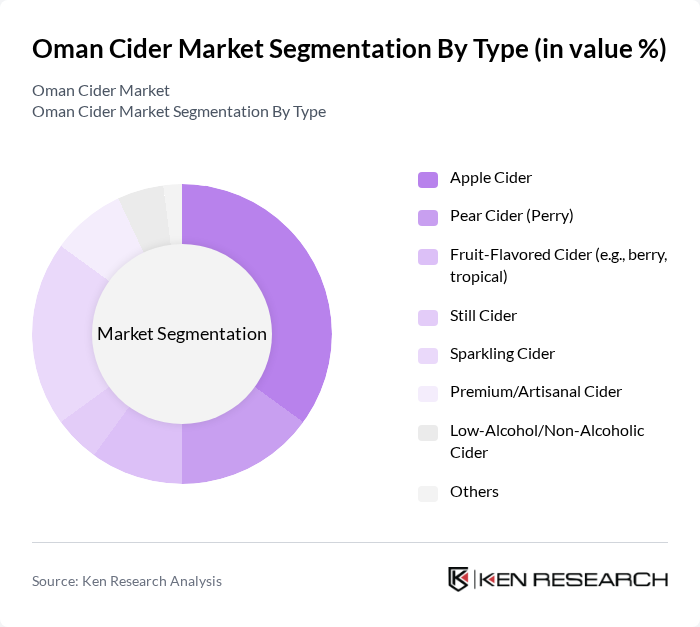

By Type:The cider market can be segmented into various types, includingApple Cider, Pear Cider (Perry), Fruit-Flavored Cider, Still Cider, Sparkling Cider, Premium/Artisanal Cider, Low-Alcohol/Non-Alcoholic Cider, and Others. Among these,Apple Cideris the most popular due to its traditional appeal and widespread availability. The increasing trend towards health-conscious drinking has also led to a rise in demand forLow-Alcohol and Non-Alcoholic Ciders, catering to a broader audience.

By End-User:The cider market is segmented by end-users, includingRetail Consumers, Restaurants and Bars, Hotels and Resorts, Events and Festivals, Corporate/Institutional Buyers, and Others. Retail Consumers dominate the market, driven by the increasing availability of cider in supermarkets and liquor stores. The growing trend of cider consumption in social settings, such as restaurants and bars, also contributes significantly to market growth.

The Oman Cider Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carlsberg Oman (Oman Refreshment Company), Heineken Oman (Oman Brewery LLC), Strongbow (Imported by Muscat Overseas Group), Bulmers (Imported by Areej Trading LLC), Savanna Dry (Distributed by Al Maha Beverages), Magners (Imported by Bahwan Beverage Trading), Rekorderlig (Imported by Muscat Beverage Company), Thatchers (Distributed by Oman Liquor Stores), Aspall (Imported by Al Fair Supermarket Group), Oman Craft Cider (Local Artisanal Producer), Muscat Valley Cider (Local Producer), Dhofar Cider Company (Local Producer), Green Valley Cider (Local Producer), Oasis Cider Co. (Local Producer), Al Hajar Cider (Local Producer) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman cider market is poised for significant growth, driven by evolving consumer preferences and an expanding tourism sector. As health-conscious trends continue to shape purchasing decisions, cider producers are likely to innovate with new flavors and organic options. Additionally, the rise of e-commerce platforms will facilitate broader distribution, making cider more accessible. With increasing collaboration between local producers and retailers, the market is expected to witness enhanced visibility and consumer engagement, fostering a vibrant cider culture in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | **Apple Cider** **Pear Cider (Perry)** **Fruit-Flavored Cider (e.g., berry, tropical)** **Still Cider** **Sparkling Cider** **Premium/Artisanal Cider** **Low-Alcohol/Non-Alcoholic Cider** Others |

| By End-User | Retail Consumers Restaurants and Bars Hotels and Resorts Events and Festivals Corporate/Institutional Buyers Others |

| By Packaging Type | Glass Bottles Aluminum Cans Kegs PET Bottles Others |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Liquor Stores Online Retail HoReCa (Hotels, Restaurants, Cafés) Direct Sales Others |

| By Alcohol Content | Non-Alcoholic Cider Low Alcohol Cider (?3% ABV) Regular Alcohol Cider (3-6% ABV) High Alcohol Cider (>6% ABV) Others |

| By Region | Muscat Salalah Sohar Nizwa Sur Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences Nationality (Omani, Expatriate) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cider Producers | 45 | Production Managers, Business Owners |

| Distributors and Retailers | 40 | Sales Managers, Retail Buyers |

| Consumers of Cider | 120 | General Consumers, Beverage Enthusiasts |

| Industry Experts | 30 | Market Analysts, Beverage Consultants |

| Tourism Sector Stakeholders | 25 | Hotel Managers, Tour Operators |

The Oman cider market is valued at approximately USD 10 million, reflecting a growing consumer interest in healthier beverage options, particularly among younger demographics seeking low-sugar and low-alcohol alternatives.