Region:Global

Author(s):Shubham

Product Code:KRAD0698

Pages:84

Published On:August 2025

By Type:The cigar market is segmented into various types, including Premium (Handmade/Long-Filler) Cigars, Conventional/Machine-Made Cigars, Cigarillos, Flavored and Infused Cigars, Limited Editions & Special Releases, Value/Bulk & Short-Filler Cigars, and Others. Among these, Premium Cigars are gaining traction due to perceived quality, craftsmanship, and premiumization trends among adult consumers and collectors. Flavored and Infused Cigars have seen demand in certain channels and regions—especially among younger?adult consumers—though flavor regulations are tightening in key markets.

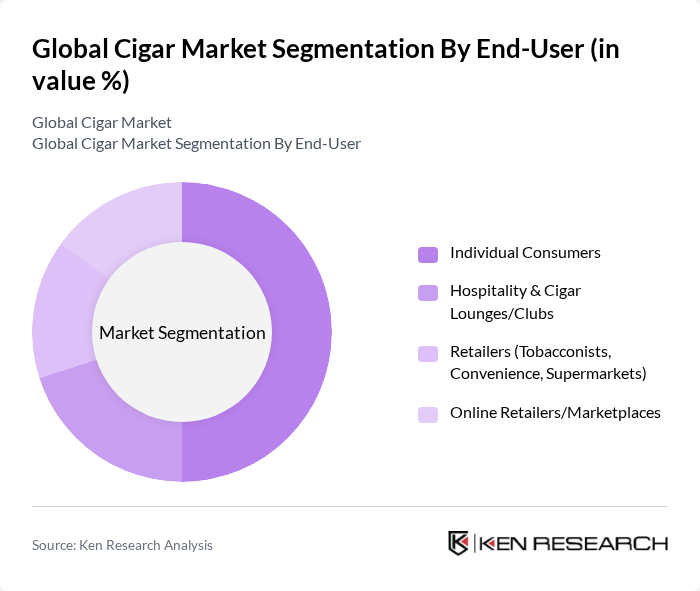

By End-User:The end-user segmentation includes Individual Consumers, Hospitality & Cigar Lounges/Clubs, Retailers (Tobacconists, Convenience, Supermarkets), and Online Retailers/Marketplaces. Individual Consumers dominate the market, supported by personal consumption and the social culture of cigar use. Cigar lounges and clubs continue to gain prominence as curated venues for premium experiences, while specialty retail and online channels expand availability and assortment.

The Global Cigar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altria Group, Inc. (John Middleton Co.), Imperial Brands PLC (Tabacalera/Altadis S.A.), Scandinavian Tobacco Group A/S (STG), Oettinger Davidoff AG, Swisher International, Inc. (Swisher Sweets), General Cigar Company, Inc. (Part of Scandinavian Tobacco Group), Habanos S.A. (Cuban State-Owned; Cohiba, Montecristo), Drew Estate (A Subsidiary of Swisher), J.C. Newman Cigar Company, Padrón Cigars, Rocky Patel Premium Cigars, Arturo Fuente Cigar Company, Oliva Cigar Co. (STG), Plasencia Cigars, A.J. Fernandez Cigars contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cigar market appears promising, driven by evolving consumer preferences and lifestyle changes. As the demand for premium and artisanal products continues to rise, manufacturers are likely to innovate with unique blends and sustainable practices. Additionally, the expansion of online retail channels will facilitate access to a broader audience. However, navigating regulatory challenges and health concerns will be crucial for sustained growth. Overall, the market is poised for a dynamic evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Premium (Handmade/Long-Filler) Cigars Conventional/Machine?Made Cigars Cigarillos Flavored and Infused Cigars Limited Editions & Special Releases Value/Bulk & Short?Filler Cigars Others |

| By End-User | Individual Consumers Hospitality & Cigar Lounges/Clubs Retailers (Tobacconists, Convenience, Supermarkets) Online Retailers/Marketplaces |

| By Distribution Channel | Offline Retail (Tobacconists, Duty?Free, Convenience) Wholesalers/Distributors E?commerce Direct?to?Consumer (Brand Boutiques/Clubs) |

| By Price Range | Premium Mid?Range Budget/Value |

| By Flavor Profile | Non?Flavored (Natural) Flavored (Sweet/Infused) Spicy/Earthy Herbal/Tea/Novelty |

| By Packaging Type | Boxes/Cartons Tins Bundles/Pouches |

| By Occasion | Celebrations & Gifting Leisure/Social Smoking Collectors/Aficionados Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigar Retailers | 140 | Store Owners, Sales Managers |

| Cigar Manufacturers | 100 | Production Managers, Marketing Directors |

| Cigar Enthusiasts | 120 | Regular Consumers, Hobbyists |

| Distribution Channels | 80 | Logistics Coordinators, Supply Chain Managers |

| Industry Experts | 50 | Market Analysts, Tobacco Specialists |

The Global Cigar Market is valued at approximately USD 62 billion, based on a five-year historical analysis. Recent assessments indicate that the market remains in the low-sixties in USD billions, reflecting ongoing growth and consumer interest.