Region:Global

Author(s):Dev

Product Code:KRAB0647

Pages:96

Published On:August 2025

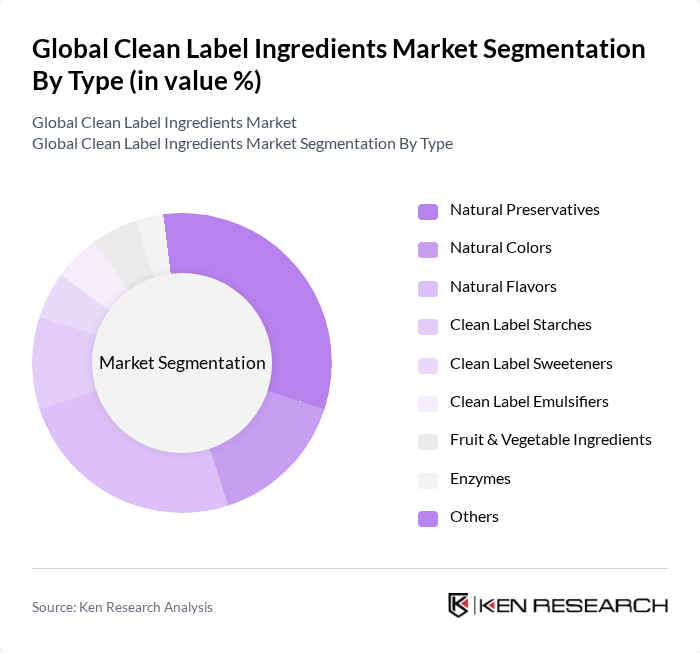

By Type:The clean label ingredients market is segmented into various types, including Natural Preservatives, Natural Colors, Natural Flavors, Clean Label Starches, Clean Label Sweeteners, Clean Label Emulsifiers, Fruit & Vegetable Ingredients, Enzymes, and Others. Among these, Natural Preservatives and Natural Flavors are leading the market due to their essential roles in enhancing food safety and taste without compromising on health standards. The increasing consumer preference for natural over synthetic ingredients, coupled with regulatory support for natural additives, is driving the growth of these subsegments .

By Application:The clean label ingredients market is also segmented by application, which includes Bakery & Confectionery, Beverages, Dairy & Frozen Desserts, Snacks, Meat & Poultry Products, Ready Meals & Convenience Foods, Personal Care Products, Pharmaceuticals, Animal Feed, and Others. The Bakery & Confectionery segment is currently dominating the market, driven by the increasing demand for healthier baked goods and snacks that align with clean label trends. The beverages and dairy segments are also experiencing robust growth due to the rising preference for natural and minimally processed ingredients in these categories .

The Global Clean Label Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ingredion Incorporated, Tate & Lyle PLC, DuPont de Nemours, Inc., Kerry Group plc, Cargill, Incorporated, Archer Daniels Midland Company, DSM-Firmenich AG, Naturex S.A. (a Givaudan company), Givaudan S.A., BASF SE, Chr. Hansen Holding A/S, Symrise AG, Emsland Group, Sensient Technologies Corporation, Roquette Frères S.A., Corbion N.V., Puratos Group, BENEO GmbH, International Flavors & Fragrances Inc. (IFF), Kemin Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the clean label ingredients market appears promising, driven by evolving consumer preferences and regulatory frameworks. As health consciousness continues to rise, manufacturers are likely to innovate and expand their clean label offerings. Additionally, the increasing focus on sustainability will push companies to adopt environmentally friendly practices. This dynamic landscape presents opportunities for growth, particularly in emerging markets where demand for clean label products is rapidly increasing, fostering a competitive environment for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Preservatives Natural Colors Natural Flavors Clean Label Starches Clean Label Sweeteners Clean Label Emulsifiers Fruit & Vegetable Ingredients Enzymes Others |

| By Application | Bakery & Confectionery Beverages Dairy & Frozen Desserts Snacks Meat & Poultry Products Ready Meals & Convenience Foods Personal Care Products Pharmaceuticals Animal Feed Others |

| By End-User | Food Manufacturers Beverage Companies Cosmetic Manufacturers Pharmaceutical Companies Animal Nutrition Companies Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Premium Mid-Range Economy |

| By Certification Type | Organic Certified Non-GMO Certified Gluten-Free Certified Vegan Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Manufacturers | 150 | Product Development Managers, Quality Assurance Specialists |

| Retail Sector Insights | 100 | Category Managers, Merchandising Directors |

| Consumer Preferences Survey | 150 | Health-Conscious Consumers, Food Enthusiasts |

| Ingredient Suppliers | 80 | Sales Managers, Technical Support Representatives |

| Regulatory Bodies Feedback | 50 | Food Safety Inspectors, Policy Makers |

The Global Clean Label Ingredients Market is valued at approximately USD 55 billion, reflecting a significant growth trend driven by consumer demand for transparency, health consciousness, and a preference for natural and organic products.